Global| Aug 30 2007

Global| Aug 30 2007Japan Retail Sales Drop Sharply

Summary

Japan retail sales are mostly lower across the board. Special factors have hit the Japanese consumer to be sure. There was a radiation leak at a nuclear plant that turned out to be worse that was first reported. And then a power [...]

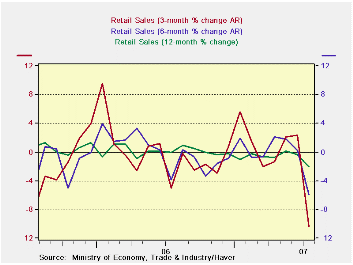

Japan retail sales are mostly lower across the board.

Special factors have hit the Japanese consumer to be sure. There was a radiation leak at a nuclear plant that turned out to be worse that was first reported. And then a power shortage hit. Bad weather has interrupted the consumer. But through it all wages have remained stagnant and the consumer’s fundamentals have also failed to improve. So the sharp drop in consumer spending is not simply something to dismiss as due to some of these rogue factors that have haunted the consumer. The consumer may be feeling real pressure. In addition Japan is closely linked to the US economy and next month it will be interesting to see if Japanese moods and spending patterns are affected by the financial turbulence we have seen. With such weak spending it is hard to see why the BOJ would still be considering a rate hike.

| Jul-07 | Jun-07 | May-07 | 3-mo | 6-mo | 12-mo | Yr-Ago | |

| Total | -2.6% | -0.4% | 0.4% | -10.4% | -6.0% | -2.1% | 0.0% |

| Motor Vehicles | -0.4% | -2.5% | -0.1% | -11.3% | -6.9% | -4.8% | -11.1% |

| Food & Beverage | -0.8% | -1.2% | 0.1% | -7.3% | -2.5% | -0.7% | -0.4% |

| Fabric apparel & access | -8.2% | 0.4% | 0.0% | -27.7% | -11.8% | -10.0% | -8.6% |

| Rest of Retail | -3.4% | 0.4% | 0.7% | -9.0% | -6.9% | -1.1% | 4.5% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.