Global| Jun 09 2015

Global| Jun 09 2015Japan's Consumer Confidence Takes Small Step Back

Summary

Japan's consumer confidence index fell for the second month in a row. The confidence reading for May sits in the 48th percentile of its longer historic queue of data back to 1992. The raw reading of 41.4 is itself a diffusion reading [...]

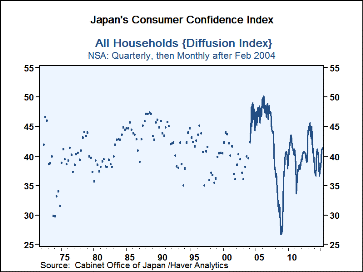

Japan's consumer confidence index fell for the second month in a row. The confidence reading for May sits in the 48th percentile of its longer historic queue of data back to 1992. The raw reading of 41.4 is itself a diffusion reading in which values greater than 50 indicate improving conditions. This May reading is not only historically weak but also indicating net deterioration.

Japan's consumer confidence index fell for the second month in a row. The confidence reading for May sits in the 48th percentile of its longer historic queue of data back to 1992. The raw reading of 41.4 is itself a diffusion reading in which values greater than 50 indicate improving conditions. This May reading is not only historically weak but also indicating net deterioration.

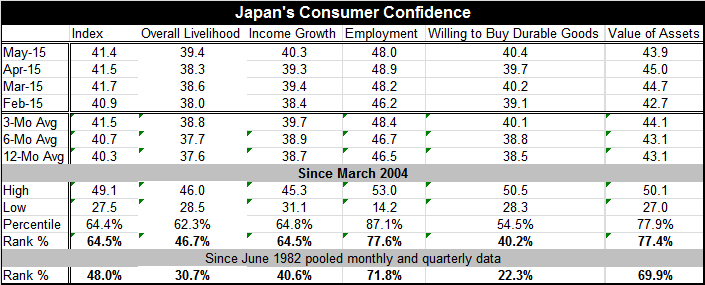

None of the component readings are at or above 50 the neutral standing position. Conditions according to each of the measures are deteriorating in May.

Employment is the category closest to neutrality with a reading of 48 in May, down from 48.9 in April. At that reading, employment stands in the top 30% of its historic queue. That standing underlines how long Japan's economy has been depressed. A reasonably firm top 30% historic standing still finds that employment conditions are deteriorating on balance.

The value of assets component has nearly as strong as an historic standing but has a weaker raw diffusion reading at 43.9. The raw diffusion score of 43.9 is still a long way from neutral.

Willingness to buy durable goods has a weak 22 percentile historic standing. But at least its diffusion value rose to 40.4 from 39.7.

Income growth and overall livelihood components both rose in May but each measure sits in a low percentile standing and at a low diffusion reading. Income growth sits at 40.3 while overall livelihood sits at 39.4.

There is no upward momentum to speak of in any of the components. The employment metric is losing momentum since its local peak in September of last year. The other measures are trying to stabilize at raw diffusion readings around 40 in value. There is not much room for optimism in the headline or components of this report. Although the overall index for May only fell by one tick, these is little good news among the details.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates