Global| Nov 08 2007

Global| Nov 08 2007Japan's Economy Watcher's Index on a Decline

Summary

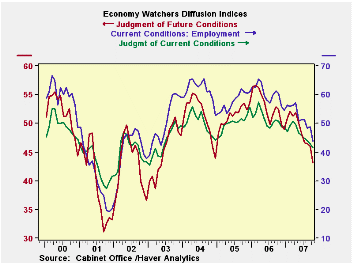

The economy watcher’s index is dropping rapidly and so is the future index. Each of them is at a relative low point in its five year range in the low 40th percentile of it. The weakness in these survey indexes is set in the table [...]

The economy watcher’s index is dropping rapidly and so is the

future index. Each of them is at a relative low point in its five year

range in the low 40th percentile of it. The weakness in these survey indexes

is set in the table against the NTC survey of manufacturing sentiment.

MFG sentiment is even weaker, residing in the bottom 15 percentile of

its range. Clearly Japan is

having some difficulty with growth. Both the anecdotal economy watchers

survey and the more grounded NTC survey of manufacturers show fading

growth and very low current activity readings.

| Key Japanese Surveys | |||||||

|---|---|---|---|---|---|---|---|

| Raw readings of each survey | Percent of 5Yr range | ||||||

| Oct-07 | Sep-07 | Aug-07 | Jul-07 | Oct-07 | Sep-07 | Aug-07 | |

| Diffusion | |||||||

| Economy Watchers | 41.5 | 42.9 | 44.1 | 44.7 | 27.5% | 33.9% | 39.4% |

| Employment | 43.8 | 48.8 | 48.3 | 51.2 | 21.5% | 39.4% | 37.6% |

| Future | 43.1 | 46.0 | 46.5 | 46.7 | 32.2% | 46.7% | 49.2% |

| NTC MFG | 49.5 | 49.8 | -- | -- | 15.5% | 18.7% | 16.2% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates