Global| Jul 26 2016

Global| Jul 26 2016Japan's PPI Stays Low

Summary

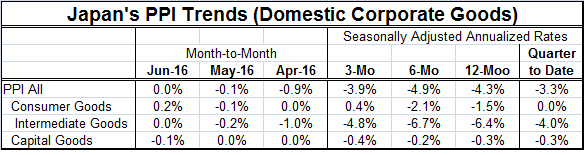

There is no rest for the weary. Japan may be tired of weak prices, but the weakness is not letting up. In June the overall PPI was flat month-to-month, keeping the PPI lower over 12 months by 4.3% and falling at a -3.9% annualized [...]

There is no rest for the weary. Japan may be tired of weak prices, but the weakness is not letting up. In June the overall PPI was flat month-to-month, keeping the PPI lower over 12 months by 4.3% and falling at a -3.9% annualized rate over three months. The pace of overall PPI decline is not escalating, but it is not easing up by much either.

There is no rest for the weary. Japan may be tired of weak prices, but the weakness is not letting up. In June the overall PPI was flat month-to-month, keeping the PPI lower over 12 months by 4.3% and falling at a -3.9% annualized rate over three months. The pace of overall PPI decline is not escalating, but it is not easing up by much either.

Trends in the quarter

In the quarter-to-date, the PPI is falling at a 3.3% annual rate (AR) led by a 4% AR decline in intermediate goods and aided by a 0.3% AR drop in capital goods. Consumer prices are dead flat in the quarter to date which is now a full quarter calculation.

PPI pressures are absent

The headline PPI is lower in two of the last three months. The PPI for consumer prices is lower in only one of the past three months but flat in another. Capital goods prices are lower in one month and flat in two. Prices trends in Japan obviously remain quite muted and are not just the result of one month's contribution but of ongoing commodity-class wide trends- real macroeconomic price weakness.

Inflation signaling

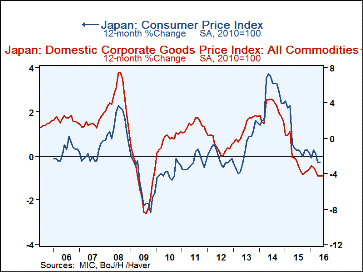

The PPI goods index does a reasonably good job of signaling on the direction for the overall CPI. Japan's PPI continues to make the case for price restraint.

The unexpected challenge of inflation

Japan, faced with a still strong yen, a shrinking population and weakness in its main trading partner, China, faces a series of ongoing challenges to getting its inflation rate in gear again. While Japan is now said to have rejected the notion of `helicopter money' (monetary expansion financed simply by printing money not by selling bonds), it is not clear what added steps it is prepared to take. Its move to negative rates this year caught markets by surprise and did not have the intended effect. With the BOJ meeting this week, all eyes are on the central bank to see if it has any rabbits to pull out of its hat. Presto inflation-o? Back in the 1970s, no one would have suspected that it could be so hard to get inflation going again. Things change...boy do they ever.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates