Global| Feb 13 2017

Global| Feb 13 2017Japan's Retail Sales Drop in December

Summary

Japan's retail sales are lower by 1.2% month to month in December. However, their sequential rates of growth show an upswing is nonetheless in place from growth rates over 12-Mo to 6-Mo to 3-Mo. This steady expansion of the pace of [...]

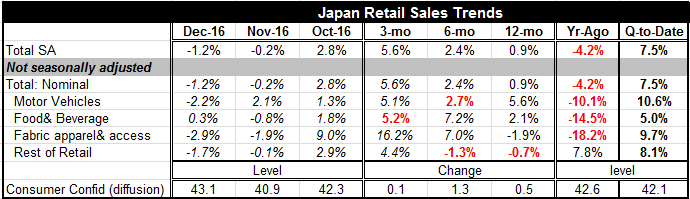

Japan's retail sales are lower by 1.2% month to month in December. However, their sequential rates of growth show an upswing is nonetheless in place from growth rates over 12-Mo to 6-Mo to 3-Mo. This steady expansion of the pace of growth is belied by the drop in sales over the last two months a drop that is dominated by a sales spurt in October.

Japan's retail sales are lower by 1.2% month to month in December. However, their sequential rates of growth show an upswing is nonetheless in place from growth rates over 12-Mo to 6-Mo to 3-Mo. This steady expansion of the pace of growth is belied by the drop in sales over the last two months a drop that is dominated by a sales spurt in October.

Japan's October sales strength also has boosted the fourth quarter's sales pace to a growth rate of 7.5% annualized. Motor vehicle sales are especially strong at a 10% annualized growth rate in Q4.

Despite some slippage in sales consumer confidence continues to move higher, rising to 43.1 in December up from 40.9 in November and above the October level of 42.3.

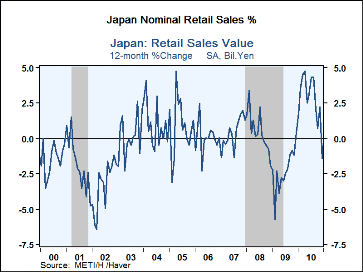

Over 12-months retail sales are up by just 0.9% with motor vehicle sales up by 5.6%. Consumer confidence is up by an increment of 0.5 in diffusion terms but the diffusion index is still below 50 in value signaling that the long stretch of consumer confidence erosion is still in play in Japan.

Gross domestic product in Japan gained only 0.2 percent on the quarter in the fourth quarter of 2016, the Cabinet Office reported on Monday. That missed expectations for an increase of 0.3 percent, which would have been unchanged from the previous three months. On a yearly basis, GDP gained 1.0 percent, a still weak result and evidence that Japan's monetary stimulus is not yet stirring the pot for growth. Japan appears to still be struggling to gain traction for its economy.

President Trump's over-the-weekend meeting With Japan Prime Minister Abe left the yen weaker as the markets took the two leaders' silence on the currency issue as a tacit endorsement of what had been in play. Japan really has few policy options and its attempts at domestic stimulus using extraordinary expansive monetary policy could be expected to do nothing other than to weaken the yen. Apparently Trump has acquiesced to this reality and the two leaders felt that the best way to deal with it is to try to keep the currency out of the lime-light of a policy discussion. At least that is my interpretation of events. Mr. Trump appears to have finally concluded a successful meeting on a solid high note with another important world leader and U.S. ally, in marked contrast to some of this other interchanges over the previous week.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates