Global| Apr 13 2015

Global| Apr 13 2015Japan's Retail Sales Rise in February But Can't Shake Weak Trends

Summary

Japan is still a struggling economy that has tried various measures to jump start growth while also trying to regain fiscal control. The combination has been frustrating and that frustration continues as retail sales creep higher in [...]

Japan is still a struggling economy that has tried various measures to jump start growth while also trying to regain fiscal control. The combination has been frustrating and that frustration continues as retail sales creep higher in February.

Japan is still a struggling economy that has tried various measures to jump start growth while also trying to regain fiscal control. The combination has been frustrating and that frustration continues as retail sales creep higher in February.

Japan toyed with QE starting half-heartedly first in 2001 and then stepped up its game in April 2013 announcing a 1.4 trillion dollar (equivalent) program. That step-up seemed to shake the economy out of its torpor. But then the imposition of a consumption tax took it back into an economic funk. The consumption tax rose to 8% from 5%. Its last increase had been a 2 percentage point rise to 5% in 1997; on that first occasion, the economy reacted badly to the tax hike and contracted briefly. Well, that repeated again as the economy's positive reaction to the Bank of Japan's QE program was sidetracked by the recent tax. As a result, the second leg of the tax hike to 10% was postponed in November 2014. But now there are some signs that the economy has begun to deal with the consumption tax bite and may be improving again. Is this recovery for real? What is the evidence?

In its quarterly regional economic report, the BOJ has upgraded its view of three of nine regions. In the other six regions, economic assessments are unchanged.

Japan's monetary policy board's minutes from its mid-March meeting, released on Monday, showed that the body expects a moderate recovery to continue. It sees inflation expectations as rising even with actual inflation held back by dropping energy prices for now. Core corporate services prices for March rose by 0.3%. Year-over-year these prices are up by 0.7%, as some price gains are holding despite energy price drops.

Japan reported today that machine orders and core machine orders fell in February. Yet, both these series are higher year-over-year. Total orders are up by 10.9% and core orders are up by 6.3%. While monthly numbers continue to prevaricate, the BOJ sees some progress in the economy overall.

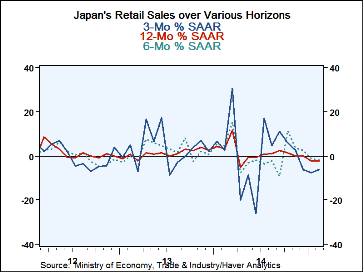

The disappointing report of the day was from retail sales. The chart above shows that three-month, six- month and 12-month trends in retail sales are still negative with sales contracting.

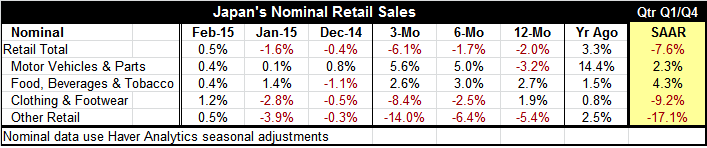

The table shows that while retail sales rose in all the categories in February they still are falling at a 6.1% annual rate over three months and a falling at a 2% annual rate year-over-year. Only motor vehicles and food sales show any tendency toward acceleration. Clothing sales are still decelerating sharply. Its sequential growth rates and those for `other' retail sales also exhibit a sharp deceleration, especially over three months, led by severe weakness in January.

Since all sales were weak or slow in January, the quarter-to-date data show weakness as well. Overall sales are falling at a 7.6% annual rate in the quarter-to-date with sharp declines in clothing and footwear and in `other' retail. However, motor vehicle purchases as well as food, beverages and tobacco purchases are showing growth.

Of course, dropping energy prices are still playing havoc with overall sales patterns. Motor vehicle sales and foods sales are free of direct energy effects and there sales are advancing. However, clothing also is free of any direct energy impact and sales there are weakening. The `other' category embodies direct energy effects and is severely weak.

For now we can be somewhat encouraged that sales did rebound in February after two straight months of declines and after three declines in the past five months. The 0.5% gain is the largest gain in overall sales since September 2014 when sales rose by 1.8%. But that optimistic assessment is damped by the fact that sales are only rebounding weakly from a 1.6% drop in January.

Japan is still a land of mystery and unique trends. It has been an economy of excesses, making it hard to evaluate. Japan has a huge federal debt problem that will continue to hang over its head- some think it is bound to be crushing. It has a massive QE program in train. Its currency has been on roller coaster like no other. After undergoing an enormous rise in the 1980s and 1990s, the yen is now declining, gaining back some of that lost competiveness. Some businesses actually are locating back in Japan after fleeing the land of the rising yen.

Japan has had some huge disasters to recover from. The Tsunami raised concerns that its nuclear plants were unsafe leading to a nationwide shut-down, sharply increasing reliance on fossil fuels. That process is just now unwinding as some nuclear facilities come back on stream amid some controversy. Japan's population is shrinking too. All of these factors imbue Japan with a very special nature.

Weak population growth alone is a huge impediment to getting growth going again. But bringing back some production facilities from overseas could help to support growth. Japan is a nation of many moving parts. While the BOJ this month is getting a bit more optimistic, too many of these parts still are moving too slowly or in the wrong direction. Japan's consumers are not yet on board with the expansion as retail sales trends show. Getting the consumers on board is crucial to this success.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates