Global| May 29 2014

Global| May 29 2014Japan's Retail Sales: The VAT Blues

Summary

Japan imposed a new VAT tax at the start of the second quarter. Consumer behavior designed for tax avoidance has had a huge impact on retail sales in the month immediately before the imposition of the tax and in the month of the [...]

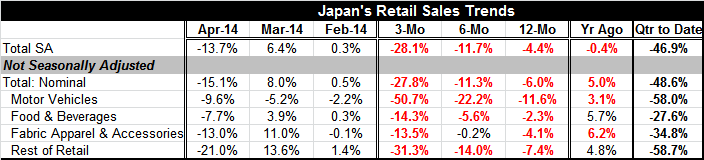

Japan imposed a new VAT tax at the start of the second quarter. Consumer behavior designed for tax avoidance has had a huge impact on retail sales in the month immediately before the imposition of the tax and in the month of the imposition of the tax. In April, the month in which the tax has been imposed, retail sales are down at a 13.7% month-to-month rate. This compares to March when sales had seemed strong because they rose by 6.4%. On balance, sales are down very sharply over those two months. It certainly is true that it's impossible to discern the trend for retail sales in the aftermath of these sharp gyrations.

Japan imposed a new VAT tax at the start of the second quarter. Consumer behavior designed for tax avoidance has had a huge impact on retail sales in the month immediately before the imposition of the tax and in the month of the imposition of the tax. In April, the month in which the tax has been imposed, retail sales are down at a 13.7% month-to-month rate. This compares to March when sales had seemed strong because they rose by 6.4%. On balance, sales are down very sharply over those two months. It certainly is true that it's impossible to discern the trend for retail sales in the aftermath of these sharp gyrations.

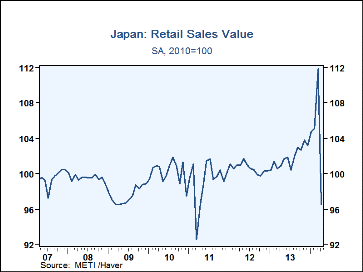

Japan's seasonally adjusted retail sales are falling at a 28% annual rate over three months, at about 12% annual rate over six months, and a 4.5% rate over 12 months. The whole of this weakness is because of the sharp drop in April. In the quarter to date, which analyzes the April gain in over the first quarter average for sales, the pace of sales is falling at a 47% annual rate. Declines are found over all the major categories of retail sales.

The Bank of Japan is optimistic that Japan will get through this bump in retail sales and that the economy will continue to grow. What we see on the brink of this sales tax imposition is that the pullback in sales is much more severe than had been anticipated. And we find that that the ramp-up in sales ahead of the imposition of the VAT has turned out to be quite small in comparison with the falloff.

The BOJ has been aggressive in making statements about its ability to stimulate the economy, pointing out that even if interest rates go to zero it will still have the ability to continue to stimulate the economy. Certainly whatever the central bank does will be more or less effective, depending on what the yen exchange rate does. Japan will be greatly helped if its exports could grow to help to stimulate output and job growth in the economy rather than to put the entire burden of greater growth on the back of domestic demand and whatever special policies the BOJ can implement.

For now, the April sales drop is simply much bigger than expected. It puts sales in a huge hole to begin the second quarter. We would certainly expect that from this low level in April sales are going to begin to rebound in May. In the past Japanese consumers have been very good arbitrageurs of the sales tax; but there are only so many things that you can or will buy forward. We expect to see sales gains in May, but certainly have no way to estimate how strong they might be.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.