Global| Oct 02 2006

Global| Oct 02 2006Japan's "Tankan" Like Germany's "IFO" Confident of the Present but Cautious of the Future

Summary

The Bank of Japan's Tankan Survey released this morning shows a greater than expected increase in the headline series (Diffusion index for large manufacturers' current conditions) from 21% in June to 24% in September and was 5 [...]

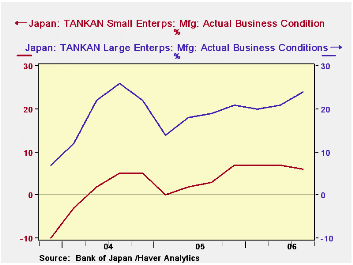

The Bank of Japan's Tankan Survey released this morning shows a greater than expected increase in the headline series (Diffusion index for large manufacturers' current conditions) from 21% in June to 24% in September and was 5 percentage points above June, 2005. A weakening of the yen and a fall in oil prices since the June survey has contributed to the increase in economic activity. Confidence in current conditions also improved for medium sized manufactures--from 13% to 14%--while that for small manufacturers declined--from 7% to 6%. The trends of the diffusion indexes of actual conditions in the large and small manufacturers are shown in the first chart.

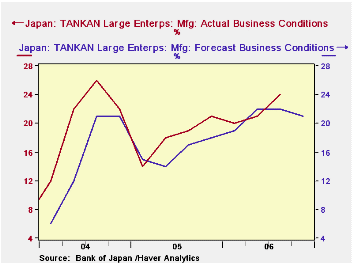

While Japanese manufacturers were more confident in their appraisal of current conditions, they were less confident in their appraisal of the future. The diffusion index for large manufacturers' appraisal of the future fell from 22% to 21%, that for medium manufacturers fell from 13% to 11% while that for small firms remained unchanged at 7%. The contrast between the optimistic appraisal of current conditions and less sanguine appraisal of the future for large corporations is shown in the second chart.

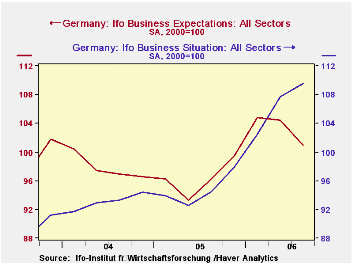

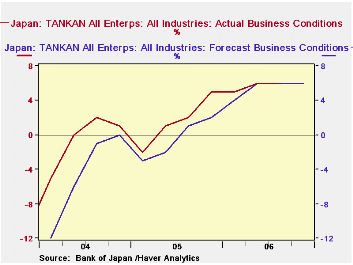

The IFO Survey of German business released last week showed the same general trends as the Tankan Survey--an improved appraisal of current conditions and less sanguine view of the outlook. We suggested, in that in case of Germany, that the decline in the appraisal of the future was more likely to reflect caution rather than alarm as current conditions had rec ently been much better than anticipated. (See Chart 3) In the case of Japan, actual business conditions for all industries have been better than expectations since the series began in 2004 until the second and third quarters of this year when they equaled expectations. (See Chart 4)

ently been much better than anticipated. (See Chart 3) In the case of Japan, actual business conditions for all industries have been better than expectations since the series began in 2004 until the second and third quarters of this year when they equaled expectations. (See Chart 4)

With the economy in the United States slowing, attention is being brought to bear on the prospects for growth in the next two largest industrial economies. While these surveys suggest some deceleration in growth may be in the cards for Japan and Germany, the trend of growth in both countries continues to recover from the depressed years of the recent past.

| Japan TANKAN (%) | 3Q 06 | 2Q 06 | 3Q 05 | Q/Q Dif | Y/Y Dif | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|

| ACTUAL CONDITIONS | ||||||||

| Large Corporations | 24 | 21 | 19 | 3 | 5 | 18 | 21 | |

| Medium Corporations | 14 | 13 | 5 | 1 | 9 | 7 | 10 | |

| Small Corporations | 6 | 7 | 3 | -1 | 3 | 3 | 2 | |

| FORECASTS | 4Q 06 | 3Q 06 | 4Q 05 | Q/Q Dif | Y/Y Dif | 2006 | 2005 | 2004 |

| Large Corporations | 21 | 22 | 18 | -1 | 3 | 21 | 16 | 15 |

| Medium Corporations | 11 | 13 | 6 | -2 | 7 | 11 | 4 | 4 |

| Small Corporations | 7 | 7 | 1 | 0 | 6 | 7 | 1 | -2 |