Global| Oct 02 2017

Global| Oct 02 2017Japan's Tankan Marks 10-Year High Reading

Summary

The Tankan assessment Japan's Tankan survey turned out much stronger than expected. The closely-watched manufacturing gauge for large enterprises in Q3 soared to a reading of 22, up from 17 in Q2 which in turn had risen from 12 in Q1. [...]

The Tankan assessment

The Tankan assessment

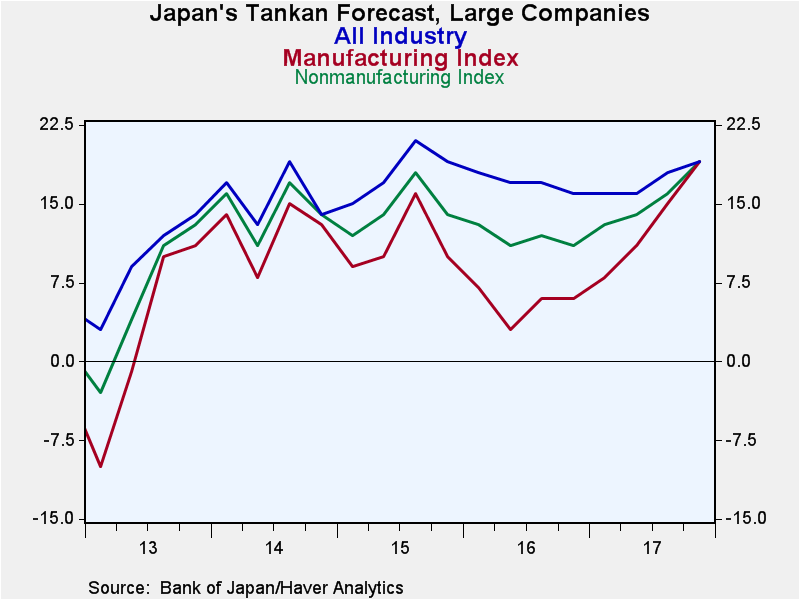

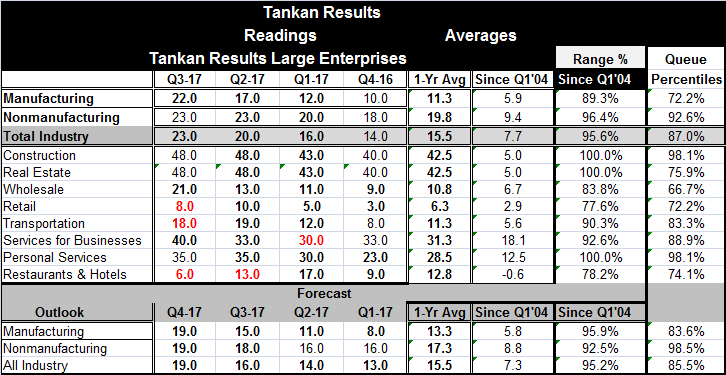

Japan's Tankan survey turned out much stronger than expected. The closely-watched manufacturing gauge for large enterprises in Q3 soared to a reading of 22, up from 17 in Q2 which in turn had risen from 12 in Q1. The Tankan has been making great strides. The quarterly manufacturing reading's q/q gain ranks as in the top 21st percentile of all quarterly changes back to 2004. The four-quarter change ranks in the top 16th percentile. The level of the reading for the large enterprise gauge in Q3 2017 stands in its 72nd queue percentile and is the highest reading in 40 quarters making it last higher before the onset of the global recession and financial crisis in late-2007. The lesser watched nonmanufacturing index was unchanged quarter-to-quarter and already has a 92.6 percentile standing.

The Tankan outlook survey

The Tankan report also has an outlook section. The outlook for large manufacturing establishments gained four points on the quarter and rose to a reading of 19 for Q4. At that level, the reading has an 83.6 queue percentile standing in its historic queue of data. The quarterly rise itself marks a top 19th percentile gain among all quarterly changes and the four-quarter gain of 13 points has been larger only 16% of the time. For nonmanufacturing, the outlook index has a reading of 19, a one-point quarter-to-quarter gain marking a 98.5 percentile queue standing. The combined standing of the two sectors has driven the outlook index for the large enterprise all-industry reading to its 85.5 percentile. But for medium-sized enterprises, the outlook for all of industry is at the highest value in the history of the survey and the same is true for small enterprises.

Other industries

Aside from manufacturing that has a 72.2 percentile standing for its Q3 reading, there are Tankan readings for industries in the nonmanufacturing sector as well. Construction and personal services each have a 98.1 queue percentile reading in Q3. The "services for businesses" sector has an 88.9 percentile standing. Transportation has a strong 83.3 percentile standing. Real estate, restaurants & hotels and retailing industries have readings in the 70th percentile in Q3. Wholesaling has a 66th percentile standing.

Momentum

The strongest gain relative to its one-year average comes from manufacturing followed by wholesaling. Transportation ranks as next best and there is a tie between services for businesses and retailing for the next slot. Restaurants & hotels are the clear lagging sector and the only one with a weaker Tankan reading in Q3 than over the previous year. Construction and real estate are two other relative laggard sectors, but they are both above their respective one-year average readings.

Conditions

The Bank of Japan expects inflation to hit its 2% objective in the fiscal year ending in March 2020, as it argues (as does the Fed in the U.S.) that a tightening job market and solid economic growth will gradually push up prices. The Tankan produced an index gauging firms' views of the job market that showed that complaints of labor shortages, rather than excess staff, were at the highest since 1992. Large firms kept their capital spending plans intact. Big firms expect to increase capital expenditure by 7.7% in the current fiscal year ending in March 2018; that is roughly unchanged from their plans back in June.

On balance, the Tankan report is a breath of fresh air. The survey is closely watched and considered an important and reliable gauge for Japan's economy. The leadership from manufacturing in terms of momentum is a very satisfying finding. While inflation in Japan continues to lag, the Tankan report is reassuring that growth remains on path. It largely agrees with the updated manufacturing survey from Markit for Japan in September also released and finalized today. The Tankan is just another global example of a report that shows that growth continues and is improving despite a lack of progress in lifting inflation to target.

For Prime Minister Abe, the Tankan is support for his case that the economy is responding to his policies, an important consideration for a politician calling a snap election. To the BOJ, there is probably something comforting in this report, but there is no clear sense that this means the inflation target is more viable. Growth and inflation have decoupled globally recently; there is no sense in this report that inflation will perk up but on traditional analysis that would be expected. I would expect the BOJ to stay optimistic based on that scenario in the wake of this report.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates