Global| Dec 16 2020

Global| Dec 16 2020Japan's Trade Balance Shifted to a Large Surplus in November As Imports Fell Faster Than Exports

Summary

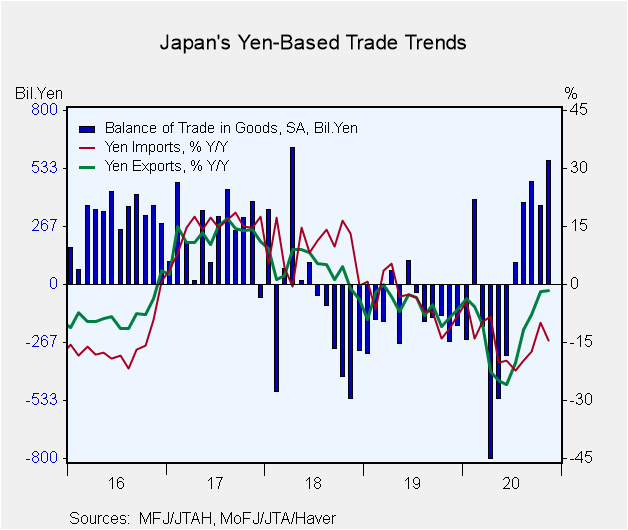

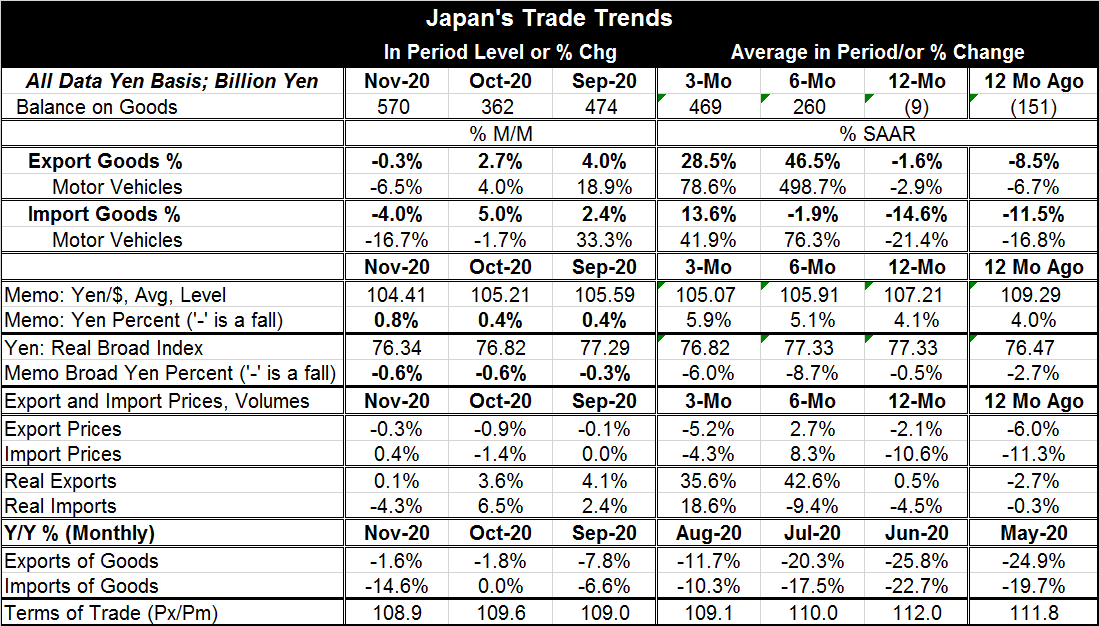

Japan's exports headed lower in November but still commanded a strong growth rate over the last three months. Imports are lower in November by 4%, a large drop; they also are growing over three months but not as robustly as exports. [...]

Japan's exports headed lower in November but still commanded a strong growth rate over the last three months. Imports are lower in November by 4%, a large drop; they also are growing over three months but not as robustly as exports. Year-on-year both exports and imports are contracting, but imports are falling faster.

Japan's exports headed lower in November but still commanded a strong growth rate over the last three months. Imports are lower in November by 4%, a large drop; they also are growing over three months but not as robustly as exports. Year-on-year both exports and imports are contracting, but imports are falling faster.

The yen exchange rate has been mixed. Against the dollar, the yen has been rising firmly and consistently. But the broad multilateral trade weighted yen has been slipping in value falling over 12 months, six months and three months.

One of the main reasons for import weakness has been falling import prices; they are lower by 10.6% over 12 months while export prices fell by only 2.1%.

Real exports are rising over 12 months, six months and three months with strong double-digit growth rates in place over six months and three months. For imports, real flows are lower over 12 months and lower over six months. However, they do manage a turn as real imports make strong gains over three months but still lag the three-month growth rate of real exports.

Japan's exports are simply leading with better volume growth and better price retention than imports. Imports reflect weak energy prices as well as relatively weak domestic demand in Japan.

Japan also has a new set of virus woes. It had launched a travel promotion plan to restart the economy but now has been forced to rescind the 'Go To Travel' plan it had recently launched. Japan is facing its own litany of record-breaking case counts for infections. It is shutting down its travel program from December 28 through January 11.

Japan's current outbreak is severe enough that the CDC in the U.S. labels Japan as a very high level 4 risk. It recommends no travel to Japan. For those who travel, nonetheless, it recommends a viral test one to three days before traveling and a test upon return along with seven days in isolation.

Japan's daily case count is still rising and may not yet have peaked, but the levels are far above those reached earlier in the year. Unlike most other countries, deaths in Japan are spiking to higher levels generally in excess of the levels seen earlier in the year. But the death curve shows some early signs of turning lower.

Japan has definite virus issues to add to its woes after having been such a success story for much of the year. This virus continues to show that no matter who you are or how you conduct yourself, you are always at risk for an outbreak.

Japan will continue to bide its time and ride its new programs of restrictions to get the virus in order through the end of the year. This fits in with the global theme of economic slowing after a terrible Q2, an explosive Q3 and now a lackluster Q4.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates