Global| Mar 09 2009

Global| Mar 09 2009Japan Starts 2009 with a CurrentAccount Deficit

Summary

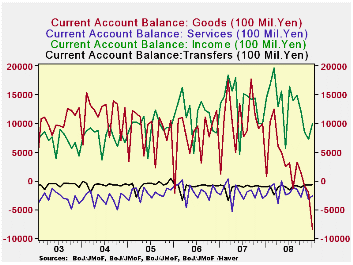

Japan recorded a current account deficit in January of $172.8 billion yen, due largely to the collapse in exports. Exports of goods declined by 1309.6 billion yen in January and were 2830.6 billion yen below a year ago. Imports [...]

Japan recorded a current account deficit in January of $172.8

billion yen, due largely to the collapse in exports. Exports of goods

declined by 1309.6 billion yen in January and were 2830.6 billion yen

below a year ago. Imports declined 663.2 billion yen in January and

were 1914.9 billion yen below January, 2008. The resulting deficit on

goods was 844.4 billion yen in January, compared with 197.9 billion yen

in December and a surplus of 71.3 in January, 2008. The balance between

income from foreign sources and payments to these sources increased

from 924.2 billion yen in December to 992.4 billion yen in January but

was substantially below the 1,448.4 billion yen of January, 2009. The

deficit on services in January was 255.8 billion yen, little changed

from the 251.6 billion yen of a year ago. The deficit on current

transfers was 65.0 billion yen, down from the 104.4 deficit of January

2008. The first chart shows the importance of the recent decline in the

balance on goods in the decline of the current account.

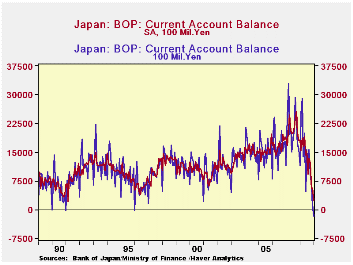

January is typically a low month for the current account balance, as can be seen in the second chart, which shows both the seasonally unadjusted and adjusted data. After seasonal adjustment, the data for the current account show a surplus of 259.0 billion yen for January. This surplus is, however, the lowest recorded since the early nineties, as can be seen in the second chart, just as the deficit in the unadjusted data was the highest.

| JAPAN CURRENT ACCOUNT (100 Mil Yen) | Jan 09 | Dec 08 | Jan 08 | M/M CHG | Y/Y CHG | 2008 | 2007 |

|---|---|---|---|---|---|---|---|

| Total NSA | -1728 | 1254 | 11637 | -2982 | -13365 | 162802 | 247938 |

| Goods | -8444 | -1929 | +713 | -6465 | -9157 | 40337 | 123225 |

| Exports | 32822 | 45920 | 61128 | -13096 | -28306 | 773522 | 797254 |

| Imports | 41266 | 47266 | 60415 | -6632 | -19149 | 733183 | 674030 |

| Services | -2558 | -3217 | -2516 | 659 | -42 | -22366 | -24971 |

| Income | 9924 | 7242 | 14484 | 2682 | -4560 | 158324 | 163267 |

| Current Transfers | -650 | -793 | -1044 | 143 | 394 | -13497 | -13580 |

| Total SA | 2580 | 5570 | 18059 | -2990 | -15478 | 162599 | 250661 |

by Robert Brusca March 9 2009

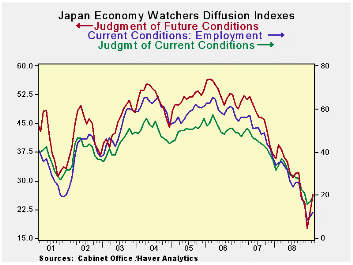

Japan’s economy watchers index is making further tentative

signs of rebounding from its very deep cyclical lows in this cycle. The

future index has made a more substantial bounced higher, but the

current index is rising too. The future index is still in the bottom

22% of its five year range. The headline index is only in the 8.5%

percentile of its range. But any improvement begins from where you are.

In December each of these measures was at a five year low. So this is

what the early signs of progress look like. It is too soon to take the

positive moves in these signs to the bank. But I think we have been

very oversold in markets and that commentators have been pessimistic

beyond what prudence would call for. Japan’s early signs join some from

the US that say conditions are not now getting worse. This may well be

among the first tentative steps on the road to eventual recovery.

| Key Japanese surveys | |||||||

|---|---|---|---|---|---|---|---|

| Raw readings of each survey | Percent of 5Yr range* | ||||||

| Diffusion | Feb-09 | Jan-09 | Dec-08 | Nov-08 | Feb-09 | Jan-09 | Dec-08 |

| Economy Watchers | 19.4 | 17.1 | 15.9 | 21.0 | 8.5% | 2.9% | 0.0% |

| Employment | 11.9 | 10.1 | 8.5 | 15.7 | 5.9% | 2.8% | 0.0% |

| Future | 26.5 | 22.1 | 17.6 | 24.7 | 22.8% | 11.5% | 0.0% |

| NTC MFG | 31.6 | 29.6 | 30.8 | 36.7 | 7.0% | 0.0% | 0.0% |

| Econ Trends (Teikoku'/50 neutral/weighted diffusion) | |||||||

| MFG | 17.0 | 17.7 | 19.3 | 24.5 | 0.0% | 0.0% | 0.0% |

| Retail | 20.5 | 21.6 | 21.3 | 24.4 | 0.0% | 1.5% | 0.0% |

| Wholesale | 18.4 | 19.0 | 20.4 | 24.7 | 0.0% | 0.0% | 0.0% |

| Services | 22.6 | 23.3 | 24.1 | 28.4 | 0.0% | 0.0% | 0.0% |

| Construction | 18.2 | 18.6 | 19.1 | 21.4 | 0.0% | 0.0% | 0.0% |

| 100 is high; Zero is low | |||||||

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates