Global| Oct 23 2003

Global| Oct 23 2003Japanese Consumers' Outlook Gains in Q3

Summary

Gains in stock prices and signs of economic recovery in Japan helped lift the Japanese Consumer Sentiment Index by 2.7 points in Q3, to 40.0, the highest level in over two years. This survey of about 5,000 Japanese households was [...]

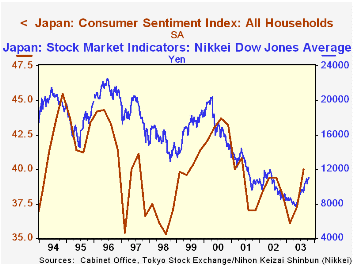

Gains in stock prices and signs of economic recovery in Japan helped lift the Japanese Consumer Sentiment Index by 2.7 points in Q3, to 40.0, the highest level in over two years. This survey of about 5,000 Japanese households was taken September 15. The Nikkei 225 stock price index stood at 10712 the Friday before, up almost 20% from 8981 on June 13, the Friday before the previous survey, and up 40% from the cycle low of 7608 on April 28. Recent consolidation in the stock market has shaved this overall increase to 35%, but it's still a quite substantial gain.

Job market conditions are perceived much less negatively than in the prior quarters. Indeed, the increase in the "job situation" component, 8.9 points, is the second largest rise in the 21-year history of these data. Interestingly, actual employment looks less vigorous than might inspire such a large rise; while off its lows, employment has moved up very erratically, and businesses' assessments of jobs actually deteriorated in the Bank of Japan's third quarter TANKAN report, issued about three weeks ago. In contrast, unemployment is somewhat reduced, as the unemployment rate decreased 0.2 percentage point in August to 5.1%, its lowest since August 2001.

In interpreting these figures, it's important to point out that, while we use the words "improve" and "gain", they are only relative. These diffusion indexes remain below 50%, so pessimists still outnumber optimists. But the "pessimism margin" is narrowing, a necessary step for outright advances to develop.

| Japan: Consumer Behavior Survey | Q3 2003 | Q2 2003 | Q1 2003 | Q3 2002 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|---|

| Consumer Sentiment Index | 40.0 | 37.3 | 36.1 | 39.4 | 38.8 | 38.7 | 43.0 |

| Job Situation | 36.2 | 27.3 | 25.0 | 28.8 | 27.7 | 25.2 | 38.0 |

| Standard of Living | 40.6 | 37.7 | 36.7 | 39.5 | 39.0 | 39.4 | 43.6 |

| Nikkei-225 Stock Price Index* | 10712 | 8980 | 8003 | 9243 | 10103 | 12126 | 17061 |

| Unemployment Rate - %** | 5.1 | 5.4 | 5.2 | 5.5 | 5.4 | 5.0 | 4.7 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.