Global| Nov 14 2005

Global| Nov 14 2005Japanese Gross Domestic Product Slows, but Exceeds Consensus Estimates

Summary

Preliminary data on Japan's Gross Domestic Product was released late last week. Total GDP rose at an annual rate of 1.7% in the third quarter, above the consensus estimate of 1.1%. Although the growth had slowed from 3.25% of the [...]

Preliminary data on Japan's Gross Domestic Product was released late last week. Total GDP rose at an annual rate of 1.7% in the third quarter, above the consensus estimate of 1.1%. Although the growth had slowed from 3.25% of the second quarter and the 6.29% of the first quarter, the report was well received by financial analysts and the stock market. The Nikkei 225 Average rose 0.5% or 74 points to 14,155.06 on last Friday, its highest close since May 2001.

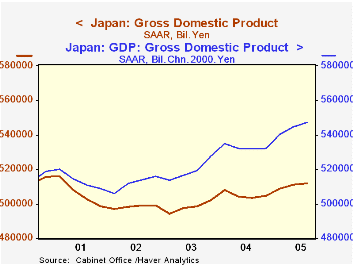

On Monday, the stock market gave back more than half of Friday's gains. While the Monday decline has been attributed to a falling off of demand for Japanese stocks by foreign investors, some of the decline may have been the result of different views on deflation expressed by the Governor of the Bank of Japan and the Prime Minister following the release of the GDP data. Toshihiko Fukui, governor of the Bank of Japan, hinted at a possible change in monetary policy. "A shift in policy, conceptually, would be a cut in current account deposits (the liquidity target) followed by very low short-term interest rates and then an adjustment to rates to a level in line with economic conditions." Prime Minister Junichiro Koizumi warned the Bank that it was too early to change its easy monetary policy of fighting deflation. In the first chart the gap between real and nominal GDP, a measure of deflation, has yet to show meaningful signs of decline.

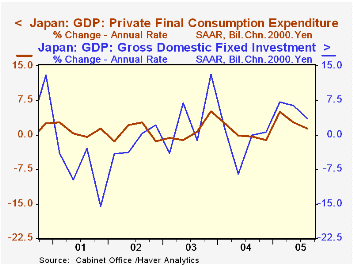

The deceleration in growth was due in part to a decline in net exports as imports, fueled by high oil prices, rose faster than exports. However, both private consumption and gross fixed investment also played a part in the deceleration of growth. The second chart shows the seasonally adjusted annual rate of change in private final consumption and in gross fixed investment. The one sector that showed higher growth was inventories as both public and private inventories rose.

| Japan: Gross Domestic Product |

Q3 2005 % | Q2 2005 % | Q1 2005 % | Q4 2004 % | 2004 % | 2003 % | 2002 % |

|---|---|---|---|---|---|---|---|

| GDP Current Yen | 0.69 | 2.05 | 3.15 | 0.89 | 1.40 | -0.05 | -1.56 |

| GDP 2000 Chn Yen | 1.70 | 3.25 | 6.29 | 0.72 | 2.61 | 1.41 | -0.29 |

| Private Final Consumption | 1.36 | 2.67 | 5.04 | -1.09 | 1.47 | 0.24 | 0.53 |

| Gross Domestic Fixed Investment | 3.66 | 6.42 | 7.10 | 0.62 | 1.34 | 1.05 | -5.67 |

| Exports of Goods & Services | 11.43 | 13.03 | -0.05 | 6.62 | 14.47 | 9.09 | 4.15 |

| Imports of Goods & Services | 16.66 | 9.40 | 0.30 | 10.33 | 8.92 | 3.82 | 1.25 |

| Q3 05 Bil. 2000.Chn Yen |

Q2 05 Bil. 2000.Chn Yen |

Q1 05 Bil.2000.Chn Yen |

Q4 04 Bil. 2000.Chn Yen |

2004 Bil. 2000.Chn Yen |

2003 Bil. 2000.Chn Yen |

2002 Bil. 2000.Chn Yen |

|

| Private Inventory Change | 2261.1 | 2046.3 | 2848.9 | 1128.9 | 839.6 | -108.5 | -983.9 |

| Public Inventory Change | 163.5 | 124.0 | 141.5 | 167.6 | 41.4 | 2.5 | -6.6 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates