Global| Feb 01 2002

Global| Feb 01 2002Job Loss Smallest Since August

by:Tom Moeller

|in:Economy in Brief

Summary

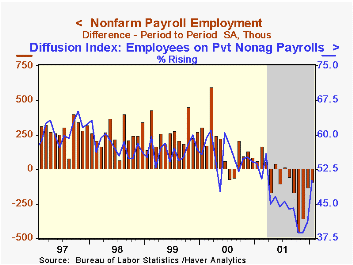

The recent decline in nonfarm payrolls moderated as expected last month continuing a trend since payrolls fell 448,000 last October. December's decline was deepened slightly but the November drop was lessened. From the household [...]

The recent decline in nonfarm payrolls moderated as expected last month continuing a trend since payrolls fell 448,000 last October. December's decline was deepened slightly but the November drop was lessened.

From the household survey, the unemployment rate fell despite a sharp drop in employment as the labor force fell by a record 924,000.

The one-month diffusion index of payroll employment rose to 50.1, the first reading over 50 (more firms expanding payrolls than contracting) since last March. The three-month figure rose slightly to 38.1.

Manufacturing payrolls again fell but by the least amount since September. The employment diffusion index for the factory sector improved to 40.8.

Employment in the service sector rose due to strength in retail hiring.

The index of aggregate hours worked (employment times hours worked) fell 0.4% and January was 0.5% below the 4Q average.

Average hourly earnings were unchanged and the sharp December increase was revised lower.

The establishment survey figures for nonfarm payrolls are based on reports provided to the US Labor Dept. by businesses. The household survey figures (incl. the unemployment rate) are based on a mail survey of US households.

| Employment | Jan '02 | Dec '01 | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Payroll Employment | -89,000 | -130,000 | -0.9% | 0.4% | 2.2% | 2.4% |

| Manufacturing | -89,000 | -122,000 | -7.2% | -4.2% | -0.5% | -1.3% |

| Average Weekly Hours | 34.0 | 34.1 | 34.4 | 34.2 | 34.4 | 34.5 |

| Average Hourly Earnings | 0.0% | 0.3% | 4.0% | 4.2% | 3.8% | 3.6% |

| Unemployment Rate | 5.6% | 5.8% | 4.2% | 4.8% | 4.0% | 4.2% |

by Tom Moeller February 1, 2002

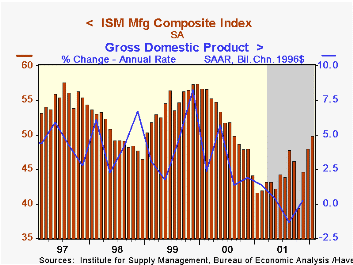

The Institute of Supply Management Manufacturing Index - formerly the NAPM Composite Manufacturing Index - rose as expected last month. New seasonal factors altered the historical data slightly.

Each of the index component series rose except new orders which was about unchanged following a surge in December.

Deflationary pressure fell as the price index rose to the highest level since last spring.

| ISM Manufacturing Survey | Jan' 02 | Dec '01 | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Composite Index | 49.9 | 48.1 | 41.7 | 43.9 | 51.6 | 54.6 |

| Prices Paid Index | 43.9 | 33.2 | 64.6 | 43.0 | 64.8 | 54.2 |

by Tom Moeller February 1, 2002

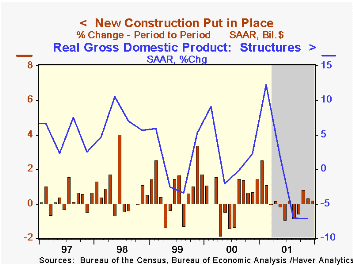

The value of construction put-in-place rose precisely as expected in December. The November total was revised down due to a lowered estimate of nonresidential building but the decline in residential building was lessened.

Residential building activity rose due to a jump in construction of multi-unit structures. The value of single-unit construction fell for the third month in four.

Nonresidential building activity fell for the eighth month of the year.

Spending by governments fell slightly after strong gains the prior two months.

| Construction Put-in-place | Dec '01 | Nov '01 | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Total | 0.2% | 0.3% | 3.0% | 5.6% | 7.0% | 8.6% |

| Residential | 0.7% | -0.9% | 6.0% | 5.6% | 7.4% | 11.1% |

| Nonresidential | -0.4% | -2.6% | -11.7% | -0.2% | 8.0% | 1.9% |

| Public | -0.2% | 4.2% | 16.0% | 11.0% | 4.5% | 10.1% |

by Tom Moeller February 1, 2002

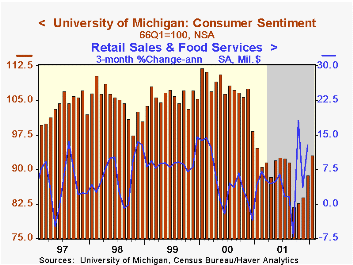

The University of Michigan’s Index of Consumer Sentiment rose less than expected in January due to weakness late in the month.

Nevertheless, the 4.7% m/m rise reflected a sharply higher reading of expectations. The reading of current economic conditions fell and nearly erased the December gain.

The figures are not seasonally adjusted.

| University of Michigan | Jan '02 | Dec '01 | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Consumer Sentiment | 93.0 | 88.8 | -1.8% | 89.2 | 107.6 | 105.8 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates