Global| Apr 05 2002

Global| Apr 05 2002Jobs in March Up, February Gain Revised Down

by:Tom Moeller

|in:Economy in Brief

Summary

Nonfarm payrolls rose about as expected last month. However, the previously reported gain in February payrolls was revised to a slight decline due to a downwardly revised gain in service sector payrolls.Yesterday's indication that [...]

Nonfarm payrolls rose about as expected last month. However, the previously reported gain in February payrolls was revised to a slight decline due to a downwardly revised gain in service sector payrolls.Yesterday's indication that initial claims for unemployment insurance rose due to filings for extended benefits was an advance indication that the pace of rehiring remained slow.

Further indication of weakness was the decline in the one-month diffusion index of job gain to 45.6%, the second decline in a row. The three month figure rose to 43.1%.The unemployment rate rose due to a 425,000 (-1.4% y/y) decline in household employment.

The median duration of unemployment was stable at 8.1 weeks, down sharply from the peak but up versus last year.

Factory sector jobs continued to fall though by the smallest amount since December 2000. Job loss continued in the industrial machinery, electronic equipment and transportation sectors. The one month diffusion index for the factory sector improved to 42.3% and the February figure was revised up.

Construction sector jobs fell 37,000 (-2.2% y/y) following a 30,000 gain in February.

Employment in the service sector rose 135,000 (0.1% m/m) led by strong gains in basic services and government. Employment in all other service sectors fell.

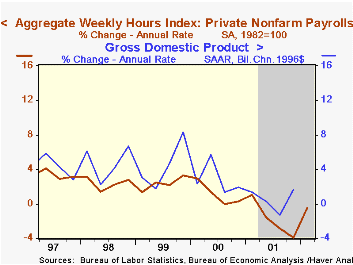

The index of aggregate hours worked (employment times hours worked) rose 0.1%. The 1Q average is 0.4% (AR) below 4Q.Aggregate hours rose in the factory sector for the first time since January 2001.

Average hourly earnings rose an expected 0.3%, but February was revised up.

The employment figures for nonfarm payrolls are based on reports provided to the US Labor Department by businesses, while the figures from which the unemployment rate is derived are based on a survey of US households.

| Employment | Mar | Feb | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Payroll Employment | 58,000 | -2,000 | -1.0% | 0.4% | 2.2% | 2.4% |

| Manufacturing | -38,000 | -54,000 | -7.1% | -4.2% | -0.5% | -1.3% |

| Average Weekly Hour1s | 34.2 | 34.2 | 34.3 | 34.2 | 34.4 | 34.5 |

| Average Hourly Earnings | 0.3% | 0.3% | 3.5% | 4.2% | 3.8% | 3.6% |

| Unemployment Rate | 5.7% | 5.5% | 4.3% | 4.8% | 4.0% | 4.2% |

by Tom Moeller April 5, 2002

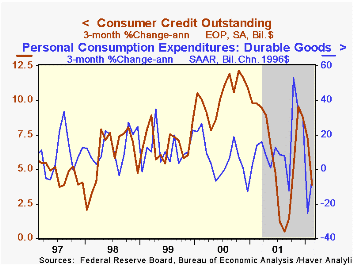

Consumer borrowing rose about as expected in February, however the surge in January was revised sharply lower.

The downward revision was due to lowered figures for nonrevolving credit (autos and other personal loans).

Revolving credit again rose by just a modest amount. Commercial banks and credit unions registered large unadjusted declines.

| Consumer Credit Outstanding | Feb m/m | Jan m/m | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Total | $7.1B | $7.0B | 5.1% | 6.1% | 10.2% | 7.5% |

| Revolving | $0.6B | $1.5B | 1.9% | 3.9% | 11.5% | 6.3% |

| Nonrevolving | $6.3B | $5.7B | 7.6% | 7.7% | 9.2% | 8.4% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates