Global| Jul 23 2020

Global| Jul 23 2020Kansas City Fed Factory Index Edges Higher in July

by:Sandy Batten

|in:Economy in Brief

Summary

• Midwest economic activity increases for the second consecutive month. • New orders and production lead gains with employment turning positive. • Expectations also rise further. The Federal Reserve Bank of Kansas City reported that [...]

• Midwest economic activity increases for the second consecutive month.

• New orders and production lead gains with employment turning positive.

• Expectations also rise further.

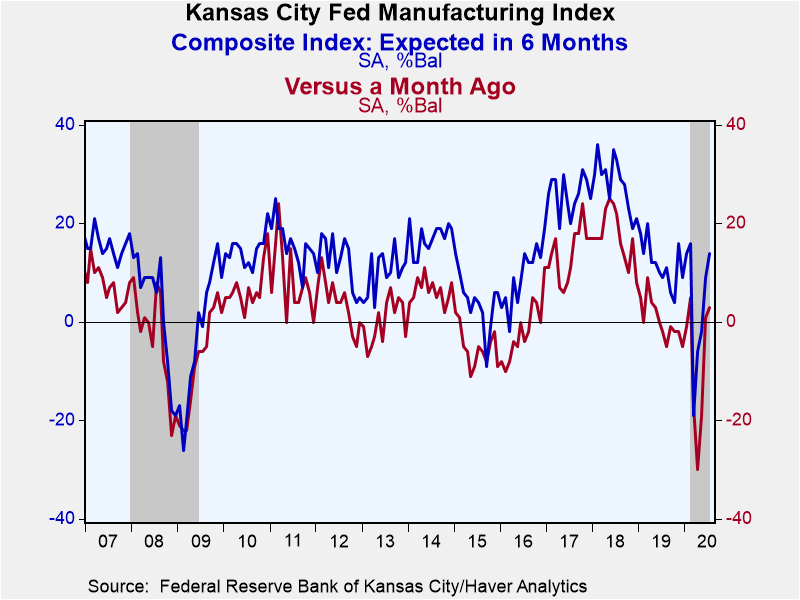

The Federal Reserve Bank of Kansas City reported that its manufacturing business activity index increased to 3 in July from 1 in June. The two consecutive positive readings were after three consecutive negative readings. The index is a diffusion index with positive readings indicating that more respondents reported increases than reported decreases. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The index of expectations in six months also posted a second consecutive positive reading, rising to 14 in July from 9 in June following three consecutive months of declining activity.

The ISM-Adjusted Index (NSA) slipped to 51.5 in July from 52.4 in June but remained above the critical 50 value that separates expansion from contraction. While well off it May 2018 high, the July value was above the average for 2019 (50.0).

This month's survey included special questions about changes in business costs and the need for physical infrastructure since managing the effects of COVID-19. 67% of respondents reported that their need for physical infrastructure had not changed in the past six months, and 69% anticipated that that need would not change in the medium term (1-2 years). Additionally, 66% of respondents said they had utilized a work-from-home policy in the last six months, but very few said that any portion of their workforce will now permanently work from home. In terms of business costs, 42% of firms reported that their costs have increased in the past six months, 26% reported no change, and 21% reported decreases.

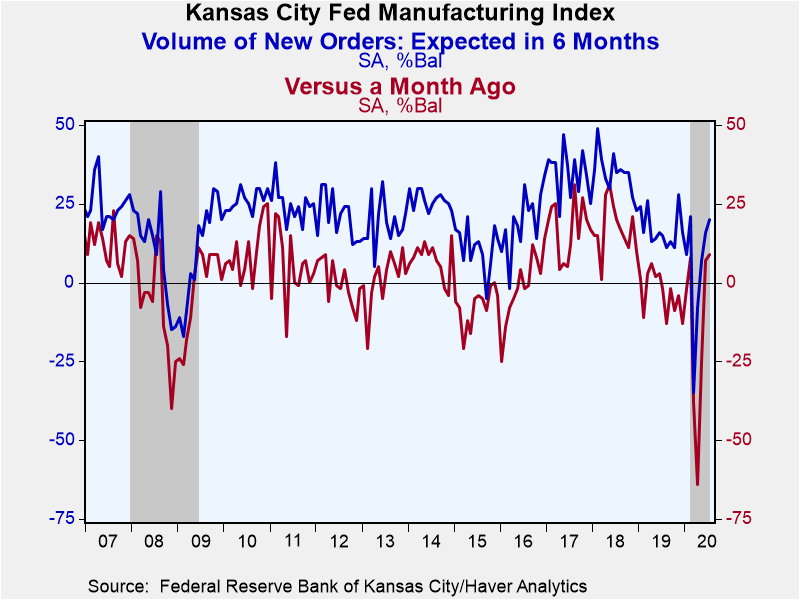

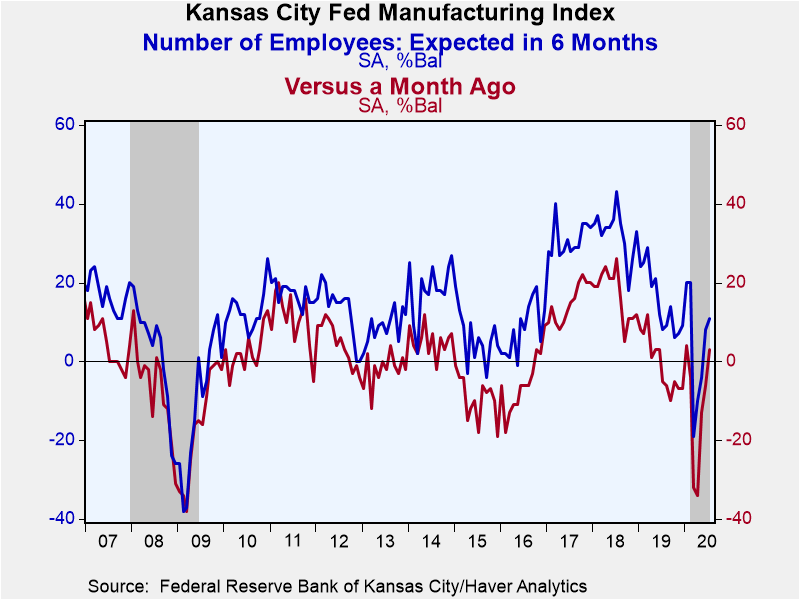

All of the current conditions components, including new orders, shipments and production strengthened again this month. Importantly, the employment index moved above zero to 3 in July after having been in negative territory for the preceding five months, indicating that employment across the Kansas City Fed district generally increased in July.

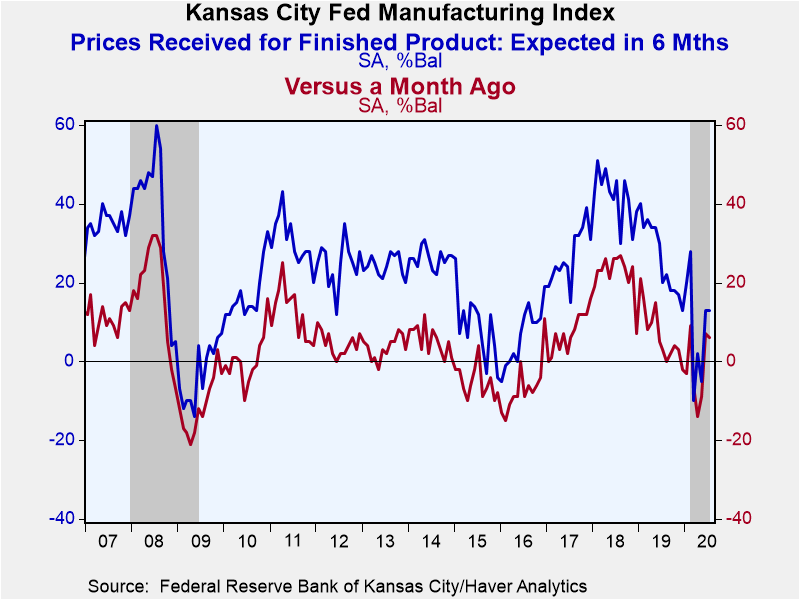

On the inflation front, the prices received index for finished products remained positive for the second consecutive month but slipped slightly to 6 in July from 7 in June. The prices paid for raw materials index edged up to 3 in July from 1 in June.

The index measuring expectations in six months was even more positive in July than in June, led by more positive expectations for shipments, new orders, employment and production each moved above zero.

The diffusion indexes are calculated as the percentage of total respondents reporting increases minus the percentage reporting declines. The July survey was conducted over a five-day period from July 15-20, 2020 and included 96 responses from plants in Colorado, Kansas, Nebraska, Oklahoma, Wyoming, northern New Mexico and western Missouri. Data for the Kansas City Fed Survey can be found in Haver's SURVEYS database.

| Kansas City Federal Reserve Manufacturing Survey (SA) | Jul | Jun | May | Jul'19 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Conditions Versus One Month Ago (% Balance) | 3 | 1 | -19 | -2 | 0 | 17 | 14 |

| ISM-Adjusted Composite Index (NSA) | 51.5 | 52.4 | 42.4 | 49.1 | 50.0 | 58.9 | 56.7 |

| New Orders Volume | 9 | 7 | -25 | -2 | -3 | 17 | 17 |

| Number of Employees | 3 | -6 | -13 | -5 | -1 | 17 | 15 |

| Production | 7 | 2 | -25 | -5 | 2 | 19 | 17 |

| Prices Received for Finished Product | 6 | 7 | -9 | 3 | 7 | 22 | 7 |

| Expected Conditions in Six Months | 14 | 9 | -2 | 9 | 12 | 28 | 26 |

| New Orders Volume | 20 | 16 | 7 | 15 | 17 | 35 | 35 |

| Number of Employees | 11 | 8 | -4 | 8 | 15 | 33 | 39 |

| Production | 25 | 14 | -2 | 20 | 19 | 40 | 40 |

| Prices Received for Finished Product | 13 | 13 | -5 | 20 | 26 | 42 | 27 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates