Global| Aug 27 2020

Global| Aug 27 2020Kansas City Fed Factory Index Rose Moderately in August

Summary

• Midwest economic activity continues to improve. • Future expectations indicate continued expansion but at a slower pace than reported in July. The Federal Reserve Bank of Kansas City reported that the manufacturing business activity [...]

• Midwest economic activity continues to improve.

• Future expectations indicate continued expansion but at a slower pace than reported in July.

The Federal Reserve Bank of Kansas City reported that the manufacturing business activity index rose to 14 in August from 3 in July and 1 in June.

The index is a diffusion index with positive readings indicating that more respondents reported increases than reported decreases. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes.

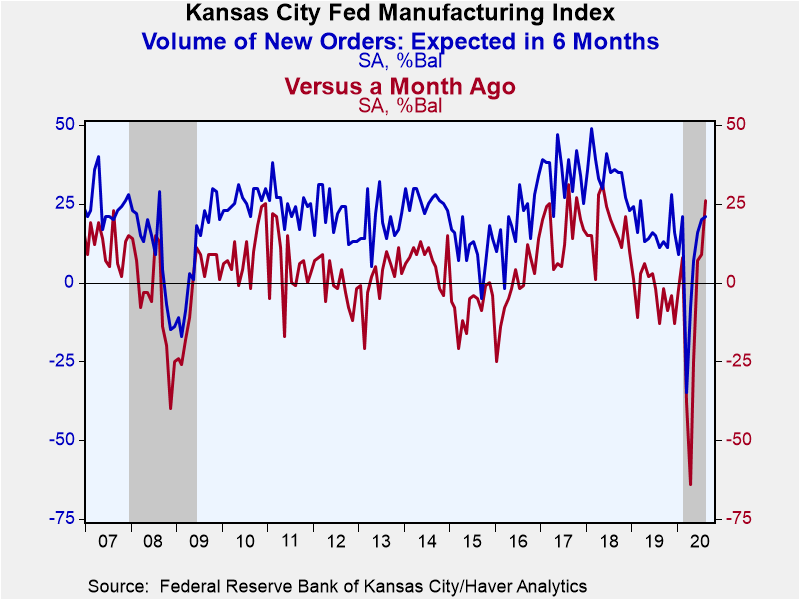

The vast majority of the current conditions components, including new orders, shipments and production were positive this month, with the exception of the finished goods inventory index, which was negative, though declined at a slower rate than in July. The production and volume of new orders indexes led the rise.

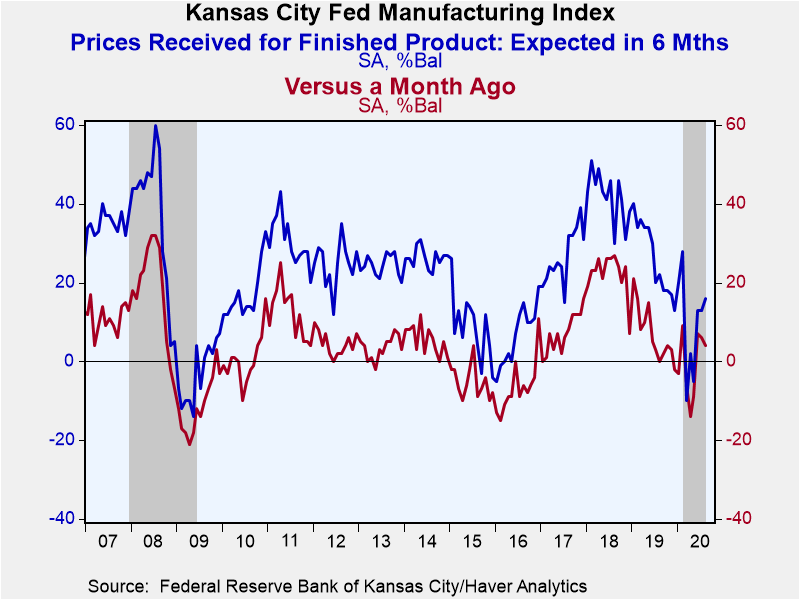

On the inflation front, the prices received index for finished products remained positive but eased in August to 4 from 6 in July, in contrast to the prices paid for raw materials, which jumped to 17 from 3 in July.

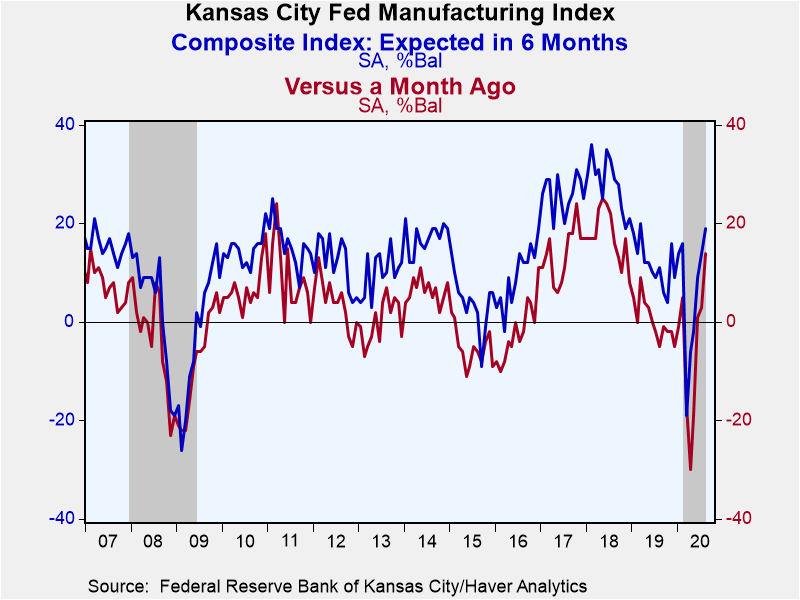

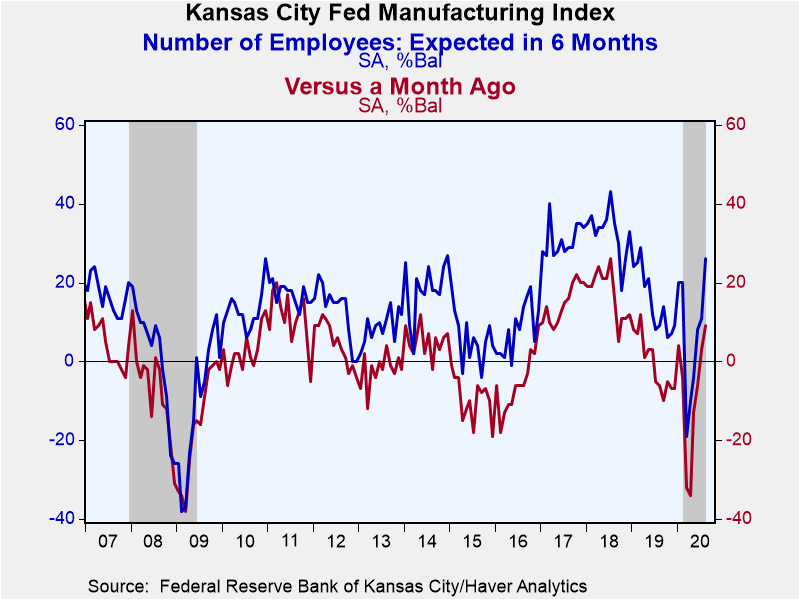

The future composite index (expectations in six months) rose to 19, up from 14 in July, led by a jump in the employment index, rising to 26 from 11 in July. Of note, the production index slowed to 20 in August from 25 in July, indicating continued expansion but at a slower pace, while expectations of price pressures intensified for both finished products (from 13 in July to 16 in August) and raw materials (from 17 in July to 31 in August).

The ISM-Adjusted Index (NSA) also improved, rising to 55 in August from 51.5 in July.

This month's survey included special questions about the impact of government stimulus and unemployment benefits. Nearly 67% of respondents reported that the stimulus programs contributed positively to the business performance in the past 3 months. Nearly 60% also indicated that the CARES Act extra $600/week in unemployment benefits made it harder in bringing laid-off or furloughed employees back to work.

The diffusion indexes are calculated as the percentage of total respondents reporting increases minus the percentage reporting declines. The August survey was conducted over a five-day period from August 19-24, 2020 and included 95 responses from plants in Colorado, Kansas, Nebraska, Oklahoma, Wyoming, northern New Mexico and western Missouri. Data for the Kansas City Fed Survey can be found in Haver's SURVEYS database.

| Kansas City Federal Reserve Manufacturing Survey (SA) | Aug | Jul | Jun | Aug'19 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Conditions Versus One Month Ago (% Balance) | 14 | 3 | 1 | -5 | 0 | 17 | 14 |

| ISM-Adjusted Composite Index (NSA) | 55.0 | 51.5 | 52.4 | 45.8 | 50.0 | 58.9 | 56.7 |

| New Orders Volume | 26 | 9 | 7 | -13 | -3 | 17 | 17 |

| Number of Employees | 9 | 3 | -6 | -6 | -1 | 17 | 15 |

| Production | 23 | 7 | 2 | -1 | 2 | 19 | 17 |

| Prices Received for Finished Product | 4 | 6 | 7 | 0 | 7 | 22 | 7 |

| Expected Conditions in Six Months | 19 | 14 | 9 | 11 | 12 | 28 | 26 |

| New Orders Volume | 21 | 20 | 16 | 11 | 17 | 35 | 35 |

| Number of Employees | 26 | 11 | 8 | 9 | 15 | 33 | 39 |

| Production | 20 | 25 | 14 | 20 | 19 | 40 | 40 |

| Prices Received for Finished Product | 16 | 13 | 13 | 22 | 26 | 42 | 27 |

Kathleen Stephansen, CBE

AuthorMore in Author Profile »Kathleen Stephansen is a Senior Economist for Haver Analytics and an Independent Trustee for the EQAT/VIP/1290 Trust Funds, encompassing the US mutual funds sponsored by the Equitable Life Insurance Company. She is a former Chief Economist of Huawei Technologies USA, Senior Economic Advisor to the Boston Consulting Group, Chief Economist of the American International Group (AIG) and AIG Asset Management’s Senior Strategist and Global Head of Sovereign Research. Prior to joining AIG in 2010, Kathleen held various positions as Chief Economist or Head of Global Research at Aladdin Capital Holdings, Credit Suisse and Donaldson, Lufkin and Jenrette Securities Corporation.

Kathleen serves on the boards of the Global Interdependence Center (GIC), as Vice-Chair of the GIC College of Central Bankers, is the Treasurer for Economists for Peace and Security (EPS) and is a former board member of the National Association of Business Economics (NABE). She is a member of Chatham House and the Economic Club of New York. She holds an undergraduate degree in economics from the Universite Catholique de Louvain and graduate degrees in economics from the University of New Hampshire (MA) and the London School of Economics (PhD abd).

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates