Global| Feb 25 2021

Global| Feb 25 2021Kansas City Fed Manufacturing Index Increases Again in February

by:Tom Moeller

|in:Economy in Brief

Summary

• Growth continues at quickest rate since June 2018. • Component improvement is widespread. • Expectations for six months ahead broadly strengthen. The Federal Reserve Bank of Kansas City reported that its manufacturing sector [...]

• Growth continues at quickest rate since June 2018.

• Component improvement is widespread.

• Expectations for six months ahead broadly strengthen.

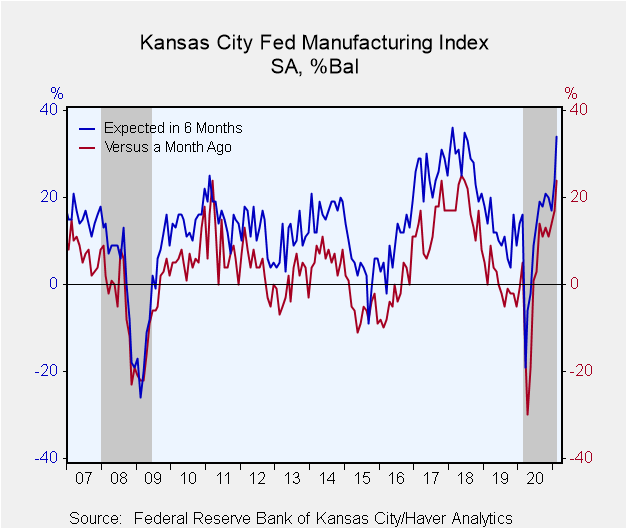

The Federal Reserve Bank of Kansas City reported that its manufacturing sector business activity index rose to 24 in February from 17 in January. The headline figure remained well above the all-time low of -30 posted in April.

The ISM-Adjusted Index (NSA) rose to 60.6 in February from 58.1 in January and remained well above the critical level of 50 that separates expansion from contraction. It also remained well above the low of 37.6 in April of last year.

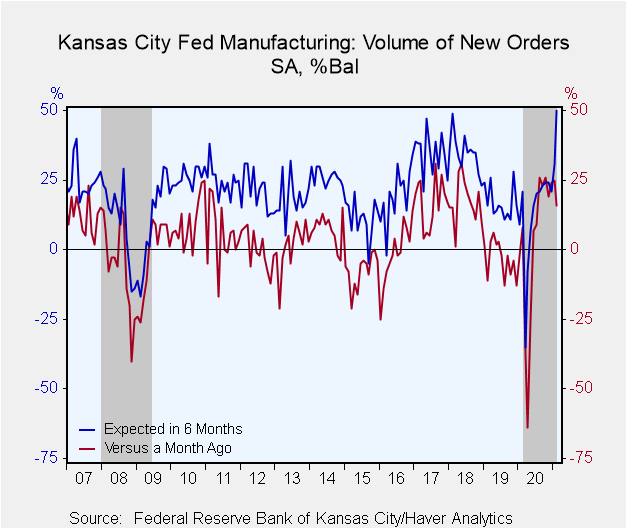

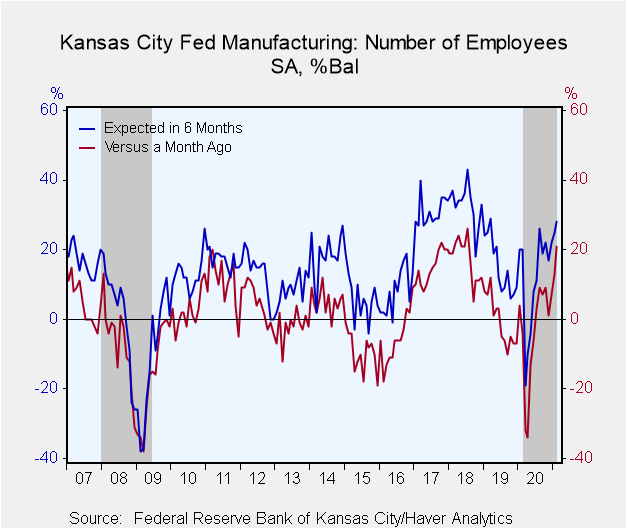

Movement amongst the individual series was mostly positive. The supplier delivery time index soared to a record 40, indicating sharply slower product delivery speeds. The employment series surged to 21, the highest level since July 2018. The production series rose to 26, the highest level since November 2018. The order backlog measure also surged. Working lower was the new orders measure which fell to 16 after having averaged around 24 for six months.

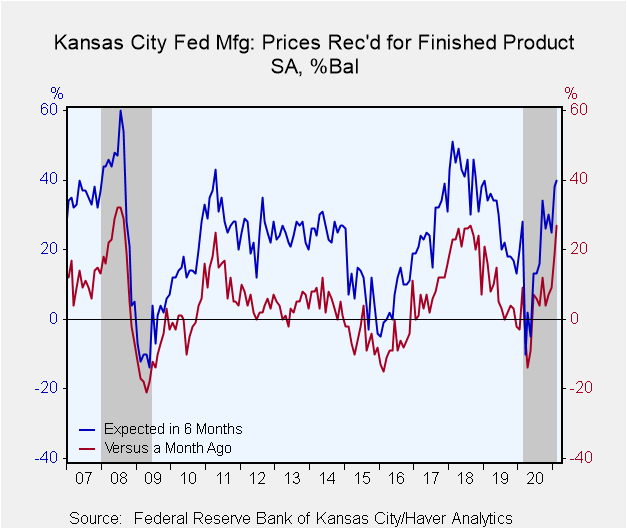

On the inflation front, the prices received index for finished products strengthened to 27, the highest level in two and one-half years. It compares to the deflationary readings registered earlier this year. The raw materials index surged to 68, up from -16 in April of 2020 and the highest reading since April 2011.

The expectations-in-six months composite reading strengthened to 34 in February, up sharply from 16 a year ago and well above -19 in March of last year. Expected new orders, shipments and employment each improved sharply.

Expectations for prices received rose to 40 in February, up from expected price deflation early last year. Expectations for raw materials prices also surged to 68 this month, the highest level since February 2018.

The figures date back to July 2001. The composite index is an average of the production, new orders, employment, supplier delivery time and raw materials inventory indexes. The diffusion indexes are calculated as the percentage of total respondents reporting increases minus the percentage reporting declines. The November survey was conducted during the six-day period from November 10-16, 2020 and included 109 responses from plants in Colorado, Kansas, Nebraska, Oklahoma, Wyoming, northern New Mexico and western Missouri. Data for the Kansas City Fed Survey can be found in Haver's SURVEYS database.

| Kansas City Federal Reserve Manufacturing Survey (SA) | Feb | Jan | Dec | Feb'20 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Conditions Versus One Month Ago (% Balance) | 24 | 17 | 14 | 5 | 0 | 0 | 17 |

| ISM-Adjusted Composite Index (NSA) | 60.6 | 58.1 | 53.0 | 52.7 | 50.1 | 50.0 | 58.9 |

| New Orders Volume | 16 | 25 | 24 | 8 | 1 | -3 | 17 |

| Number of Employees | 21 | 13 | 7 | -4 | -4 | -1 | 17 |

| Production | 26 | 22 | 12 | 8 | 0 | 2 | 19 |

| Prices Received for Finished Product | 27 | 19 | 9 | 9 | 2 | 7 | 22 |

| Expected Conditions in Six Months | 34 | 24 | 17 | 16 | 10 | 12 | 28 |

| New Orders Volume | 50 | 31 | 21 | 21 | 12 | 17 | 35 |

| Number of Employees | 28 | 25 | 22 | 20 | 11 | 15 | 33 |

| Production | 44 | 46 | 20 | 21 | 14 | 19 | 40 |

| Prices Received for Finished Product | 40 | 38 | 25 | 28 | 16 | 26 | 42 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.