Global| Nov 18 2016

Global| Nov 18 2016Kansas City Federal Reserve Factory Index Weakens; Expectations Ease

by:Tom Moeller

|in:Economy in Brief

Summary

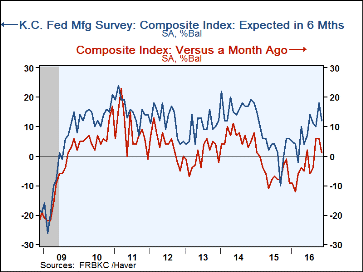

The Federal Reserve Bank of Kansas City reported that its index of regional manufacturing sector business activity declined to 1 during November from an unrevised 6 during each of the prior two months. That still represented [...]

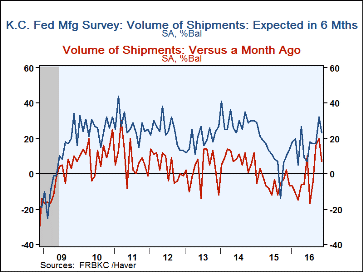

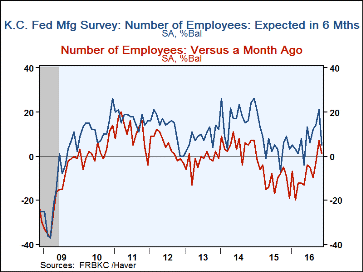

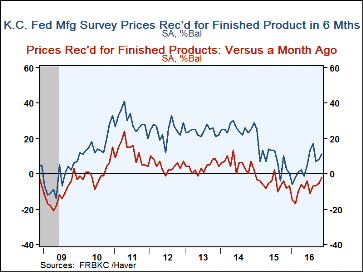

The Federal Reserve Bank of Kansas City reported that its index of regional manufacturing sector business activity declined to 1 during November from an unrevised 6 during each of the prior two months. That still represented improvement, however, versus negative readings registered early last year. New orders eased recently as have shipments. Production slackened while employment eased. The length of the employee workweek shortened and supplier delivery times fell. The rate of decline in finished goods prices slowed significantly, while raw materials prices increased at the quickest rate since Q3'14.

Expectations for business conditions in six months deteriorated m/m, although they remained in an upward trend. Expected shipments eased, but new orders expectation picked up. Employment expectations weakened sharply, but the expected workweek improved. Expected capital expenditures surged. Expectations for export orders were positive versus negative readings for all of 2015. The future inventories reading fell sharply. Expectations for finished goods prices continued to be positive. Expected raw materials prices also strengthened.

The diffusion indexes are calculated as the percentage of total respondents reporting increases minus the percentage reporting declines. The survey included 94 responses from plants in Colorado, Kansas, Nebraska, Oklahoma, Wyoming and northern New Mexico. Data for the Kansas City Fed Survey can be found in Haver's SURVEYS database.

| Kansas City Federal Reserve Manufacturing Survey (SA) | Nov | Oct | Sep | Nov '15 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|

| Conditions Versus One Month Ago (% Balance) | 1 | 6 | 6 | -1 | -5 | 7 | 0 |

| New Orders Volume | 6 | 14 | 12 | 1 | -8 | 7 | 1 |

| Number of Employees | 1 | 7 | -3 | -9 | -10 | 5 | -2 |

| Production | 9 | 18 | 15 | 0 | -5 | 8 | 2 |

| Prices Received for Finished Product | -2 | -5 | -7 | -8 | -5 | 5 | 4 |

| Expected Conditions in Six Months | 12 | 18 | 10 | 6 | 4 | 17 | 10 |

| New Orders Volume | 27 | 16 | 24 | 17 | 11 | 26 | 18 |

| Number of Employees | 5 | 21 | 14 | 9 | 6 | 18 | 9 |

| Production | 24 | 32 | 15 | 10 | 11 | 28 | 20 |

| Prices Received for Finished Product | 11 | 8 | 7 | 3 | 9 | 26 | 24 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.