Global| Jul 25 2007

Global| Jul 25 2007Korea GDP Up 1.7% in Q2; Maintaining 4-5% Annual Pace, Country Sees Its Credit Rating Raised

Summary

South Korea's GDP grew 1.7% in Q2, following 0.9% in the previous two quarters. This was the strongest quarterly increase since Q4 2003, 4-1/2 years ago. The year-to-year growth was 4.9%, up from 4.0% in Q1 and also in Q4. The [...]

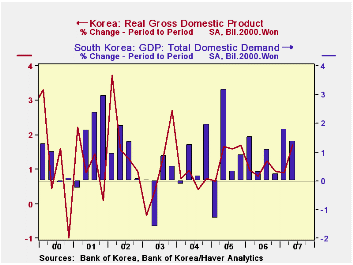

South Korea's GDP grew 1.7% in Q2, following 0.9% in the previous two quarters. This was the strongest quarterly increase since Q4 2003, 4-1/2 years ago. The year-to-year growth was 4.9%, up from 4.0% in Q1 and also in Q4.

The quarterly growth was led by the manufacturing sector, which rebounded sharply to a 3.6% quarterly increase from a 0.9% fall in Q1. This pushed the year-on-year rate to 5.9% from 3.9%. Data on industrial production suggest that Q2 started off stronger for electrical machinery, electronic components and motor vehicles. Service industries collectively slowed a bit in Q2, gaining 1.1% after 1.2% in Q1 and Q4. Construction activity declined outright, falling 1.8% after a 1.4% increase in Q1 and 0.6% in Q4.

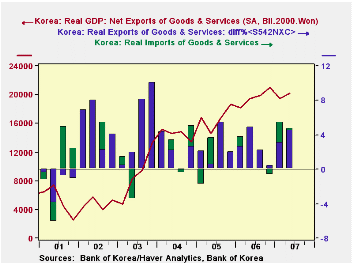

The expenditure accounts show that the greater part of the pickup in GDP came from foreign demand. Exports surged 4.6% in Q2, their strongest quarterly advance in a year. Imports rose 4.7%, but this was less than Q1's 5.4%, and net exports widened to a surplus of KRW20.23 trillion from KRW19.48 trillion in Q1. Domestic demand, in contrast, slowed to 1.4% growth in Q2 from 1.8% in Q1. So net foreign demand added 0.3% to total GDP growth after cutting it by 0.9% in Q1.

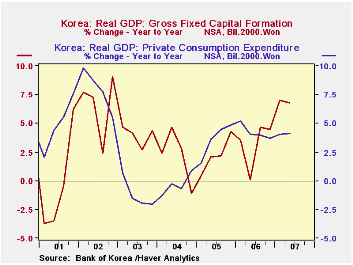

These figures hardly mean, however, that domestic demand was "weak". Private consumption was up 0.8% in the quarter and 4.1% from a year ago. Fixed investment also grew 0.8%, putting it a substantial 6.8% higher than the year-ago period. Within this latter category, what the Koreans call "facilities investment" led the way in Q2, with a gain of 3.5% following 4.4% the quarter before; encompassing machinery and transport equipment, this item was up 12.1% from a year ago, the strongest since radically higher growth during the tech boom of 1999/2000.

As these data might suggest, the Korean economy is showing steady, moderate growth, which it has sustained now since about 2002. In the 2000/2001 fall-out from the tech bust, it managed to avoid recession and has had just one negative quarter since then, in early 2003. According to Bloomberg news, Moody's rating service has been sufficiently impressed announce today a hike in the country's credit rating to A2 from A3, where it has been since early 2002. "A2" is Moody's sixth highest rating and in the middle of the "investment grade" spectrum.

| Korea GDP, 2000 Won | 2Q 2007* | 1Q 2007* | 4Q 2006* | Year/ Year | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Total | 1.7 | 0.9 | 0.9 | 4.9 | 5.0 | 4.2 | 4.7 |

| Private Consumption | 0.8 | 1.5 | 1.0 | 4.1 | 4.2 | 3.6 | -0.3 |

| Gross Fixed Capital Formation | 0.8 | 2.0 | 1.2 | 6.8 | 3.2 | 2.4 | 2.1 |

| Net Exports (Tril.2000.Won) | 20.2 | 19.5 | 21.0 | 19.4 | 19.6 | 16.7 | 14.5 |

| Exports | 4.6 | 3.1 | 0.5 | 10.7 | 12.4 | 8.5 | 19.6 |

| Imports | 4.7 | 5.4 | -0.6 | 12.2 | 11.3 | 7.3 | 13.9 |

| Industry Value Added | |||||||

| Manufacturing | 3.6 | -0.9 | 1.0 | 5.9 | 8.4 | 7.1 | 11.1 |

| Services | 1.1 | 1.2 | 1.2 | 4.5 | 4.2 | 3.4 | 1.9 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.