Global| Feb 07 2007

Global| Feb 07 2007Machinery Output Leads Industrial Production in Several European Nations

Summary

European industry is trying hard to grow and some sectors are more successful than others, according to data for December 2006 reported today by various statistical agencies. German production fell by 0.7% after a 1.8% surge in [...]

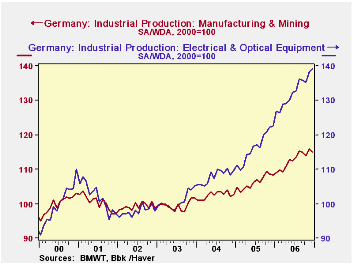

European industry is trying hard to grow and some sectors are more successful than others, according to data for December 2006 reported today by various statistical agencies. German production fell by 0.7% after a 1.8% surge in November. Its growth has moderated since August, but analysts were surprised by today's drop, having projected a gain for the month of about 0.5%. The VAT went up on January 1, so activity was expected to be strong through the end of 2006, but it appears to have tailed off earlier. Even so, industrial output for 2006 as a whole was up 6.1%, the strongest since the tech boom period in 2000.

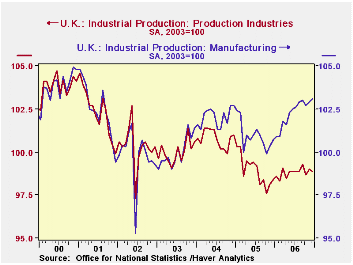

In the UK, basic manufacturing has done fairly well in 2006, with that sector's production index up 2.4% from a year ago (based on seasonally adjusted data) and the year total up 1.3% from 2005, more than reversing a decline in 2005. Machinery, especially electrical equipment, was the strongest segment. In Britain, mining is in a decline as oil production decreases. This is weighing significantly on total industrial production, which was up in December by only 0.5% from December 2005 and actually down modestly for the year as a whole compared with 2005. That year, it fell 1.8%.

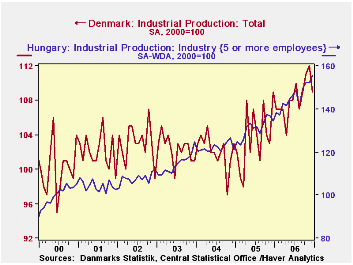

Denmark's industrial production fell back in December by 3 points (2.7%), but it enjoyed vigorous expansion through most of the rest of 2006. Wood products, clothing, oil refining and machinery all contributed sizable gains.

In Hungary, the number reported today is an advance estimate for a subset of the larger companies. Their production advanced 2.2% in December, bringing the gain to 11.2% for the year as a whole. Details for December will be reported on February 15. Through November, the breakdown looked similar to other neighboring nations, with strength greatest in machinery and equipment. In Hungary, rubber and plastics production has also been strong.

Sometimes, with all the publicity favoring manufacturing in Asia, one can get the impression that industry elsewhere is languishing. But as we see here, that is not so and especially for machinery, European companies are experiencing sizable growth.

| IP: Indexes, 2000=100 | Dec 2006 | Nov 2006 | Oct 2006 | Year Ago | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Germany: Total IP* | 115.2 | 116.0 | 113.8 | 108.6 | 112.9 | 106.4 | 102.6 |

| UK: Total IP** | 95.2 | 95.3 | 95.1 | 94.8 | 95.2 | 95.3 | 97.1 |

| Manufacturing** | 99.3 | 99.1 | 98.9 | 97.0 | 98.5 | 97.2 | 98.3 |

| Denmark: Total | 109 | 112 | 111 | 109 | 108 | 104 | 102 |

| Hungary: Total, 5 or more Employees | 155.6 | 152.2 | 152.3 | 134.4 | 145.8 | 131.1 | 122.1 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates