Global| Apr 29 2020

Global| Apr 29 2020March Pending Home Sales Drop to Lowest Level in Nine Years

Summary

• Pending home sales fell 20.8% in March to its lowest level since May 2011. • Prospective sales declined at double-digit rates in all regions of the country. • Mortgage applications suggest substantial weakness ahead. The National [...]

• Pending home sales fell 20.8% in March to its lowest level since May 2011.

• Prospective sales declined at double-digit rates in all regions of the country.

• Mortgage applications suggest substantial weakness ahead.

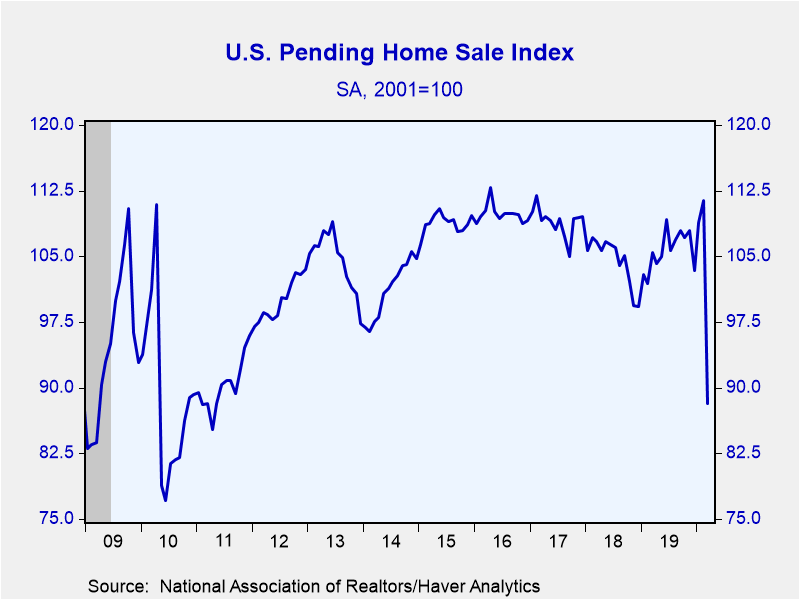

The National Association of Realtors (NAR) reported that pending home sales plummeted 20.8% in March (-21.5% year-on-year). This is the second largest monthly decline since this series began in 2001 – the record drop occurred when the First-Time Homebuyer Credit was expiring in 2010 – and took the level of future sales to its lowest level since May 2011. Unfortunately, indications such as the over 30% y/y drop in the Mortgage Bankers Association index of loan applications for home purchase in April, suggest substantial weakness in housing activity going forward.

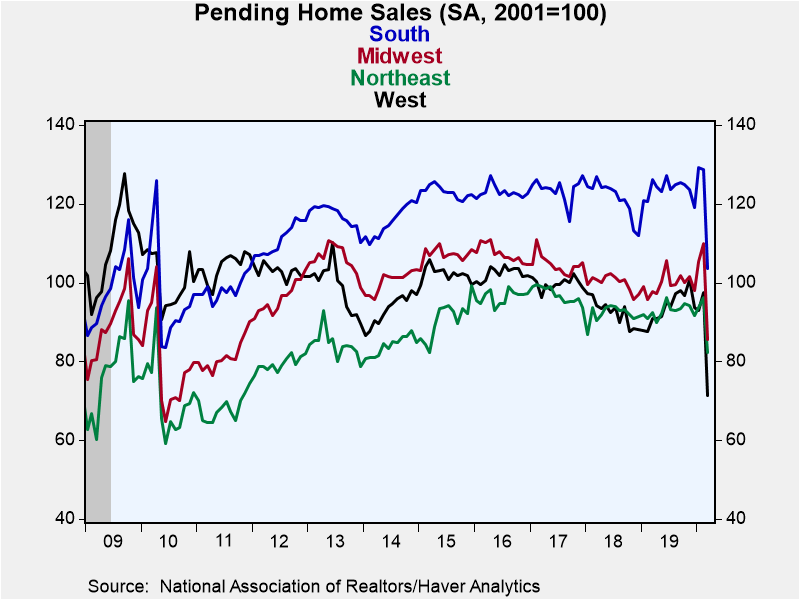

The number of signed contracts in March decreased at double-digit rates in every region of the country, led by a 26.8% drop in the West (-21.5% y/y). Pending sales fell 22.0% in the Midwest (-12.4% y/y), 19.5% in the South (-17.8% y/y) and 14.5% in the Northeast (-11.0% y/y)

The pending home sales index measures sales at the time the contract for an existing home is signed, analogous to the Census Bureau's new home sales data. In contrast, the National Association of Realtors' existing home sales data are recorded when the sale is closed. In developing the pending home sales index, the NAR found that the level of monthly sales contract activity anticipates the level of closed existing home sales in the following two months. The series dates back to 2001, and the data are available in Haver's PREALTOR database. Mortgage interest rates from the Mortgage Bankers Association can be found in the SURVEYW database.

| Pending Home Sales (SA, % chg) | Mar | Feb | Jan | Mar Y/Y % | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Total | -20.8 | 2.3 | 5.3 | -21.5 | 1.1 | -4.1 | -0.8 |

| Northeast | -14.5 | 2.8 | 2.2 | -11.0 | 0.8 | -5.0 | 0.6 |

| Midwest | -22.0 | 4.2 | 7.4 | -12.4 | -0.3 | -4.6 | -2.5 |

| South | -19.5 | -0.2 | 8.5 | -17.8 | 1.8 | -1.9 | 0.6 |

| West | -26.8 | 5.1 | -0.9 | -21.5 | 1.3 | -7.3 | -2.5 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.