Global| Mar 30 2005

Global| Mar 30 2005Marked Erosion in German Business Climate, March Ifo Survey Says

Summary

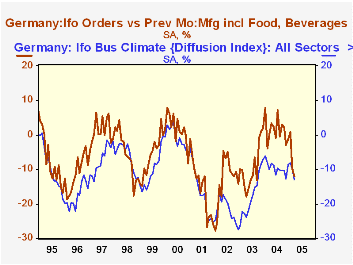

Back at the turn of the year, business prospects were looking up in Germany. December and January saw an improvement in the Ifo Business Climate Index to the highest values in almost a year; this was reflected in production, the [...]

Back at the turn of the year, business prospects were looking up in Germany. December and January saw an improvement in the Ifo Business Climate Index to the highest values in almost a year; this was reflected in production, the assessment of demand and orders. However, February and March have reversed this encouraging pattern, with some gauges falling rather precipitously.

The Business Climate Index has slumped 2.4 points in the two months to 94.0 (2000=100), with the corresponding diffusion index retreating to -12.9% from -8.1% in January. The "business situation", the measure of current conditions, fell to -18.2%, a 5-percentage-pointing deterioration since December. Expectations also decreased, reaching down to -7.4% in March from -1.5% in January. Orders are a source of the worsening outlook, led by the domestic sector.

Most industry groups have participated in the renewed downturn. Among better readings, food processing increased to -6.2% from -7.0%; construction rose 3 percentage points, but, at -39.8%, this move can hardly be seen as an indication of better health in that sector. Other basic industries saw relative deteriorations: March values were generally less positive or more negative.

We can guess that rising energy prices have contributed to the erosion in business conditions; producer prices for energy were up 8.2% in the year to February, compared with a drop of 0.7% in the comparable year-ago period. Total producer prices rose 4.2% from February 2004; they had been basically unchanged in the 12-months ended in February 2004. The euro, after a pause last spring and summer, has been rising again. By contrast, other exogenous forces seem fairly supportive: German stock prices are firm or rising, some quite notably; interest rates are low. Perhaps, with this financial backstop, the current downtick in the Ifo survey will turn out to be short-lived or at least quite moderate.

| Germany: Ifo Survey | Mar 2005 | Feb 2005 | Jan 2005 | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|

| Business Climate Index, 2000=100 | 94.0 | 95.4 | 96.4 | 95.7 | 91.7 | 89.4 |

| % Balance | -12.9 | -10.0 | -8.1 | -9.6 | -17.5 | -22.0 |

| Business Situation | -18.2 | -16.0 | -14.4 | -16.9 | -27.9 | -33.9 |

| Business Expectations | -7.4 | -3.9 | -1.5 | -1.8 | -6.5 | -9.0 |

| Orders on Hand, Manufacturing | -20.8 | -19.0 | -13.4 | -21.1 | -33.2 | -35.2 |

| Foreign Orders on Hand, Manufacturing | -13.5 | -10.1 | -11.2 | -16.2 | -28.2 | -26.8 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates