Global| Feb 23 2007

Global| Feb 23 2007Mass Layoff Events Increase in January, But the Number of People Involved Decreases

Summary

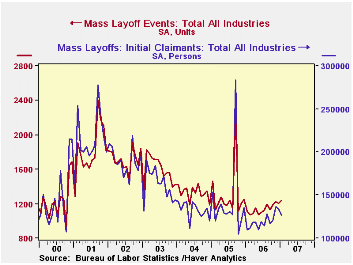

The number of mass layoff events was up 3.0% in January, according to BLS data reported this morning. These specific layoff incidents are called "mass layoffs" because they involve 50 or more initial claims for unemployment insurance. [...]

The number of mass layoff events was up 3.0% in January, according to BLS data reported this morning. These specific layoff incidents are called "mass layoffs" because they involve 50 or more initial claims for unemployment insurance. January's number, 1,237, was the highest since December 2005, and traces a very mild uptrend from a recent low of 1,073 in February 2006. At the same time, the total number of people filing associated unemployment insurance claims fell in January by 5.6% to 125,368, just 2.2% higher than the average for 2006 as a whole.

The industrial distribution of these layoffs and unemployment insurance claims follows the recent evolution of other information about the economy. [Note that the data for individual industries are not seasonally adjusted.] For instance, the number of layoff events and the number of people are rising in the wood products industry, a development that would be expected as housing demand contracts. Perhaps also associated with this is a large number of events in the furniture manufacturing industry, the most in four years. The finance sector is also seeing more layoffs, but the absolute level of these remains low. However, not all relevant industries exhibit the expected trend: construction has not recently seen layoffs noticeably higher than the large numbers that usually occur in the winter, and construction payroll employment has held flat.

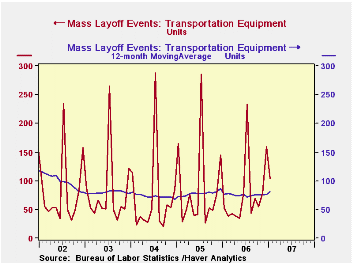

The tenuous health of the US auto industry is evident in a rising number of layoff events in transportation equipment manufacturing; this was the largest in December and January since the comparable period of December 2001/January 2002. A related group, fabricated metal products, also shows a hint of upward drift.

In contrast, wholesale and retail trade evidence at least stable employment patterns. Both have among the smallest numbers of December and January layoffs in the 12-year history of these layoff data. Correspondingly, the retail trade sector payrolls have been basically flat for about 18 months, and wholesale trade payrolls are climbing steadily.

These mass layoff data are contained in Haver's flagship database, USECON. Data are also available by Census regions, divisions and states, including some industry detail for each. These are all carried in the REGIONAL database.

| Mass Layoffs, SA | Jan 2007 | Dec 2006 | Nov 2006 | Jan 2006 | Monthly Averages|||

|---|---|---|---|---|---|---|---|

| 2006 | 2005 | 2004 | |||||

| Number of Events | 1,237 | 1,201 | 1,220 | 1,112 | 1,167 | 1,372 | 1,332 |

| Initial Claims (Number Persons) |

126,368 | 133,818 | 136,340 | 109,429 | 123,699 | 149,612 | 133,930 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates