Global| Apr 13 2007

Global| Apr 13 2007Michigan Consumer Sentiment Sags as Inflation Concern Rises

Summary

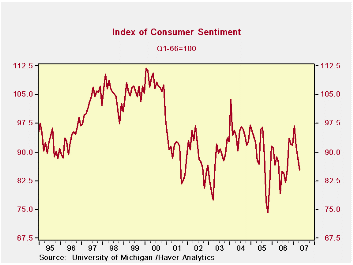

The University of Michigan's consumer sentiment index has lost 11.6 points through mid-April to 85.3 from its January peak of 96.9 (Q1 1966 = 100). The reading of current conditions stands at 102.4, down from 111.3 in January, while [...]

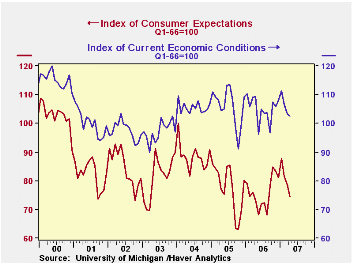

The University of Michigan's consumer sentiment index has lost 11.6 points through mid-April to 85.3 from its January peak of 96.9 (Q1 1966 = 100). The reading of current conditions stands at 102.4, down from 111.3 in January, while expectations are at 74.3 from January's 87.6. These declines have come in roughly equal installments in February, March and early April.

Consumers' reading of personal finances has fallen to 112 in early April from 123 in January, but is actually up from 111 in March. A few more people have rising incomes and a few less have lower incomes, both helping this component. But a growing number of respondents are saying their purchasing power is suffering from higher prices, even though their income position looks better. Survey participants see buying conditions deteriorate for "large household goods"; even among those who say this is a "good time to buy" a rising number give the reason that prices will go up, so buy now before that happens.

The fall in the expectations component results from concern over general business conditions. Fewer people look for "good times" and more people look for "bad times". However, they remained generally positive about their own personal finances: those looking to be "better off" did edge down by 1 percentage point from January but those expecting to be "worse off" fell by 2 points.

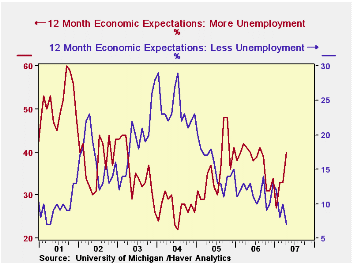

Inflation and unemployment expectations both contributed to the deterioration in sentiment. Median inflation expectations rose to 3.3% from 3% in January, February and March; the mean is 4.1%. Both figures are the highs since the high energy price period last summer. The unemployment outlook worsened as the smallest number of people since the 2001 recession expect "less unemployment" while the number expecting "more unemployment" returned to 40%, a kind of threshold of concern that has recently coincided with high energy price periods and was last breached in August.

The University of Michigan survey is not seasonally adjusted.This mid-month survey was based on telephone interviews with about 304 households nationwide on personal finances and business and buying conditions. The survey is expanded to a total of 500 interviews at month-end.

| University of Michigan | April (Prelim) | March | February | Y/Y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Consumer Sentiment | 85.3 | 88.4 | 91.3 | -2.4% | 87.3 | 88.5 | 95.2 |

| Current Conditions | 102.4 | 103.5 | 106.7 | -6.2% | 105.1 | 105.9 | 105.6 |

| Expectations | 74.3 | 78.7 | 81.5 | +1.2% | 75.9 | 77.4 | 88.5 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates