Global| Nov 13 2009

Global| Nov 13 2009Michigan Consumer Sentiment Sags Once Again

Summary

Consumer sentiment declined again in early November, falling from October's 70.6 to 66.0, measured by the Reuters/University of Michigan Index of Consumer Sentiment. Forecasters had looked for only a marginal decrease to 70.0. The [...]

Consumer

sentiment declined again in early November, falling from October's 70.6

to 66.0, measured by the Reuters/University of Michigan Index of

Consumer Sentiment. Forecasters had looked for only a

marginal decrease to 70.0.

Consumer

sentiment declined again in early November, falling from October's 70.6

to 66.0, measured by the Reuters/University of Michigan Index of

Consumer Sentiment. Forecasters had looked for only a

marginal decrease to 70.0.

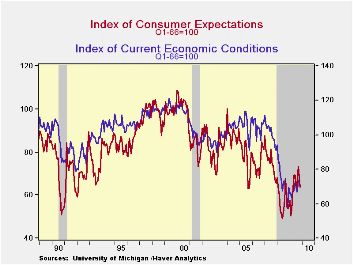

The reading on expectations for mid-November was down 4.9 points to 63.7 from October's 68.6. The primary weakness came in survey participants' outlook for business conditions over the next year. That had leaped to 88 in September and then fell back in October to 81 and now to 67. This move seems to show that the nice rise in September was a temporary blip, reversed last month and again now. Indeed, November's expectations for "times" to be "good" fell by 7 points and those for "times" to be "bad" increased by 7 points from October's amounts. Expected personal finances were also less optimistic, decreasing by 6 points in this survey round after a 2-point uptick last month. The latest move was related to a rise in the number of people who expect their income to fall during the coming year.

The

reading of current economic conditions also fell; it went

down 4.1 points from October to mid-November. People's

assessments of their current financial condition and business

conditions in general both moved adversely. In particular,

more respondents indicated that current "bad times" make this a "bad

time" to buy large consumer items. At 21, this reading was up

3 points in the month and returned to its level back at the beginning

of this year. The record high for this negative indicator is

24, reached in August 2008. Prior to this cycle, the record was 17 in

October 1992.

The

reading of current economic conditions also fell; it went

down 4.1 points from October to mid-November. People's

assessments of their current financial condition and business

conditions in general both moved adversely. In particular,

more respondents indicated that current "bad times" make this a "bad

time" to buy large consumer items. At 21, this reading was up

3 points in the month and returned to its level back at the beginning

of this year. The record high for this negative indicator is

24, reached in August 2008. Prior to this cycle, the record was 17 in

October 1992.

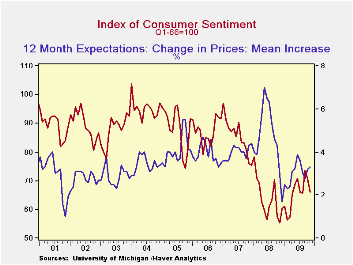

Expected price inflation during the next year amounted to 3.3% in this mid-November survey, according to the mean of participants' estimates, edging up from October's 3.2%. In contrast, the median of those estimates ticked down from 2.9% to 2.8%, suggesting that people see little overall change in price pressures this month.

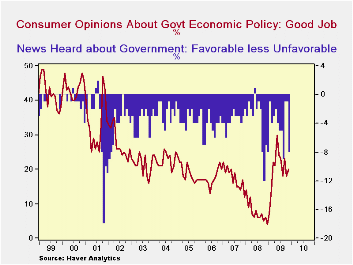

Respondents'

views on government

policy, which may eventually influence economic expectations, showed

mixed developments in this current survey. The number

expressing a favorable opinion rose from 86% in October to 88%,

reflected in a like increase in the number believing government is

doing "a good job" in November. At the same time, the

open-ended query about news reports people have heard gave a negative

spin to their impressions of government; the number hearing favorable

news about government fell from 6% last month to 3% and the number

hearing unfavorable news increased from 7% to 11%. While this

latter "news" reading has hardly ever been positive on a net basis, the

current -8 is well above averages between -3.5 and -4. So

people are clearly uneasy about the news they're getting on government

even though they're feeling marginally better about how government is

working in the economy.

Respondents'

views on government

policy, which may eventually influence economic expectations, showed

mixed developments in this current survey. The number

expressing a favorable opinion rose from 86% in October to 88%,

reflected in a like increase in the number believing government is

doing "a good job" in November. At the same time, the

open-ended query about news reports people have heard gave a negative

spin to their impressions of government; the number hearing favorable

news about government fell from 6% last month to 3% and the number

hearing unfavorable news increased from 7% to 11%. While this

latter "news" reading has hardly ever been positive on a net basis, the

current -8 is well above averages between -3.5 and -4. So

people are clearly uneasy about the news they're getting on government

even though they're feeling marginally better about how government is

working in the economy.

The Reuters/University of Michigan survey data are not seasonally adjusted. The reading is based on telephone interviews with about 500 households at month-end. These mid-month results are based on about 320 interviews. The summary indexes are in Haver's USECON database with details in the proprietary UMSCA database.p

| University of Michigan | Mid-November | October | September | Oct y/y | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|---|

| Consumer Sentiment | 66.0 | 70.6 | 73.5 | 18.2% | 63.8 | 85.6 | 87.3 |

| Current Conditions | 69.6 | 73.7 | 73.4 | 21.0 | 73.7 | 101.2 | 105.1 |

| Expectations | 63.7 | 68.6 | 73.5 | 20.4 | 57.3 | 75.6 | 75.9 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.