Global| Aug 20 2008

Global| Aug 20 2008Mortgage Applications Edge Lower; Credit Spreads Evince High Risk

Summary

Mortgage applications fell 1.5% in the week ended August 15, following a like decline the week before, together basically erasing a 2.8% increase in the August 1 week. This "Market Composite Index" stood at 419.3 in the latest week, [...]

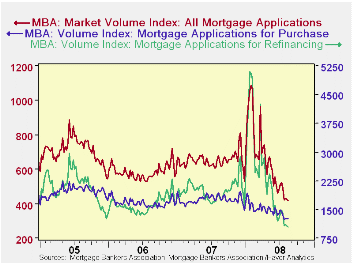

Mortgage applications fell 1.5% in the week ended August 15, following a like decline the week before, together basically erasing a 2.8% increase in the August 1 week. This "Market Composite Index" stood at 419.3 in the latest week, where the number of applications on March 16, 1990 is set equal to 100; this is down 34.6% from a year ago. Applications for loans to purchase houses edged down 0.4% in the week and are off 8.4% from July's weekly average and 28.9% from the year earlier; those to refinance old loans decreased 3.7% to 1034.5, down 22.2% from July and 42.7% below a year ago.

These data from the Mortgage Bankers Association are included in Haver's SURVEYW database. Other analytical information in this application survey tells that refinancing presently constitutes only 34.8% of the number of applications and 32.4% of their dollar value.

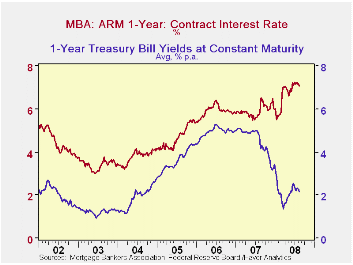

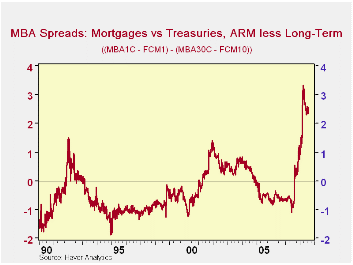

The mortgage interest rate situation is also notable. With the turmoil among Fannie Mae, Freddie Mac and originating lenders and rising delinquencies by borrowers, credit spreads remain wide throughout financial markets, keeping interest rates elevated on all but short-term, highly liquid debt. The most dramatic illustration in these MBA data comes from the 1-year ARM rate versus the 1-year Treasury. The ARM rate itself was 7.07% last week, higher than the fixed rate on 30-year mortgages, 6.47%. The spread on the ARM over the 1-year constant maturity Treasury was 4.89%; the spread of the 30-year mortgage over the 10-year Treasury was 2.56%. For the vast majority of the history of these MBA mortgage rate series (since 1990), the spread was larger for the longer-term rates, as one might intuit. But since last August, this relationship, along with many other risk measures, has been turned on its head, and sharply so. There is today far more perceived risk in short-term mortgage instruments than long-term.

| MBA Mortgage Applications (3/16/90=100) | 08/15/08 | 08/08/08 | Y/Y | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|

| Total Market Index | 419.3 | 425.9 | -34.6% | 652.6 | 584.2 | 708.6 |

| Purchase | 314.0 | 315.2 | -28.9% | 424.9 | 406.9 | 470.9 |

| Refinancing | 1,034.5 | 1,074.6 | -42.7% | 1,997.9 | 1,634.0 | 2,092.3 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.