Global| Oct 12 2007

Global| Oct 12 2007Mr. Gore's Nobel Prize Occasions a Look at Haver's Energy & Environment Data

Summary

The awarding of the Nobel Peace Prize to Al Gore and the United Nations Intergovernmental Panel on Climate Change brings environmental issues to specific public attention once again. The news prompted us to browse Haver's offerings [...]

The awarding of the Nobel Peace Prize to Al Gore and the United Nations Intergovernmental Panel on Climate Change brings environmental issues to specific public attention once again. The news prompted us to browse Haver's offerings for information on climate and energy. We are a bit surprised, though we shouldn't be, to see how many different databases contain relevant data. Here are some select items.

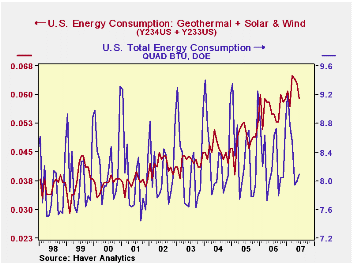

An obvious place to begin is OGJ, the Oil & Gas Journal database of its own and Department of Energy series. One section of this we haven't looked at much is "Other Energy". It includes the intriguing item "Renewable Energy Production and Consumption". The data, available through June, show that these sources constitute about 9.5% of total energy production in the US. Hydroelectric power and "wood, waste and alcohol" are most of this, at about 4-1/4% each. Other, more esoteric types are small but expanding rapidly: each geothermal and wind and solar have recently been about 0.3% of total energy production. This is a tiny fraction, but it has increased by about 75% over the past five years, with most of the advance in wind and solar.

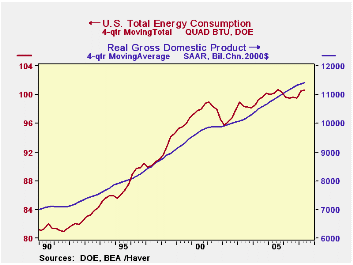

Another fact evident in the first graph here is that total energy consumption in the US has been about flat in recent periods. These data are not seasonally adjusted, but we can get around that to make our analysis more intelligible. We can aggregate the monthly energy consumption data to quarterly totals using the "A" function in the Haver DLXVG3 software and then take a 4-quarter moving total. The numerical result here is a convenient figure, right at 100 quadrillion BTU. The peak was 100.683 quads in Q3 2005; after a dip in 2006, Q2 this year was 100.637 quads. But GDP has grown over this period; in Q2 2007 its 4-quarter moving average (a figure comparable to our BTU calculation) was 4.5% higher than in Q3 2005. So the energy productivity of the economy has increased noticeably over this span: almost the same amount of energy yielded more economic activity.

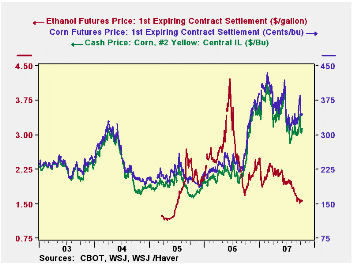

We're hearing a lot about biofuels [a word, by the way, that I just added to the Microsoft Office spell-check dictionary!], and one thing we can say is that they have contributed to higher prices for grain. In the DAILY database, we find spot and futures prices for corn, and we can see plainly how they have lurched higher from about this time last year. However, the price of ethanol is yet to establish a smooth trading pattern. The futures market for it began on the Chicago Board of Trade on March 23, 2005, with the nearby (1st expiring) contract closing at $1.22/gallon. It shot up by mid-2006 to $4.23 and today closed at $1.575. Clearly, underlying supply and demand for ethanol have not gone up by three-and-a-half times and back down by two-thirds. So traders, both hedgers and speculators, have yet to find their footing in the rapidly changing economic, financial and scientific environment.

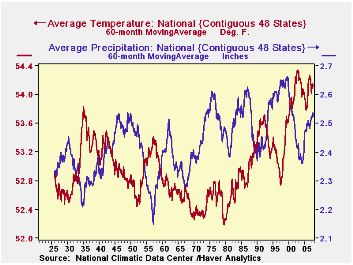

Finally, what about climate. After all, that is what concerns Mr. Gore the most. What can Haver's data tell us? We have average temperature and precipitation data, monthly back to 1921, in USECON for the "Lower 48" and in REGIONAL for individual regions and states. A quick way to see trends here is a moving average that's in a multiple of 12 months; 5 years seems easy. Looks that there's been some very slight tendency for wetter weather in the latter years and also the warming trend we hear so much about. Obviously these data just cover the US, so we can't speak here to the global situation, but the move in this country over the past 25 years seems more distinctive than might be attributable to mere chance. Being proper econometricians -- or at least cautious ones -- we'll be sure to say we haven't tested that proposition. And it would quite clearly need testing. Moreover, this only says the trend is up. It does not examine why that might be the case.

These paragraphs only scratch the surface of the information in Haver's data collections that covers environmental questions. Previous commentary here has covered miles driven and compared that to GDP growth, a result we called "driving productivity". We have seasonally adjusted some of the weekly EIA data and those are in WEEKLY. And of course, there are the highly useful Energy Intelligence databases on world oil supply and demand and natural gas weekly and monthly data. There are electric power prices in several databases. So we can help you assess numerous questions on energy, alternative energy and uses of energy and the ramifications of developments for economic growth and inflation. And you can bet our database managers will be adding more all the time. Indeed, let us know what's most important for you.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates