Global| Jul 17 2003

Global| Jul 17 2003NBER Determined the Recession Ended in November 2001

by:Tom Moeller

|in:Economy in Brief

Summary

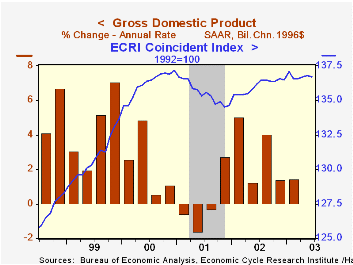

The Business Cycle Dating Committee at the National Bureau of Economic Research (NBER) reported that "a trough in economic activity occurred in November 2001." Earlier this month, Haver Analytics began using November 2001 as the [...]

The Business Cycle Dating Committee at the National Bureau of Economic Research (NBER) reported that "a trough in economic activity occurred in November 2001."

Earlier this month, Haver Analytics began using November 2001 as the trough date for purposes of shading the last economic cycle in its graphs.

Click here for the memo from NBER's Business Cycle Dating Committee.

Housing Starts Strongby Tom Moeller July 17, 2003

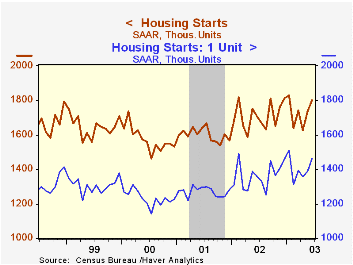

Housing starts were much stronger than expected last month, rising 3.7% to 1.80 mil. units. Consensus expectations had been for starts of 1.75 mil. June was the second highest level of starts this year.

Single family starts rose 5.3% m/m to the third highest level since the late 1970s. So far this year single family starts are up 2.9% from the 2002 average.

Multi-family starts fell 2.6% last month following a 29.6% surge in May. Multi-family starts this year are down 6.1% versus 2002.

Building permits ticked higher by 0.8%, adding to strong gains in the prior two months. Single family permits were quite strong and rose 5.3% (8.6% y/y) while multi family permits fell.

| Housing Starts (000s, AR) | June | May | Y/Y | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| Total | 1,803 | 1,738 | 5.5% | 1,711 | 1,601 | 1,573 |

| Single Family | 1,462 | 1,388 | 7.6% | 1,364 | 1,272 | 1,232 |

| Multi Family | 341 | 350 | -2.6% | 347 | 330 | 341 |

| Building Permits | 1,817 | 1,803 | 4.1% | 1,750 | 1,637 | 1,598 |

by Tom Moeller July 17, 2003

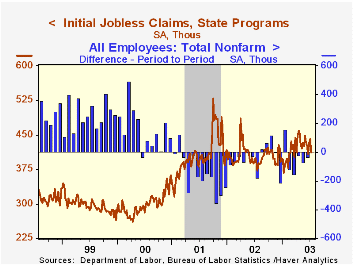

Initial claims for unemployment insurance fell more than expected last week. The 29,000 drop to 412,000 erased virtually all of the gains in the prior two weeks. Consensus expectations had been for claims of 430,000.

The latest claims data is for the July survey period for nonfarm payrolls. Initial claims fell 14,000 from the June survey period.

The four-week moving average of initial claims dropped to 424,000 (+8.4% y/y).

Continuing claims for unemployment insurance collapsed by 117,000 (-3.1%) w/w and the prior week's surge was roughly halved to 43,000.

During the last ten years there has been a 79% (inverse) correlation between the level of initial claims for unemployment insurance and the y/y change in nonfarm payrolls.

The insured rate of unemployment fell to 2.9% from 3.0% the week prior.

| Unemployment Insurance (000s) | 7/12/03 | 7/5/03 | Y/Y | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| Initial Claims | 412.0 | 441.0 | 6.5% | 404.3 | 406.0 | 299.7 |

| Continuing Claims | -- | 3,654 | 2.6% | 3,575 | 3,022 | 2,114 |

by Tom Moeller July 17, 2003

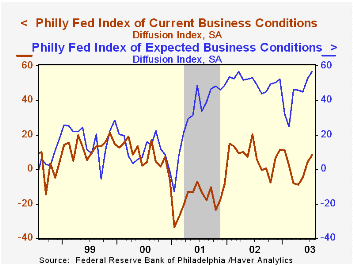

The Philadelphia Fed’s index of general business conditions for July rose slightly more than expected to 8.3 from 4.0 in June. Consensus expectations had been for a reading of 7.0.

Gains amongst the sub indexes were broad based. New orders improved substantially to 10.4, the first month in five the index was not in negative territory. Shipments also surged to 9.1, the first positive reading in four months. The employment index even indicated positive growth for only the third month since October 2000.

During the last twenty years there has been a 67% correlation between the level of the Philadelphia Fed Business Conditions Index and quarterly growth in real GDP. The correlation with quarterly growth in factory sector industrial production has been 79%.

The business conditions index reflects a separate survey question, not the components.

A separate survey of expected business conditions in six months rose to 56.9, the highest reading since November 1992.

The prices paid index fell to -6.5, the first negative reading since February 2002.

The Philadelphia Fed index is based on a survey of 250 regional manufacturing firms, but these firms sell nationally and internationally.

The latest Business Outlook survey from the Philadelphia Fed can be found here.

| Philadelphia Fed Business Outlook | July | June | Y/Y | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| General Activity Index | 8.3 | 4.0 | 5.9 | 7.7 | -17.2 | 8.3 |

| Prices Paid Index | -6.5 | 5.8 | 19.2 | 12.2 | -0.9 | 27.2 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates