Global| Aug 16 2004

Global| Aug 16 2004Net Foreign Purchases of Securities in US Markets Gain in June as Sales Fall

Summary

In June, net foreign purchases of securities traded in US markets totaled $71.8 billion, more than May's $65.9 billion. The latter figure, though, was revised upward from an original $56.4 billion. So there has been considerably more [...]

In June, net foreign purchases of securities traded in US markets totaled $71.8 billion, more than May's $65.9 billion. The latter figure, though, was revised upward from an original $56.4 billion. So there has been considerably more foreign activity in US securities markets of late. The US Treasury publishes the array of monthly data on foreign investors' purchases and sales of "long-term" US securities (having maturity greater than one year). Known as the "TIC" data for "Treasury International Capital", these data are contained in Haver's USINT database in the section "US International Investment Tables", shown by security type and country.

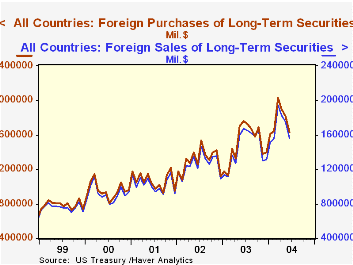

The performance of the net figure can give a somewhat misleading impression of outright demand for US securities, however. As indicated in the first graph, foreign investors actually bought fewer bonds and stocks in June. The gain in net purchases occurred because these investors also curtailed their sales.

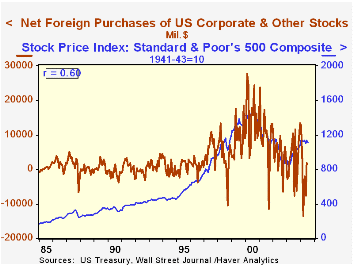

By security type, net purchases increased for Treasuries and bonds of US corporations. Purchases of federal agency securities fell, and foreign investors were net sellers of foreign bonds and foreign stocks in US markets. They moved from net sales of US corporate stocks to modest net purchases, ending a three-month-long net liquidation. It is seen in the second graph that this last development corresponds to the evolution of the US stock market. Net foreign purchases of stocks have a 60% correlation with the S&P 500 Index over the last 20 years. Here too, though, the "net purchases" occurred because sales fell by more than purchases, meaning this is not a genuinely positive commitment to the US markets.

| Net Foreign Purchases of Securities in US Markets (Billions US$) | June 2004 | May 2004 | Apr 2004 | June 2003 | Monthly Average|||

|---|---|---|---|---|---|---|---|

| 2003 | 2002 | 2001 | |||||

| Total | 71.8 | 65.2 | 75.4 | 92.9 | 59.2 | 47.9 | 41.8 |

| Treasuries | 40.6 | 29.2 | 35.7 | 46.9 | 23.2 | 10.0 | 1.5 |

| Federal Agencies (mostly "GSEs") | 15.9 | 20.6 | 31.8 | 31.1 | 13.4 | 16.3 | 13.7 |

| US Corporate Bonds | 27.1 | 20.3 | 16.5 | 23.0 | 22.5 | 15.2 | 18.5 |

| US Corporate Stocks | 1.9 | -7.7 | -1.9 | 10.4 | 2.9 | 4.2 | 9.7 |

| Foreign Bonds | -6.2 | 8.6 | 4.7 | 10.5 | 2.2 | 2.4 | 2.5 |

| Foreign Stocks | -7.5 | -5.8 | -11.3 | -5.2 | -5.9 | -0.1 | -4.2 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.