Global| Jun 16 2010

Global| Jun 16 2010New Accounting Rules Shock MBS and ABS Data

Summary

The FASB's new accounting rules 166 and 167 on the use of off-balance sheet accounting for securitized debt issues took effect at the beginning of 2010 for financial institutions with a calendar year fiscal year. From a data user's [...]

The FASB's new accounting rules 166 and 167 on the use of off-balance sheet accounting for securitized debt issues took effect at the beginning of 2010 for financial institutions with a calendar year fiscal year. From a data user's perspective, earlier this year, they were reflected in changes to commercial bank balance sheet data, and last week, with the release of the Q1 Flow-of-Funds data, we saw their impact more broadly on banks, GSEs and the special purpose vehicles (SPVs) these rulings were intended to reform.

It has been routine practice for issuers of securitized debt to "spin" the specific loans and the securities issues off the institutions' balance sheets to a subsidiary set up for the express purpose, an SPV. As FASB's notice explains, this SPV procedure is helpful for financing a narrowly defined project without putting an entire firm at risk. However, the original intention of the SPVs was not to distort the institution's underlying risk profile over a protracted period, which had in fact been happening, as investors found to their dismay during the recent financial crisis. These new rules basically cause the securitized debt issuers to move assets and associated securities liabilities back to their balance sheets.

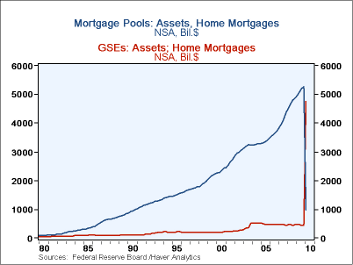

The following couple of charts show the dramatic impact of the rule

changes on the biggest items.  First, in the mortgage sector, 1-4 family

mortgages that are held at "agency- and GSE-backed mortgage pools"

plunged from $5.27 trillion at the end of 2009 to just $983 billion on

March 31. By contrast, the direct mortgage holdings of the agencies

themselves surged from $438 billion at year-end to $4.75 trillion on

March 31.

First, in the mortgage sector, 1-4 family

mortgages that are held at "agency- and GSE-backed mortgage pools"

plunged from $5.27 trillion at the end of 2009 to just $983 billion on

March 31. By contrast, the direct mortgage holdings of the agencies

themselves surged from $438 billion at year-end to $4.75 trillion on

March 31.

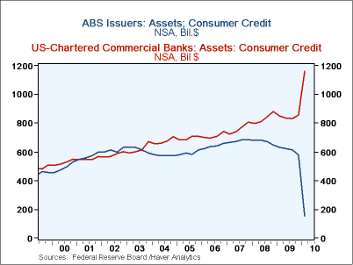

Similarly, among ABS issuers, holdings of consumer credit -- loans and credit card debt -- dropped from $578 billion on December 31 to $152 billion on March 31. The contrast here is at commercial banks, whose balance sheets now show $1,163 billion in consumer credit assets, up from $855 billion at year-end.

Importantly,

these accounting changes did not affect the transactions generating the

"flows" of credit to either of these borrowing sectors. There were net

new issues of agency mortgage pool securities of $22 billion in Q1 and

net liquidations of $22 billion of consumer debt holdings of ABS

issuers. The Federal Reserve's data is defined as outstanding(t) =

outstanding(t-1) + flow(t) + discontinuity(t), and these accounting

changes are clearly "discontinuities".

Importantly,

these accounting changes did not affect the transactions generating the

"flows" of credit to either of these borrowing sectors. There were net

new issues of agency mortgage pool securities of $22 billion in Q1 and

net liquidations of $22 billion of consumer debt holdings of ABS

issuers. The Federal Reserve's data is defined as outstanding(t) =

outstanding(t-1) + flow(t) + discontinuity(t), and these accounting

changes are clearly "discontinuities".

These data series are contained in Haver's FFUNDS database. The Financial Accounting Standards Board's press release and descriptive material are found here.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates