Global| Aug 02 2011

Global| Aug 02 2011New Data For Analyzing The Swedish Economy

Summary

The Riksbank Macro Indicators that the Bank uses in its conduct of monetary policy have been added to NORDIC, as noted in the July Haver Analytic News. The Riksbank attempts to stabilize inflation around targeted rate and production [...]

The Riksbank Macro Indicators that the Bank uses in its conduct of

monetary policy have been added to NORDIC, as noted in the July Haver

Analytic News. The Riksbank attempts to stabilize inflation

around targeted rate and production and employment around a normal

level of resource utilization.

The Riksbank Macro Indicators that the Bank uses in its conduct of

monetary policy have been added to NORDIC, as noted in the July Haver

Analytic News. The Riksbank attempts to stabilize inflation

around targeted rate and production and employment around a normal

level of resource utilization.

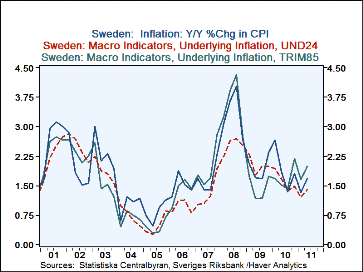

To monitor inflation, the Riksbank uses two measures of underlying inflation, TRIM85 and UND24, based on the CPI divided into 70 sub groups and calculated as annual percentage changes in the CPI. In TRIM85, 7.5% of the lowest and highest price changes are excluded from the calculation and in UND24, all the sub groups are included, but weighted differently. Goods and services that vary substantially are given a lower weight and those that do not vary much, a higher weight. Data are available monthly since January 1995. The two measures of underlying inflation and inflation defined as the year to year change in the CPI are shown in the first chart.

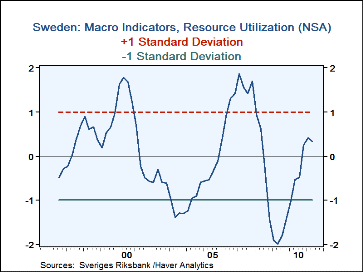

To monitor resource utilization, the Riksbank uses what is essentially a weighted average of a wide variety of survey and labor force data. In aggregating the material the principal components analysis is used. Because the variables used in the calculation of the RU indicator are measured in different units, the variables must first be standardized in some manner. The usual method of doing this is to set the average of the values to zero and the standard deviation to one. The final RU indicator has also been standardized in this manner. It is shown in the second chart together with a plus and minus one standard deviation. The data for the Resource Utilization indicator are quarterly and begin in the third quarter of 1996.

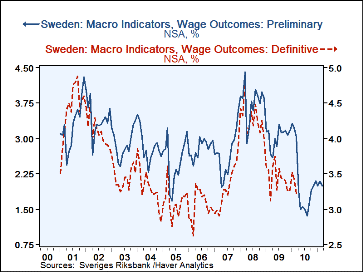

Forecasts of wages and labor costs are also important in the Banks appraisal of inflation and employment. According to the Bank, "An important source of statistics is that the outcomes are revised on an ongoing, systematic basis over the year. It takes 12 months for the first preliminary outcomes to become definitive. The Riksbank uses a method known as a "wage Algorithm", which uses for instance the first preliminary wage outcome, to obtain an estimate of the coming final wage outcome." The Riksbank publishes an estimate of the coming final wage outcome for the month concerned. It also publishes the first preliminary wage outcome (which is the same measure as the National Mediation Office publishes) and the size of the revision given the Riksbank estimate. These data are monthly and begin in January, 2001. The preliminary and the definitive outcomes are shown in the third chart.

Currently Swedish inflation appears to be well under control, although the latest underlying indicators are pointing upward. The Resource Utilization is positive for the third successive quarter, but the absolute value of the RU at 0.34 is still low. On the wage front, the definite wage outcomes were consistently higher that the preliminary through March 2010. The preliminary first wage outcomes took a dive in April, 2010 and did not turn up until September, but they still remain low--just around 2% a year.