Global| May 26 2020

Global| May 26 2020NEW TT

Summary

• • PREVIOUS >>> The Federal Reserve Bank of Dallas reported in its Texas Manufacturing Outlook Survey for April that the Current General Business Activity Index weakened to a record low of -73.7 from -70.0 in March............ Each [...]

•

•

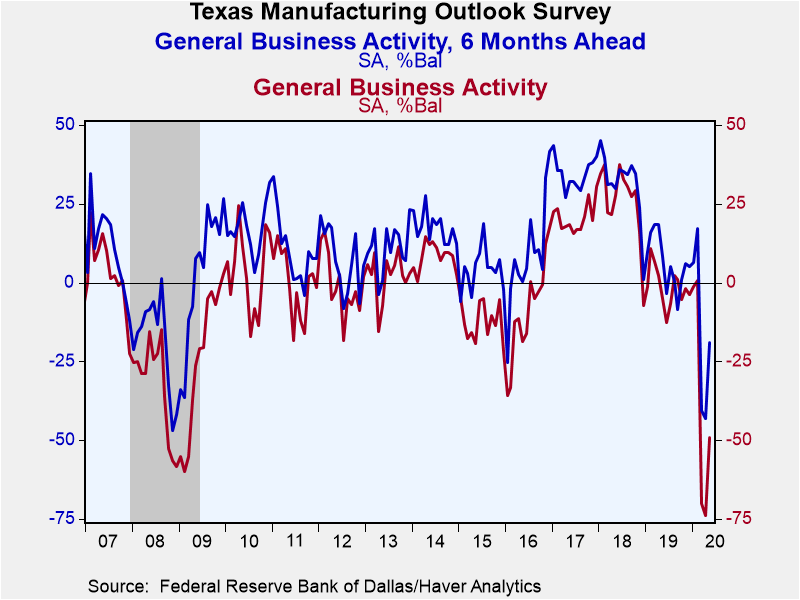

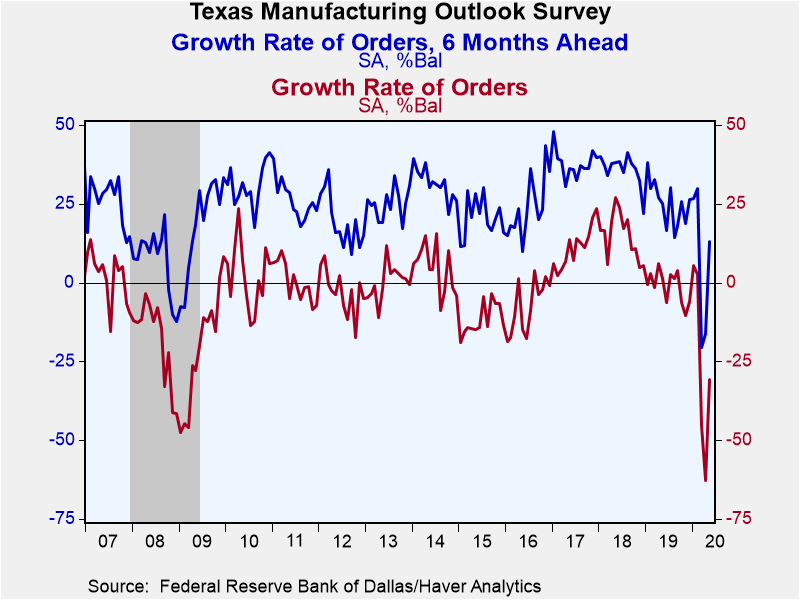

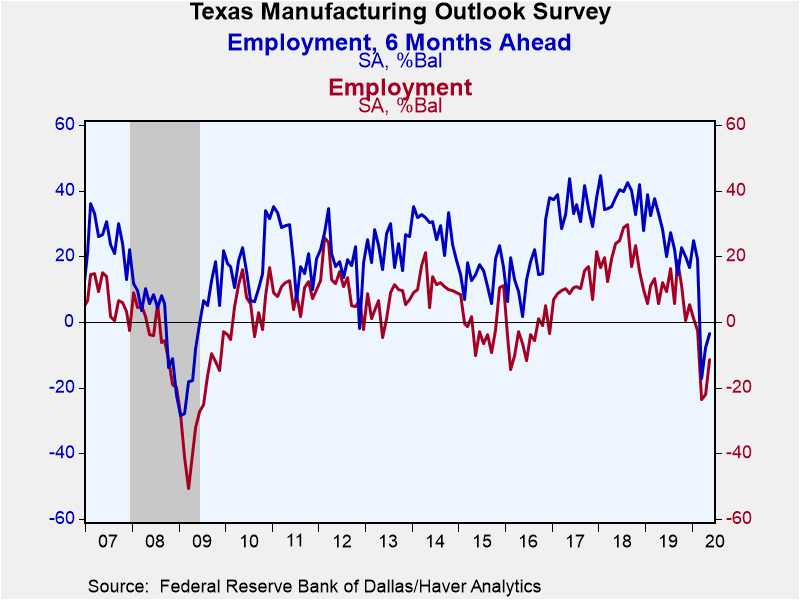

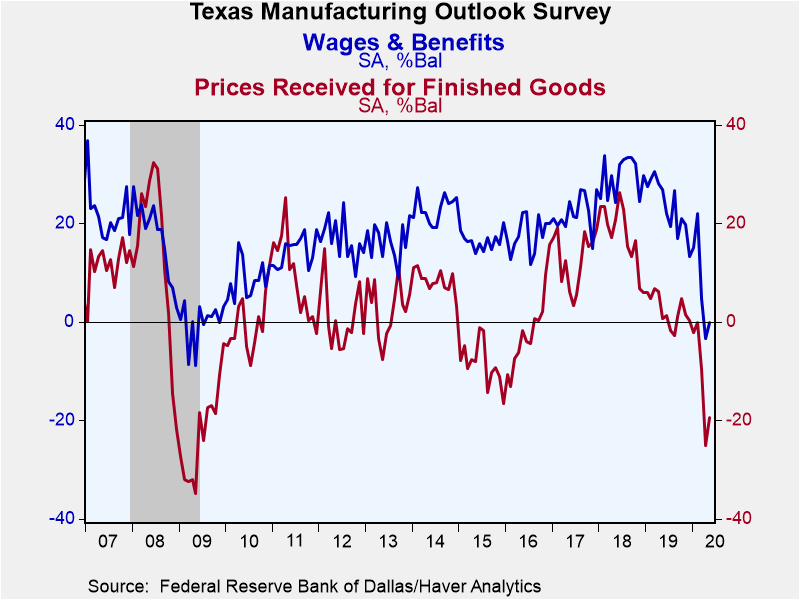

PREVIOUS >>> The Federal Reserve Bank of Dallas reported in its Texas Manufacturing Outlook Survey for April that the Current General Business Activity Index weakened to a record low of -73.7 from -70.0 in March............

Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. When all respondents report rising activity, the index will register 100. The index will register -100 when all respondents report a decrease. The index will be zero when the number of respondents reporting an increase equals the number reporting a decrease. Items may not add up to 100% because of rounding. Data for the Texas Manufacturing Outlook can be found in Haver's SURVEYS database.

| Texas Manufacturing Outlook Survey (SA, % Balance) | May | Apr | Mar | May '19 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Current General Business Activity Index | -49.2 | -74.0 | -70.1 | -5.1 | -1.1 | 25.8 | 20.6 |

| Production | -28.0 | -55.6 | -35.6 | 5.7 | 8.9 | 21.4 | 20.2 |

| Growth Rate of New Orders | -30.8 | -62.7 | -45.3 | 1.2 | -1.1 | 14.8 | 11.4 |

| Employment | -11.5 | -22.0 | -23.5 | 12.0 | 9.5 | 20.0 | 11.4 |

| Wages & Benefits | -0.2 | -3.4 | 4.7 | 26.9 | 23.5 | 29.7 | 22.2 |

| Prices Received for Finished Goods | -19.4 | -25.0 | -9.6 | 0.8 | 2.5 | 17.6 | 12.7 |

| General Business Activity Index Expected in Six Months | -19.0 | -43.0 | -40.5 | 8.4 | 6.4 | 31.6 | 34.6 |

| Production | 29.7 | -13.2 | -18.9 | 35.9 | 35.6 | 48.6 | 46.9 |

| Growth Rate of New Orders | 13.0 | -16.1 | -20.7 | 25.0 | 25.2 | 35.8 | 37.7 |

| Employment | -3.5 | -7.9 | -17.2 | 28.2 | 26.1 | 37.7 | 35.3 |

| Wages & Benefits | 12.7 | -1.1 | 0.2 | 32.8 | 39.7 | 50.4 | 43.4 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates