Global| Mar 21 2008

Global| Mar 21 2008Nonbank Dealers Borrow $29 Billion from the Fed

Summary

You can't say the Fed isn't trying. And if the current credit crisis situation turns into something far worse, it's unlikely that historians a generation from now will be able to blame the Fed's present efforts, as they can with the [...]

You can't say the Fed isn't trying. And if the current credit crisis situation turns into something far worse, it's unlikely that historians a generation from now will be able to blame the Fed's present efforts, as they can with the Great Depression. When various institutions have encountered troubles in recent months, the Fed has conjured a way to try to help them.

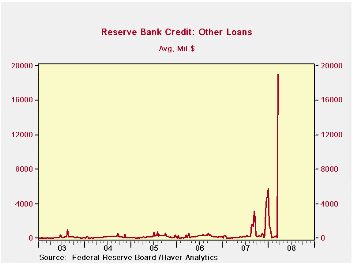

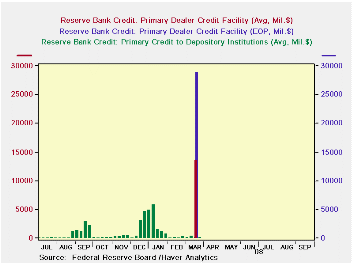

So it is that this week's H.4.1 release, the presentation by the Fed of its own provision of credit to the economy, has new line items. The indicator that years ago was known simply as "member bank borrowing" is now a five-part section of the statement, with the latest two added this week, "primary dealer credit facility" and the vaguely titled "other credit extensions". The central bank's attempt last summer to encourage borrowing largely fell on deaf ears; despite the Fed's encouragement, few "depository institutions" wanted to be known as accessing the old discount window. Some that did borrowed for 28 days, the period the Fed indicated it would favor, and then let the loans run off. At the peak in early September, these loans averaged $3.2 billion for the statement week ended Wednesday, September 12. Year-end pressures brought some back in again from mid-December through early January. Otherwise these loans were only frictional amounts. In the week ended March 12, they averaged $103 million daily and there was a total of just $27 million outstanding at the close of business that Wednesday (that's million, with an "m").

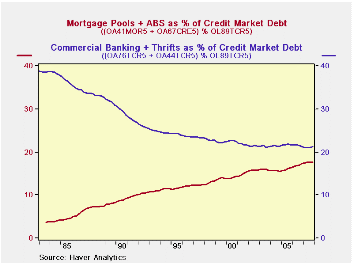

These loans covered just "depository institutions", that is, banks and thrifts, which fund their activities from a base of customer deposits. But as securitization has grown to cover more and more of the US credit markets (see the graph from the Flow-of-Funds data), the bank-oriented discount window safety value on the economy's finances has become less and less relevant. The Fed, "the lender of last resort", needed to be able to reach non-depository credit providers. This week, it found one big way. The "primary dealer credit facility" surged from $0 on Monday morning to $28.8 billion by Wednesday (that's billion, with a "b"). No token borrowing here, clearly.

The mechanical workings of this facility appear to be very similar to the repo transactions the Fed does. Dealers offer various securities as collateral for an overnight loan of cash. The differences are that the loan comes at the dealers' initiative, not the Fed's, and the collateral is of the dealers' choosing, not the Fed's prescription. And there is a fixed rate, the "discount rate", rather than the competitive auction-type proceeding the Fed conducts in its repos. So indeed, the Fed found it could essentially open the discount window to nonbanks. This got cash where it is needed in yet another example of the Bernanke approach of targeted responses to specific circumstances.

The Fed's H.4.1 release, "Factors Affecting Reserve Balances", is in Haver's WEEKLY database under the "Money and Banking" heading. Flow-of-funds data are in FFUNDS.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates