Global| Sep 21 2007

Global| Sep 21 2007NTC Measures Plunge in September-Back to Central Banking School?

Summary

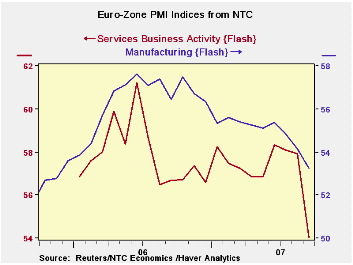

Slip-slidin away The chart on the left tells the story. The table below gives the perspective on the trend with more precision. Anyway you slice it, the release of the Reuters NTC PMI FLASH! readings for the Euro area tell a grim [...]

Slip-slidin’ away…

The chart on the left tells the story. The table below gives the perspective on the trend with more precision. Anyway you slice it, the release of the Reuters NTC PMI FLASH! readings for the Euro area tell a grim story…the weakest readings in 21 months. That is since its inception for the services measure taking the MFG PMI back to January 2000, so as to include a recession, raises the range ranking of the MFG PMI to the 70th percentile or the top 30%. That is better but it falls short of being called ‘strong’ or robust. If we were grading papers a 70 would be a C-minus.

And this is a September reading that predates the recent push up in the Euro. We have heard Germany’s wise man Bofinger talk of the potential for FX intervention. Intervention was a topic of the speech to today by the ECBs Bini Smaghi. Airbus has warned of adverse strong-euro effects. The currency game is in full swing.

Who’s at risk: Who Da man?While everyone gnashes their teeth for the poor, poor dollar let’s remember that it’s the strong currency country that really get hurt.

Look at Japan’s decade-long torpor after the too-strong yen. Maybe Europe should spend more time worrying about its own polices instead of the US. Since the US has been denied any control of some its most important FX rates as Japan has wallowed in weak growth and borrowing that cheapie has mushroomed into a cottage industry of massive proportions and since China has asserted its right to commandeer its bilateral peg with the dollar, stress has been left fall elsewhere. Euro anyone?

From jubilation to frustration. We have watched with interest as Europe has chortled over the rise of the euro and as that has segued into a view of the literal invincibility of its growth even as the termites have set about their work on those wooden arguments.

Some have talked of switching reserves into euro. Well be careful what you wish for. Now Europe looks in horror at what is happening. This is a continent based on exporting. Exports are typically high; 40% of GDP in Germany and higher in other countries there. A too-high exchange rate is not the sort of collateral problem for Europe that it has been in the US with export more like 10% to 15% of GDP. And, as we have written before, the trouble with being a reserve center currency is that you need a lot of flexibility in your economy to deal with the swing in capital flows that might arise. So despite the fact that those who have shifted into euro may now be happy the real question is this: for how long?

A one-two punch? For Europe the FX rise is taking its toll in concert with the impact from the financial situation everyone said would not spread. The Bank of England was for a while stubborn about its own building crisis (a gathering storm?). But it has had to cave and offer so much assistance that Mr. King is now being crowned (in the pejorative sense) by the Select Committee looking into those matters.

One in repair, one in despair. The ECB is now taking blasts from its favorite critic, Mr Sarcastic, err Sarkozy. While the dollar is floundering, it is in shallow water. As I remind people of this key question: from here how far can the dollar fall and against what? Meanwhile, back at the Euro-ranch, real trouble is brewing and it does not have a good solution. Talk of FX intervention is a pea shooter against a charging elephant. No trained Mahoot would stand in the way of that charging beast, let alone with a pea shooter for a weapon. It is fair to say that the US is in state of repair and Europe is in a state of despair. So much for the fate of the poor dollar… Dollar rules! Euro drools! Why? Because the dollar and US economy can survive this sort of things since IT IS A REAL RESERVE UNIT with all the trappings. The euro, sadly, is not.

| FLASH Readings | ||

|---|---|---|

| NTC PMIs for the Euro area 13 | ||

| MFG | Services | |

| Sep-07 | 53.23 | 54.04 |

| Aug-07 | 54.16 | 57.91 |

| Averages | ||

| 3-Mo | 54.08 | 56.68 |

| 6-Mo | 54.67 | 57.01 |

| 12-Mo | 55.41 | 57.14 |

| 21-Mo Range | ||

| High | 57.61 | 61.21 |

| Low | 53.23 | 54.04 |

| % Range | 0 | 0 |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates