Global| Nov 24 2010

Global| Nov 24 2010October U.S. Durable Goods Orders Reverse September Jump

Summary

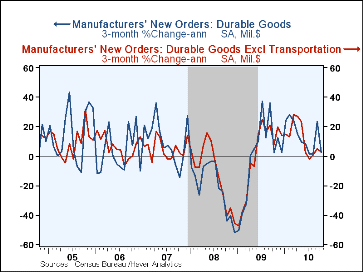

Tom Moeller began last month's discussion of durable goods order with the warning, "Be not misled by the headline figure", which was +3.3%, a hefty one-month gain. He continued, "The underlying trend of durable orders has weakened [...]

Tom Moeller began last month's discussion of durable goods order with the

warning, "Be not misled by the headline figure", which was +3.3%, a

hefty one-month gain. He continued, "The underlying trend of durable orders

has weakened substantially." Indeed. Today, the Census Bureau

reports that October new orders reversed the September surge, falling 3.3%, with

declines across a number of industry categories. The Consensus forecast

compiled by Action Economics called for a 0.3% increase. The whipsaw

cannot be totally blamed on aircraft, often the culprit, since the October

subtotal excluding transportation was also down, falling 2.7%. However,

some of the concern in this figure can be alleviated by the upward revisions to

September; total orders then are now seen up 5.0% and excluding transportation,

they were lifted from a 0.8% decline to a 1.3% increase.

Tom Moeller began last month's discussion of durable goods order with the

warning, "Be not misled by the headline figure", which was +3.3%, a

hefty one-month gain. He continued, "The underlying trend of durable orders

has weakened substantially." Indeed. Today, the Census Bureau

reports that October new orders reversed the September surge, falling 3.3%, with

declines across a number of industry categories. The Consensus forecast

compiled by Action Economics called for a 0.3% increase. The whipsaw

cannot be totally blamed on aircraft, often the culprit, since the October

subtotal excluding transportation was also down, falling 2.7%. However,

some of the concern in this figure can be alleviated by the upward revisions to

September; total orders then are now seen up 5.0% and excluding transportation,

they were lifted from a 0.8% decline to a 1.3% increase.

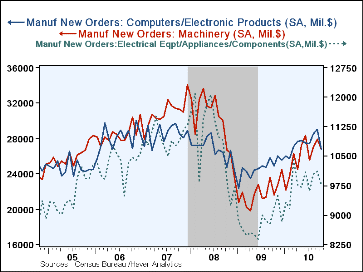

The October developments thus continue the hesitant pattern that emerged in May and June following several months of sustained and promising advances. Three major machinery categories, computers, electrical equipment and machinery itself all declined in October, with computers in particular dropping 7.7% and cutting short what had looked like a nice uptrend. In the transportation sector, motor vehicles extended a downward move that began in August. Aircraft by now seem to have no identifiable trend; those orders fell 4.4% in October, following a drop of 30.0% in August and a jump of 112.6% in September. If we smooth these a bit by looking at a 3-month moving average, we see that the nondefense aircraft segment came to $10.8 billion in October, compared with $5.3 billion a year ago. So there is some firmness overall.

Shipments of durable goods also remain sluggish. They fell 0.9% last month after a mild upward revision of September's 0.4% decrease to just above zero. This put the latest three months down 2.1% (8.3% annualized), the first negative reading on this basis since June of 2009.

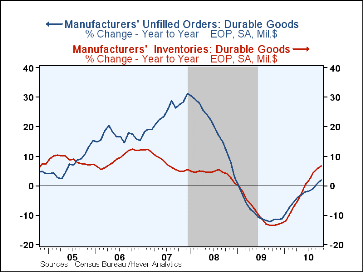

Inventory accumulation continued to slow. Durable goods inventories rose 0.4% (6.8% y/y) but that contrasted with 1.2% monthly increases this spring. The three-month growth eased to 1.8% (7.4% annualized) from 1.9% (7.9% annual rate) in September and a high of 3.3% (13.9% A.R.) in June. Finally, backlogs of durable goods orders rose 0.7% during September, yielding a year-on-year gain of 1.8%, only the second year-to-year increase since the end of 2008.

The durable goods figures are available in Haver's USECON database.

| NAICS Classification (%) | October | September | August | Y/Y | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|

| Durable Goods Orders | -3.3 | 5.0 | -0.8 | 10.5 | -20.7 | -9.0 | 9.7 |

| Excluding Transportation | -2.7 | 1.3 | 2.1 | 10.0 | -18.4 | -2.5 | 4.5 |

| Nondefense Capital Goods | -4.5 | 11.7 | 1.3 | 27.1 | -26.8 | -12.6 | 17.5 |

| Excluding Aircraft | -4.5 | 1.9 | 5.1 | 13.9 | -19.8 | -4.2 | 5.3 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates