Global| Feb 09 2007

Global| Feb 09 2007OECD Leading Index Up in December

Summary

The Leading Index of the major 7 OECD economies rose 0.2% in December after a like gain during November. The index's six-month growth rate for December was 1.2%, up from 1.1% reported a month ago. There were scattered minor revisions [...]

The Leading Index of the major 7 OECD economies rose 0.2% in December after a like gain during November. The index's six-month growth rate for December was 1.2%, up from 1.1% reported a month ago. There were scattered minor revisions to prior months, notable only because they are all downward (though not in all countries, as we note below).

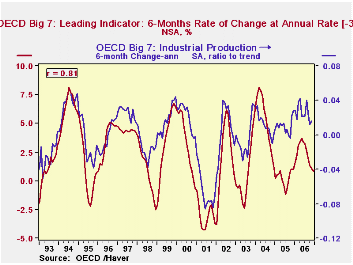

For the last 15 years, there has been an 81% correlation between the six-month growth rate and the six-month change in industrial production, measured as a ratio to trend, a series published by the OECD as part of the release. The correlation is maximized when the leaders have a three-month lead-time, as seen in the accompanying chart.

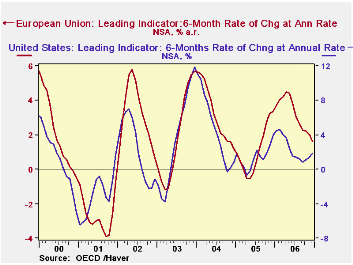

The U.S. leading indicators increased 0.4% for a second month with upward revisions for at least October and November. The September index still shows a tiny decline. The index's six-month growth rate recovered to 1.9%, the strongest since May, although still well below growth rates of more than 4% at the beginning of 2006. The correlation between the leaders' growth rate and U.S. industrial production has been 62% in recent years.

The leading index for the European Union (15 countries) was virtually flat after four monthly increases of about 0.1% each. The six-month growth was 1.6%; this was just over a third as fast as the pace for several months up through May, and it was the weakest since August 2005. This index has a close 85% correlation with industrial production for this group of countries.

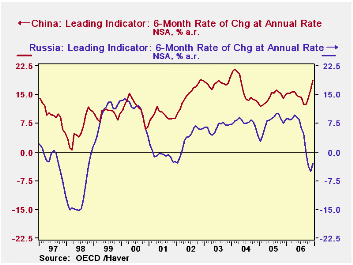

Besides providing these data for all of its member countries, the OECD calculates them for several "transition" economies, including China, Russia and India, among others. For China, as one might imagine, the index is very strong, up 2.5% in December, the third successive month faster than 2%. This puts the six-month growth at 18.9%. In Russia, the December index rose 1.1%, but it had fallen 0.6% in November and was also down in the four preceding months. This means the six-month growth rate is -3.0% for December, but that's an improvement from November's -5.0%. Neither of the countries shows much relationship between the leaders and its industrial sector.

The latest OECD Leading Indicator report can be found here.

| OECD | December | November | October | Y/Y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Composite Leading Index | 105.63 | 105.41 | 105.20 | 1.3% | 105.04 | 102.73 | 102.24 |

| 6 Month Growth Rate | 1.2% | 1.1% | 1.0% | -- | 2.1% | 0.7% | 3.5% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates