Global| Apr 21 2009

Global| Apr 21 2009Optimists Exceed Pessimists Among German Investors And Analysts For The First Time Since July 2007

Summary

For the first time since July 2007 when wind of the sub prime mortgage crisis in the United States began to surface, there were more optimists than pessimists among German analysts and institutional investors regarding the outlook six [...]

For the first time since

July 2007 when wind of the sub prime mortgage

crisis in the United States began to surface, there were more optimists

than pessimists among German analysts and institutional investors

regarding the outlook six months ahead. The ZEW Center for

European Economic Research at Mannheim reported today that its measure

of investor expectations (the percent balance between positive and

negative opinions) rose from -3.5% to +13%. The excess of

optimists is, however, well below the 71.0% reached in January, 2006

and also the historical average of 26.1%. It is

however, encouraging.

For the first time since

July 2007 when wind of the sub prime mortgage

crisis in the United States began to surface, there were more optimists

than pessimists among German analysts and institutional investors

regarding the outlook six months ahead. The ZEW Center for

European Economic Research at Mannheim reported today that its measure

of investor expectations (the percent balance between positive and

negative opinions) rose from -3.5% to +13%. The excess of

optimists is, however, well below the 71.0% reached in January, 2006

and also the historical average of 26.1%. It is

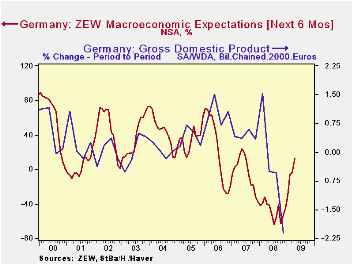

however, encouraging.  The ZEW expectation indicator has

performed reasonably well in heralding changes in German GDP and their

magnitudes, as can be seen in the first chart.

The ZEW expectation indicator has

performed reasonably well in heralding changes in German GDP and their

magnitudes, as can be seen in the first chart.

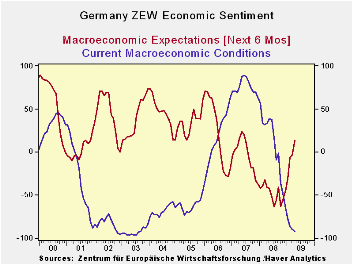

While there was an improvement in expectations among the participants in the survey, there was a worsening in their appraisal of the current conditions. The excess of pessimists over optimists rose to 91.6% from 89.4%. An excess of pessimists this large was last seen in September, 2003. The second chart shows the balances of opinion on expectations and current conditions.

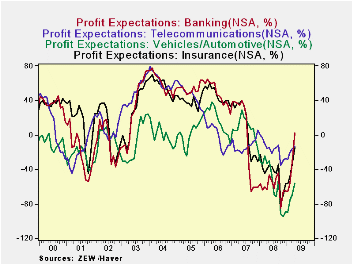

The ZEW

survey also includes the participants' expectations for profits in a

number of industries. In general the balances of opinion on

profit expectations also turned negative around August, 2007 and became

more and more negative until the last few months. Since then,

most balances of opinion have become less negative. The

exception is the expectation for profits in the banking industry where

the optimists exceed the pessimists by 2% for the first time since July

2007. The third chart shows the profit expectations for the

banking industry and a few other industries.

The ZEW

survey also includes the participants' expectations for profits in a

number of industries. In general the balances of opinion on

profit expectations also turned negative around August, 2007 and became

more and more negative until the last few months. Since then,

most balances of opinion have become less negative. The

exception is the expectation for profits in the banking industry where

the optimists exceed the pessimists by 2% for the first time since July

2007. The third chart shows the profit expectations for the

banking industry and a few other industries.

| ZEW INDICATORS (% balance) | Apr 09 | Mar 09 | Previous Low | Date | Previous High | Date |

|---|---|---|---|---|---|---|

| Expectations | 13.0 | -3.5 | -63.9 | Jul 08 | 71.0 | Jan 06 |

| Current Conditions | -91.6 | -89.4 | -91.7 | Sep 03 | 88.7 | Jun 07 |

| Profit Expectations | ||||||

| Banking | 2.0 | -31.6 | ||||

| Telecommunications | -13.0 | -16.1 | ||||

| Vehicles/Automotive | -56.1 | -70.2 | ||||

| Insurance | -15.1 | -34.2 |