Global| Mar 09 2007

Global| Mar 09 2007Payrolls Up 97,000, Close to Forecast; Construction Hit by Bad Weather

Summary

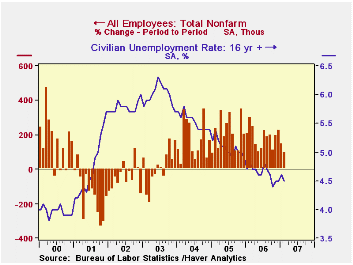

Nonfarm payrolls grew by 97,000, an increase that was right in line with the Consensus forecast for a 100,000 rise; the prior two months' gains were revised upward once again, this time by a collective 55,000. The unemployment rate [...]

Nonfarm payrolls grew by 97,000, an increase that was right in line with the Consensus forecast for a 100,000 rise; the prior two months' gains were revised upward once again, this time by a collective 55,000.

The unemployment rate eased last month to 4.5% from 4.6%, but this was the result of a decline in the total labor force of 190,000. Household employment edged lower by 38,000 and the number unemployed fell 152,000. The labor force participation rate fell to 66.2% from 66.3% in January and the employment rate (the number of people employed as a share of the civilian population over age 16) decreased to 63.2% in February from 63.3% the month before.

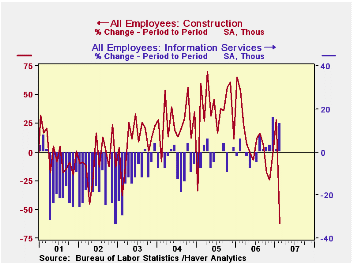

From the establishment survey, the job gain of 97,000 was the smallest since January 2005. However, the February figure included a 62,000 drop in construction jobs, most probably related to the severe winter storms that hit several parts of the country during the reference week. Other data from the household survey show that "bad weather" caused 522,000 employees to be "not at work", the largest number since January 1997. [This information is in Haver's EMPL database.]

Total private sector payrolls grew 58,000 (incorporating that construction drop), close to the ADP figure of 57,000 reported Wednesday. Manufacturing jobs continue to decline, falling 14,000, the eighth consecutive negative number; the two most recent declines were revised noticeably, however, to just 14,000 combined from 34,000 reported last month. Private service sector jobs picked up to a 129,000 increase and were revised for January from 90,000 to 105,000. Most notable is a small but so far sustained recovery in the information sector, up 13,000 in February, following increases of 1,000 and 16,000 in January and December. This is the best result for that grouping since the tech bust in 2000. Financial services and business and professional services are seeing modest slowdowns, but retail trade looks to have stabilized in January and February after a six-month-long contraction from July through December. Government employment was up 39,000 in February, the largest increase since last September.

Average hourly earnings increased 0.4%, offsetting the prior month's weak 0.2% rise. The average workweek, though, dipped to 33.7 hours, a second consecutive 0.1 hour decrease.

| Employment | February | January | December | Y/Y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Nonfarm Payrolls | 97,000 | 146,000 | 226,000 | 1.5% | 1.8% | 1.7% | 1.1% |

| Manufacturing | -14,000 | -2,000 | -12,000 | -0.7% | -0.2% | -0.6% | -1.3% |

| Average Weekly Hours | 33.7 | 33.8 | 33.9 | 33.8 (Feb. '06) | 33.8 | 33.8 | 33.7 |

| Average Hourly Earnings | 0.4% | 0.2% | 0.5% | 4.1% | 3.9% | 2.8% | 2.1% |

| Unemployment Rate | 4.5% | 4.6% | 4.5% | 4.8% (Feb. '06) | 4.6% | 5.1% | 5.5% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates