Global| Jun 14 2018

Global| Jun 14 2018Petroleum Drives Gains in U.S. Import and Export Prices

Summary

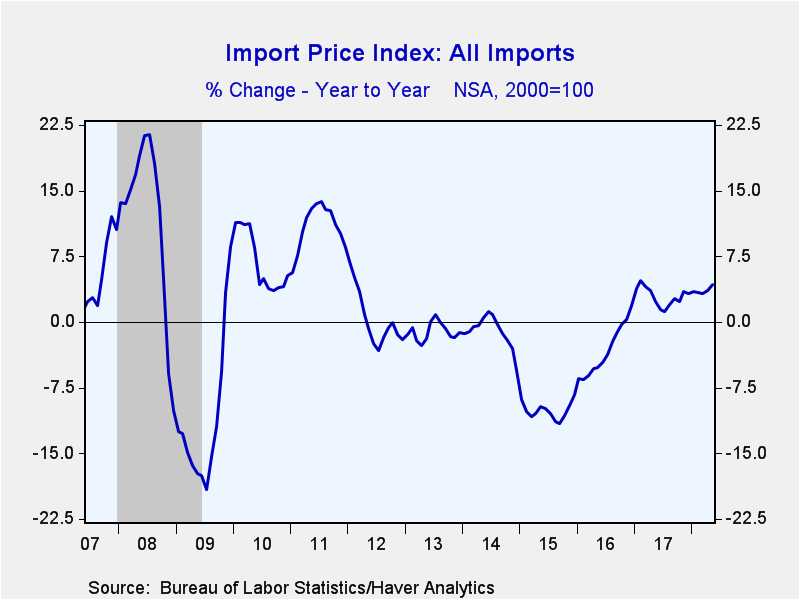

Import prices increased 0.6% during May (4.3% year-on-year), the second consecutive monthly growth of that magnitude; April's gain was revised higher. A 0.4% rise had been expected in the Action Economics Forecast Survey. These [...]

Import prices increased 0.6% during May (4.3% year-on-year), the second consecutive monthly growth of that magnitude; April's gain was revised higher. A 0.4% rise had been expected in the Action Economics Forecast Survey. These figures are not seasonally adjusted..

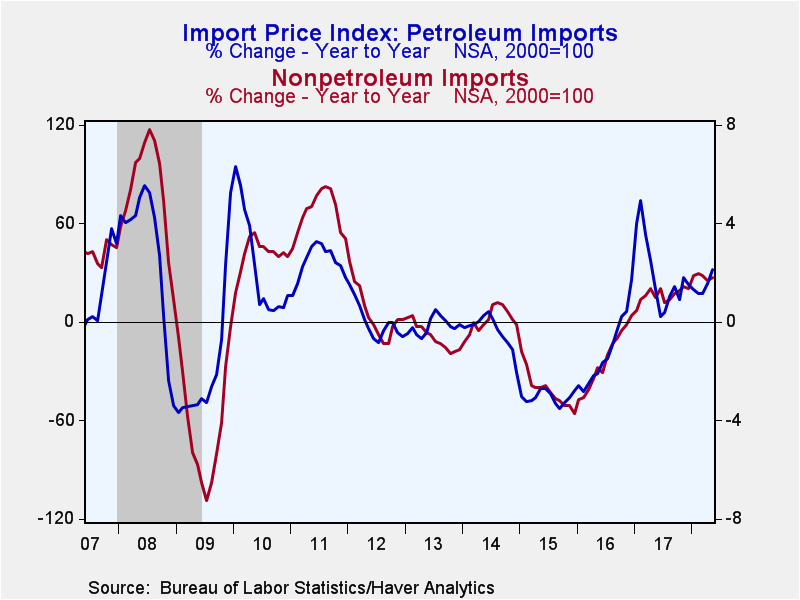

A 5.9% jump in petroleum import costs (31.9% y/y) led import prices higher last month. In April these prices were up 4.4%. Nonpetroleum import prices ticked 0.1% higher for the second consecutive month (1.8% y/y). Among end-use categories, prices of foods, feeds and beverages rose 0.4% (1.6% y/y). Industrial supplies and materials prices excluding petroleum increased 0.2% (7.6% y/y). Capital goods prices edged down 0.1% (+0.9% y/y) with prices of computers, peripherals & semiconductors decreasing 0.4% (+0.8% y/y). Capital goods prices excluding computers, semiconductors & peripherals held steady (1.0% y/y). Prices of motor vehicles and parts edged down 0.1% (-0.1% y/y). Prices of consumer goods excluding automobiles improved 0.1% (0.7% y/y)..

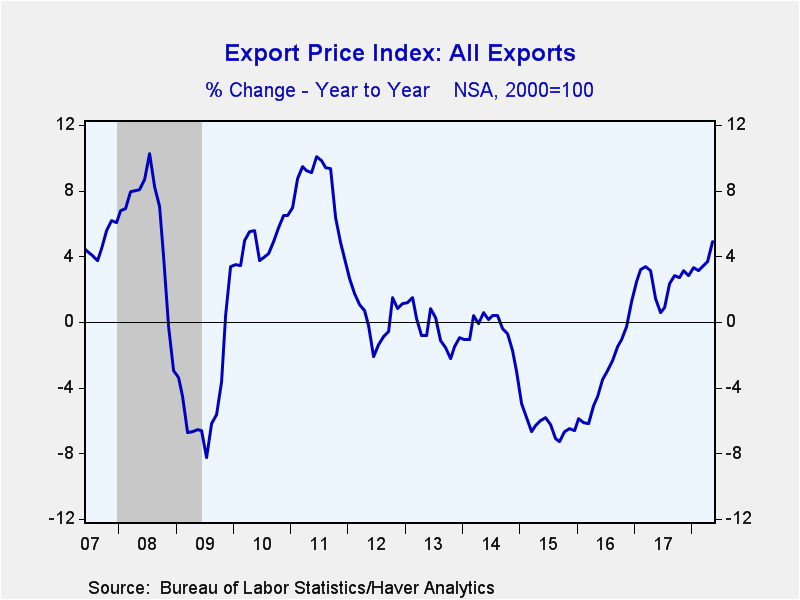

Export prices showed a similar pattern as import prices gaining 0.6% (4.9% y/y) for the second consecutive month. A 0.3% May rise had been expected..

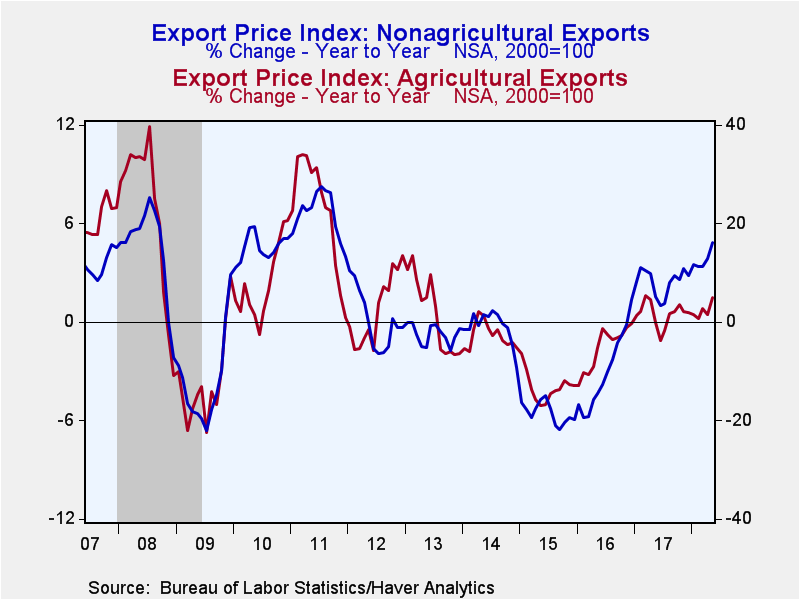

Agricultural export prices grew 1.6% (4.9% y/y) following a 1.2% decline. Nonagricultural export prices increased 0.5% (4.9% y/y) after a 0.7% gain. Among the end-use categories, prices of industrial supplies and materials jumped 1.6% (11.7% y/y), as petroleum prices flared 5.1% (29.7% y/y). Nonagricultural supplies and materials prices excluding fuels and building materials strengthened 0.2% (7.1% y/y). Prices of foods, feeds and beverages chewed 1.0% higher (4.2% y/y). Capital good prices edged up 0.1% (2.0% y/y) with computers, peripherals & semiconductors increasing 0.2% (2.1% y/y). Excluding this sector capital goods prices also grew 0.2% (1.9% y/y). Prices of motor vehicles and parts inched 0.1% higher (0.8% y/y). Prices of consumer goods excluding automobiles edged down 0.1% (+1.5% y/y). .

The import and export price series can be found in Haver's USECON database. Detailed figures are available in the USINT database. The expectations figure from the Action Economics Forecast Survey is in the AS1REPNA database..

| Import/Export Prices (NSA, %) | May | Apr | Mar | Y/Y | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| Imports - All Commodities | 0.6 | 0.6 | -0.2 | 4.3 | 2.9 | -3.3 | -10.2 |

| Petroleum & Petroleum Products | 5.9 | 4.4 | -2.5 | 31.9 | 26.6 | -19.7 | -46.0 |

| Nonpetroleum | 0.1 | 0.1 | 0.0 | 1.8 | 1.1 | -1.5 | -2.8 |

| Exports - All Commodities | 0.6 | 0.6 | 0.3 | 4.9 | 2.4 | -3.2 | -6.3 |

| Agricultural | 1.6 | -1.2 | 3.2 | 4.9 | 1.5 | -5.4 | -13.3 |

| Nonagricultural | 0.5 | 0.7 | 0.0 | 4.9 | 2.5 | -3.0 | -5.5 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.