Global| Jan 16 2020

Global| Jan 16 2020Petroleum Drives Import Prices Higher, Uncommon Rounding Issue Causes Larger Decline in Export Prices

Summary

• Import prices rose 0.3% in December as fuel prices jumped 2.8%. Excluding fuels, import prices were unchanged. • Export prices declined 0.2%. Rounding at lower levels of the aggregation of the price index accounted for a larger [...]

• Import prices rose 0.3% in December as fuel prices jumped 2.8%. Excluding fuels, import prices were unchanged.

• Export prices declined 0.2%. Rounding at lower levels of the aggregation of the price index accounted for a larger decline in the headline index than its subcomponents.

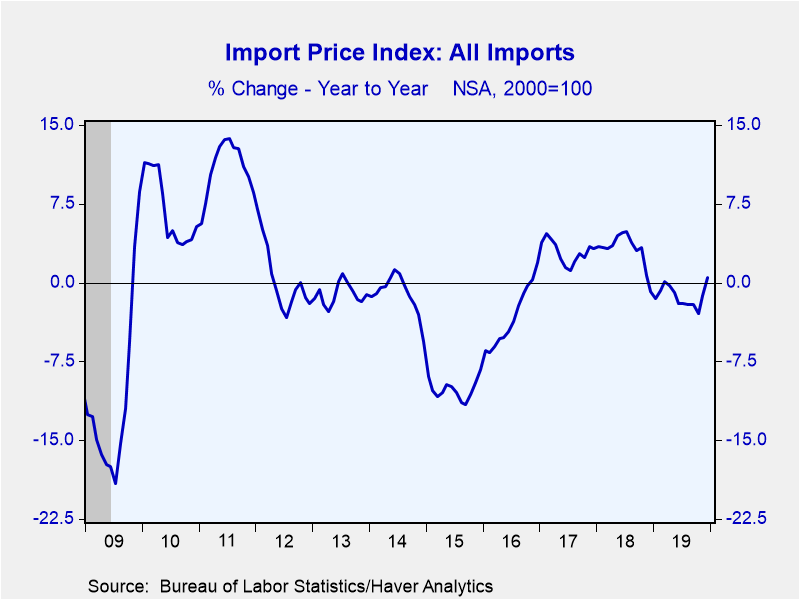

Import prices grew 0.3% during December (0.5% year-on-year), following a slightly downwardly revised 0.1% gain in November (was 0.2%). The Action Economics Forecast Survey correctly anticipated December's 0.3% gain. On an annual average basis, import prices were down 1.3% y/y in 2019 after growing 3.1% in 2018. These figures are not seasonally adjusted and do not include import duties.

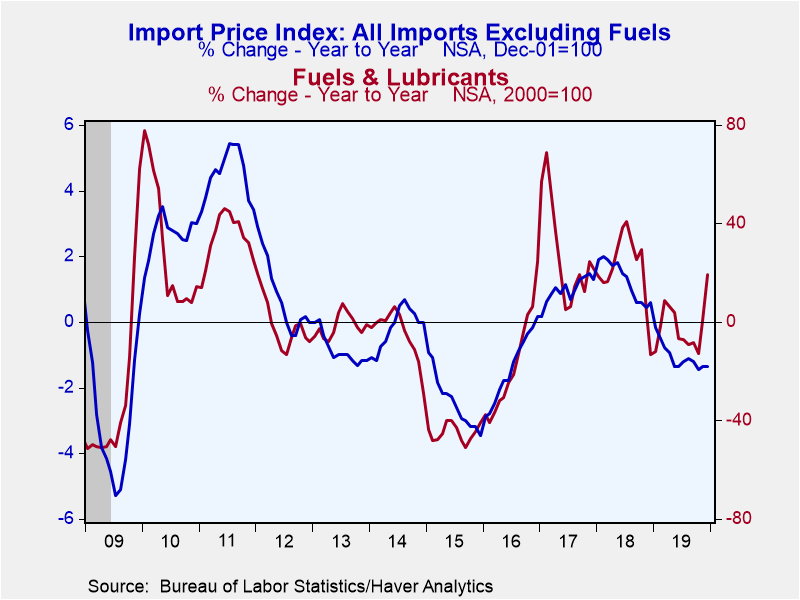

The increase in import prices last month was driven by a 2.8% jump in fuel import costs (19.3% y/y). Nonfuel import prices were unchanged (-1.4% y/y). Among key end-use categories, capital goods, the largest category of imports, edged up 0.1% (-1.7% y/y). Nonauto consumer goods prices, the second largest, were unchanged (-0.6% y/y). Motor vehicle prices increased 0.1% (-0.6% y/y).

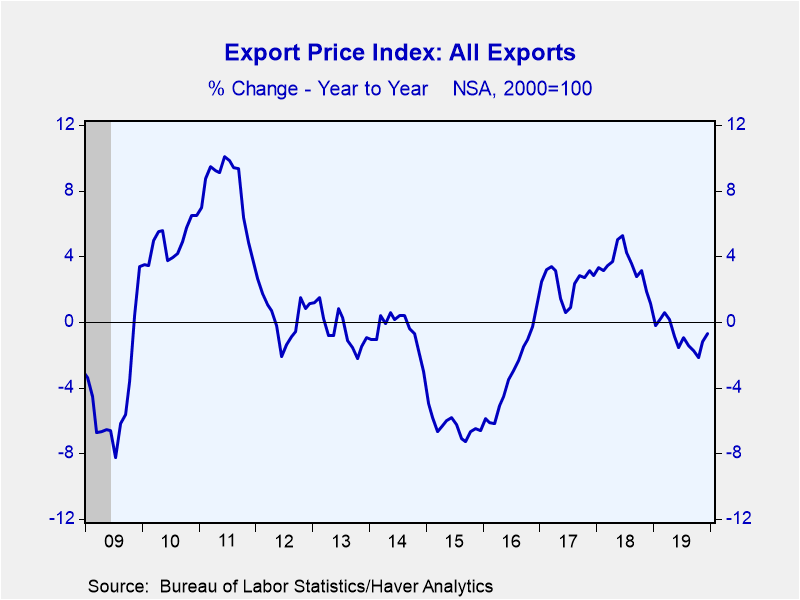

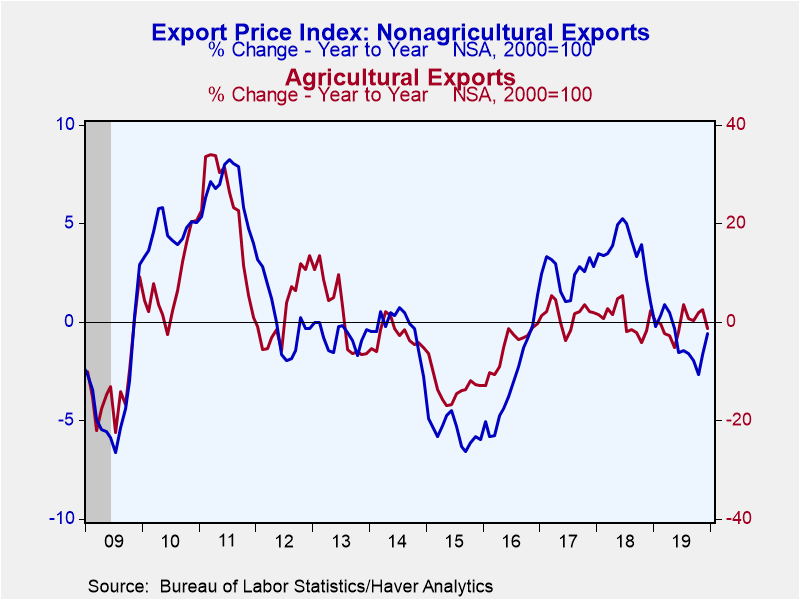

Export prices decreased 0.2% in December (-0.7% y/y), following an unrevised 0.2% gain in November. Forecasters' expected a 0.2% decline in December. The agricultural and non-agricultural subcomponents, which make up the entirety of the overall index, both declined 0.1% (-1.3% and -0.6% y/y respectively). We contacted the Bureau of Labor Statistics to explain this inconsistency and they noted that it is the result of rounding that takes place on detailed components of the index -- likely at a lower level than the top-line end-use categories discussed below -- and is very unusual.

On an annual average basis, import prices declined 0.8% y/y in 2019 after rising 3.4% in 2018. Among key end use categories, capital goods prices, the largest category making up over one-third of all goods exports, were unchanged in December (0.5% y/y). Non-agricultural industrial supplies & materials, the second largest category, decreased 0.3% (-2.4% y/y). Nonauto consumer goods prices edged down 0.1% (+0.5%).

The import and export price series can be found in Haver's USECON database. Detailed figures are available in the USINT database. The expectations figure from the Action Economics Forecast Survey is in the AS1REPNA database.

| Import/Export Prices (NSA, %) | Dec | Nov | Oct | Dec Y/Y | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Imports - All Commodities | 0.3 | 0.1 | -0.4 | 0.5 | -1.3 | 3.1 | 2.9 |

| Fuels | 2.8 | 1.3 | -1.7 | 19.3 | -2.1 | 20.8 | 25.6 |

| Nonfuels | 0.0 | -0.1 | -0.2 | -1.4 | -1.1 | 1.3 | 1.0 |

| Exports - All Commodities | -0.2 | 0.2 | 0.0 | -0.7 | -0.8 | 3.4 | 2.4 |

| Agricultural | -0.1 | 2.2 | 1.7 | -1.3 | -0.5 | 0.6 | 1.5 |

| Nonagricultural | -0.1 | 0.0 | -0.2 | -0.6 | -0.9 | 3.7 | 2.5 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.