Global| Apr 17 2014

Global| Apr 17 2014Philadelphia Fed Business Conditions Index Points To Further Economic Growth

by:Tom Moeller

|in:Economy in Brief

Summary

The Philadelphia Federal Reserve Bank reported that its General Business Conditions Index for April improved to 16.6. That added to its March improvement into positive territory after a weather-depressed negative reading in February. [...]

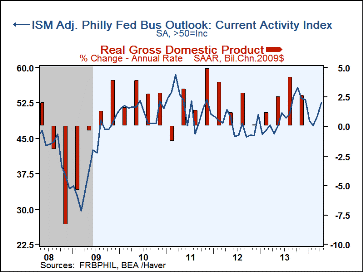

The Philadelphia Federal Reserve Bank reported that its General Business Conditions Index for April improved to 16.6. That added to its March improvement into positive territory after a weather-depressed negative reading in February. The latest figure surpassed consensus expectations for 10.0 according to the Action Economics Forecast Survey. The seasonally adjusted figure, constructed by Haver Analytics, also moved above break-even to 52.5. It is comparable to the ISM Composite index. During the last ten years, there has been a 71% correlation between the adjusted Philadelphia Fed index and real GDP growth.

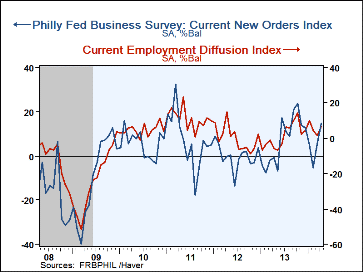

Rebounds in the new orders, shipments, unfilled orders and inventories components carried the overall index higher. The employment index also recovered to its highest level in three months. During the last ten years, there has been a 79% correlation between the employment index and the m/m change in nonfarm payrolls. To the downside versus March were the unfilled orders and delivery time series.

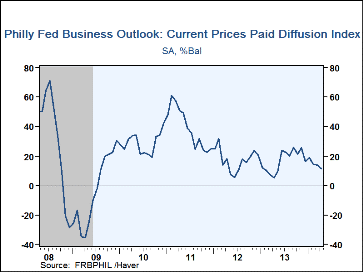

Pricing power deteriorated as the prices paid index fell to its lowest level since last May. A lessened 17 percent of respondents paid higher prices and a higher 6 percent paid less. During the last ten years, there has been a 71% correlation between the prices paid index and three-month growth in the intermediate goods PPI.

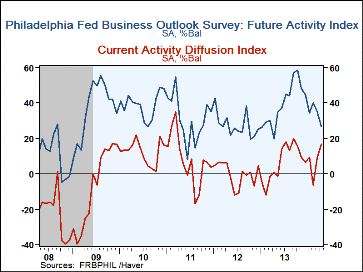

The separate index of expected business conditions in twelve months fell sharply to its lowest level in a year. Deterioration in the new orders, shipments, inventories, employment and capital expenditures components paced the fall. The future prices paid index improved to the highest level in three months.

The survey panel consists of 150 manufacturing companies in Federal Reserve District III (consisting of southeastern PA, southern NJ and Delaware.) The diffusion indexes represent the percentage of respondents indicating an increase minus the percentage indicating a decrease in activity. The ISM adjusted figure, calculated by Haver Analytics, is the average of five diffusion indexes, new orders, production, employment, supplier deliveries and inventories with equal weights (20% each). Each diffusion index is the sum of the percent responding "higher" and one-half of the percent responding "same."

The figures from the Philadelphia Federal Reserve can be found in Haver's SURVEYS database. The Consensus expectations figure is available in AS1REPNA.

The Fed's latest Beige Book covering regional economic conditions is available here.

| Philadelphia Fed (%, SA) | Apr | Mar | Feb | Apr'13 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|

| ISM-Adjusted General Business Conditions | 52.5 | 49.7 | 47.7 | 46.0 | 50.0 | 47.8 | 52.0 |

| General Business Conditions | 16.6 | 9.0 | -6.3 | 1.0 | 6.4 | -0.2 | 7.7 |

| New Orders | 14.8 | 5.7 | -5.2 | -0.8 | 7.3 | -0.1 | 7.2 |

| Shipments | 22.7 | 5.7 | -9.9 | 4.0 | 7.1 | -1.3 | 9.9 |

| Unfilled Orders | 2.0 | 2.6 | -2.6 | -9.6 | -3.8 | -6.5 | -0.9 |

| Delivery Time | -14.3 | -2.7 | 2.9 | -12.6 | -4.0 | -9.1 | -0.4 |

| Inventories | -1.5 | -6.8 | 3.6 | -22.1 | -3.2 | -6.0 | -0.3 |

| Number of Employees | 6.9 | 1.7 | 4.8 | -5.6 | 1.5 | 0.1 | 11.0 |

| Prices Paid | 11.3 | 13.9 | 14.2 | 5.0 | 16.7 | 17.7 | 39.3 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.