Global| Jul 16 2020

Global| Jul 16 2020Philadelphia Fed Manufacturing Activity Down Slightly

Summary

• Business conditions index has notable positive reading for second month. • Component gains somewhat mixed but generally favorable. • However, expectations have lower positive reading. The Federal Reserve Bank of Philadelphia [...]

• Business conditions index has notable positive reading for second month.

• Component gains somewhat mixed but generally favorable.

• However, expectations have lower positive reading.

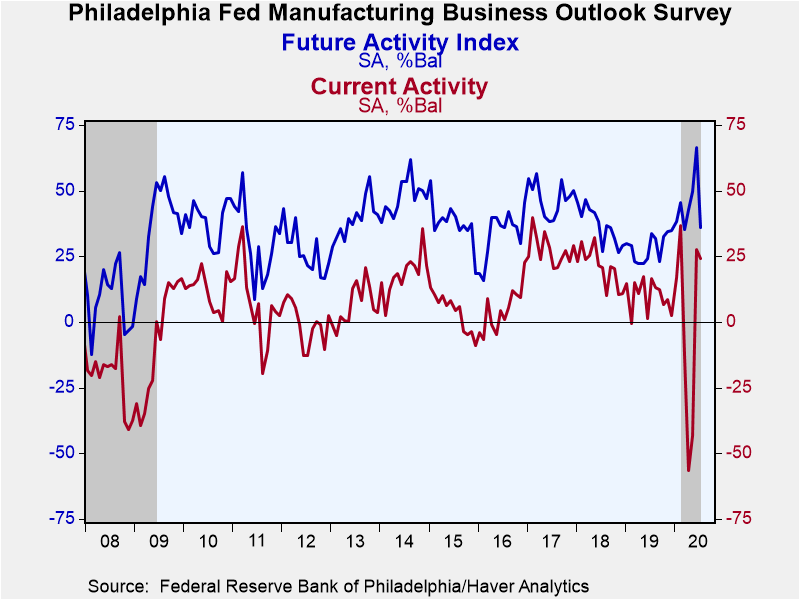

The Federal Reserve Bank of Philadelphia reported that its General Factory Sector Business Conditions Index edged down to 24.1% in July from 27.5% during June. The June reading followed three sizable negative values. The Action Economics Forecast Survey actually looked for a somewhat larger reduction in July to a still-positive 17.1%. These figures are diffusion indexes where readings above zero indicate expansion. The percentage of firms reporting an improvement in business activity eased to 45.1% this month from 46% in June. The percentage reporting weaker conditions rose to 21.1% from 18.5%.

Haver Analytics constructs an ISM-Adjusted General Business Conditions Index. It ticked down to 53.6 this month from 53.7 last month, which was the first value above 50 since February. Over the past dozen years, there has been a 57% correlation between the ISM-Adjusted Philadelphia Fed Index and q/q change in real GDP.

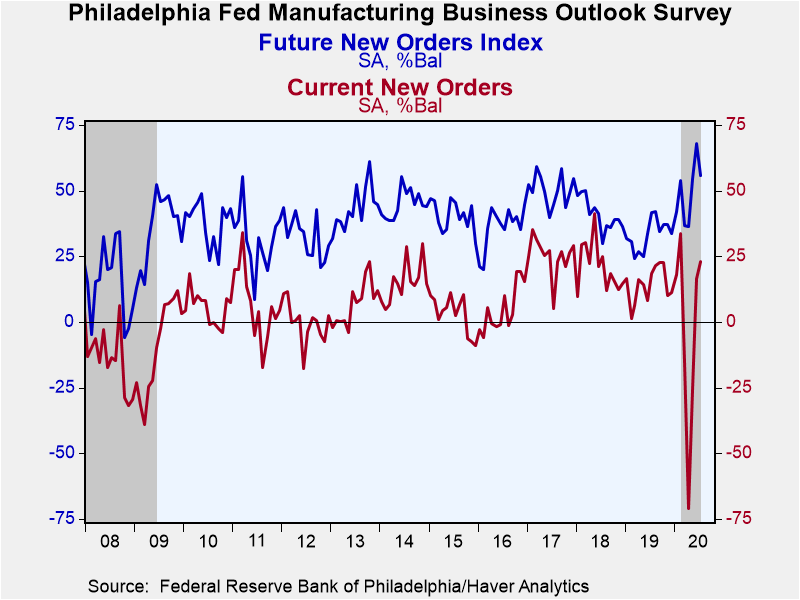

The underlying components of business activity are sampled separately from the composite index; these were somewhat mixed in July. New orders improved further to 23.0% from 16.7%, while shipments slowed to 15.3% from 25.3%; that encouraged an increase in unfilled orders to +3.9% from -0.1%. Delivery times fell to -6.4% from +0.4% and inventories decreased to -11.8% from 0.0% in June.

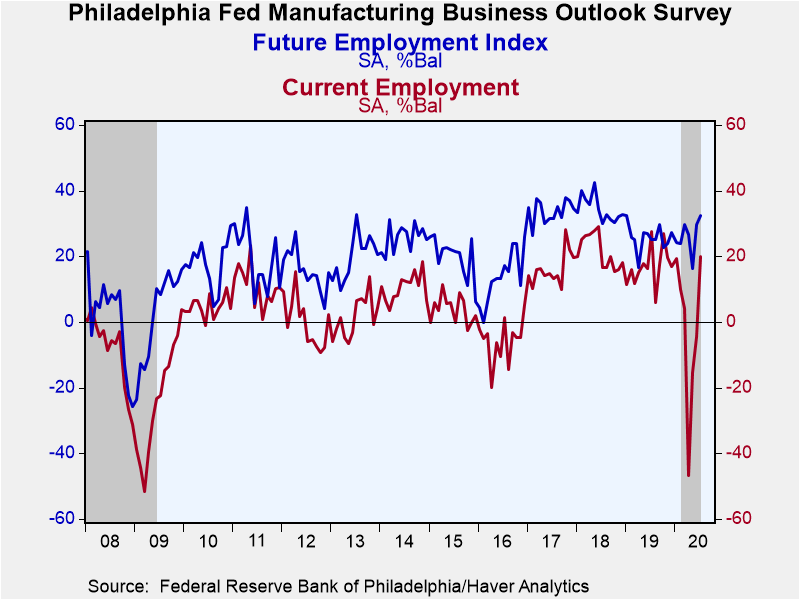

On the labor front, the employment index moved quite positively to +20.1% from -4.3% and the workweek had a similar kind of advance, reaching +17.2% from -6.5%.

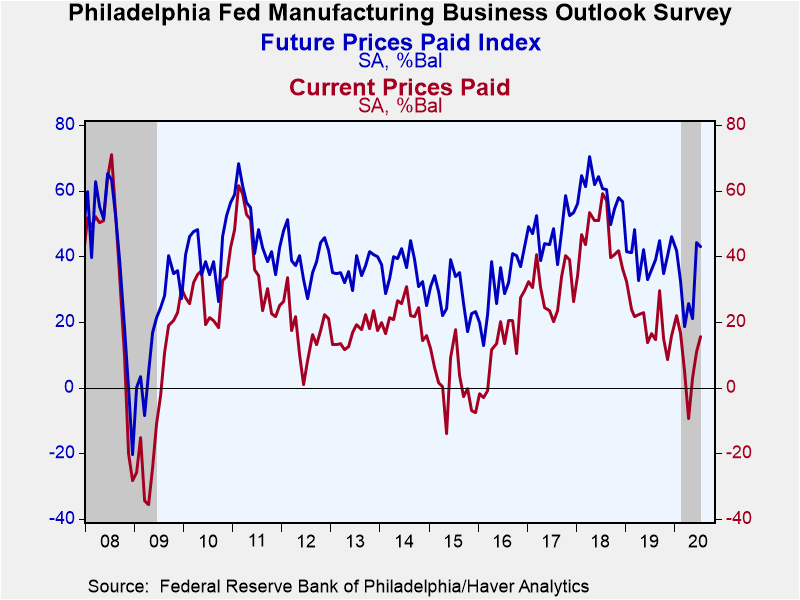

The index of prices paid rose again this month to 15.7% from 11.1% in June. Respondents reported paying higher prices were also 15.7%, down from 16.3% last month; respondents no prices decreased this month compared to 5.2% in June. The index of prices received edged higher to 11.5% from 11.0%, and these follow two negative months and a smaller positive in March.

The Philadelphia Fed also asks survey participants about their expectations for activity six months later. After an increase in June to 66.3%, its highest since 1992, the Future Activity Index fell back to 36.0%. The future new orders, shipments, unfilled orders and delivery times eased moderately but were still quite positive; inventory expectations and the labor market components rose. Capital expenditure plans ticked up from 26.3% to 26.6%. Expectations for both prices paid and prices received edged a bit lower but are also still quite positive.

The survey panel consists of 150 manufacturing companies in the third Federal Reserve District (which consists of southeastern Pennsylvania, southern New Jersey and Delaware). The diffusion indexes represent the percentage of respondents indicating an increase minus the percentage indicating a decrease in activity. The ISM-adjusted figure, calculated by Haver Analytics, is the average of five diffusion indexes: new orders, shipments, employment, delivery times and inventories with equal weights (20% each). Each ISM-adjusted index is the sum of the percent responding "higher" and one-half of the percent responding "no change."

The figures from the Philadelphia Federal Reserve dating back to 1968 can be found in Haver's SURVEYS database. The expectation from the Action Economics Forecast Survey is available in AS1REPNA.

| Philadelphia Fed - Manufacturing Business Outlook Survey (%, SA) | Jul | Jun | May | Jul'19 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| ISM-Adjusted Business Conditions | 53.6 | 53.7 | 42.7 | 57.6 | 55.5 | 57.7 | 57.2 |

| General Factory Sector Business Conditions | 24.1 | 27.5 | -43.1 | 16.6 | 9.9 | 20.9 | 27.3 |

| New Orders | 23.0 | 16.7 | -25.7 | 18.4 | 14.1 | 21.0 | 25.3 |

| Shipments | 15.3 | 25.3 | -30.3 | 20.4 | 16.9 | 22.8 | 26.7 |

| Unfilled Orders | 3.9 | -0.1 | -13.7 | 4.1 | 7.7 | 7.0 | 11.8 |

| Delivery Time | -6.4 | 0.4 | -6.7 | 13.5 | 9.4 | 9.5 | 10.6 |

| Inventories | -11.8 | 0.0 | 11.7 | 6.9 | 5.1 | 7.2 | 2.8 |

| Number of Employees | 20.1 | -4.3 | -15.3 | 27.6 | 16.9 | 21.5 | 16.1 |

| Average Workweek | 17.2 | -6.5 | -7.1 | 21.1 | 9.8 | 15.9 | 14.9 |

| Prices Paid | 15.7 | 11.1 | 3.2 | 16.4 | 19.7 | 46.1 | 30.4 |

| Expectations - General Business Conditions; Six Months Ahead | 36.0 | 66.3 | 49.7 | 33.6 | 28.4 | 36.8 | 47.1 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates