Global| Jul 23 2019

Global| Jul 23 2019Philadelphia Fed Nonmanufacturing Business Activity in Partial Rebound

Summary

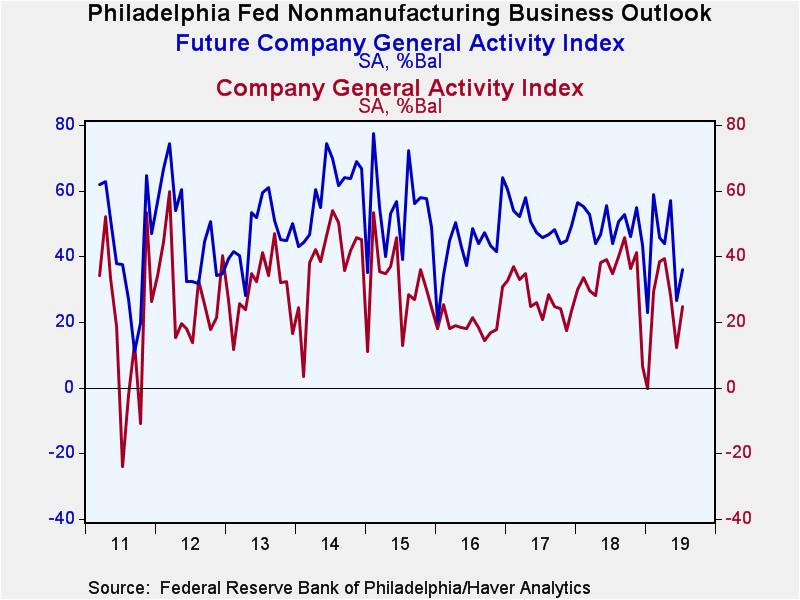

The Federal Reserve Bank of Philadelphia reported that its Nonmanufacturing Business Index of current conditions at the company level rose to 24.6 in July from June’s 12.2. This partially reversed the June decrease from 28.1 in May. [...]

The Federal Reserve Bank of Philadelphia reported that its Nonmanufacturing Business Index of current conditions at the company level rose to 24.6 in July from June’s 12.2. This partially reversed the June decrease from 28.1 in May. Sentiment about the future also reversed part of its June decrease as the index of expected conditions rose to 36.0 from 26.4, which had been the lowest reading since January. The general business activity reading for the region gained to 21.4 from June’s 8.2 and was the best result since March.

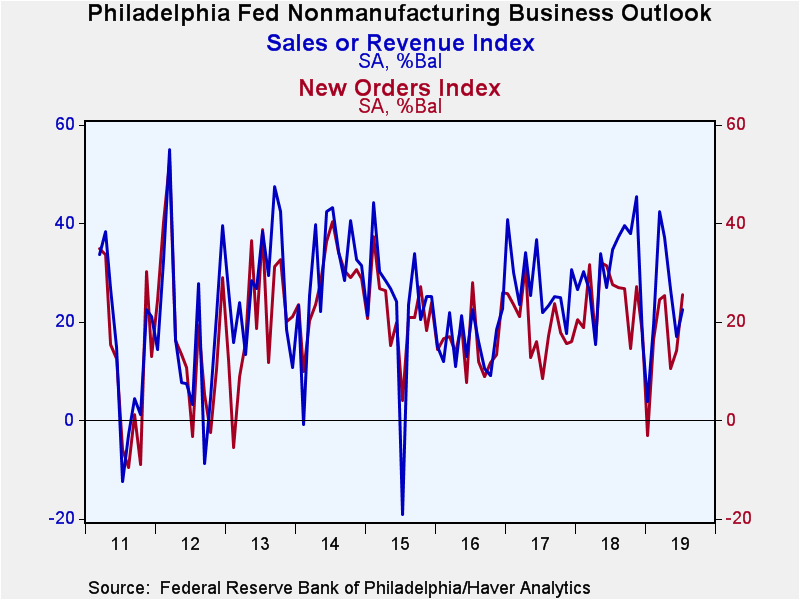

Major components participated in the July improvement. Sales gained to 22.5 from 17.0 in June, new orders to 25.5 from 14.3 and unfilled orders to 13.1 from 4.4. The new orders reading, while not especially high, is the strongest so far this year. Sales, however, remain relatively low, as 41.5% of companies reported increases in their sales, compared with an average last year of 48.1%. Inventories had a positive reading of 8.6, up from June’s 2.9 and sustaining gains after May’s net decrease of 3.2.

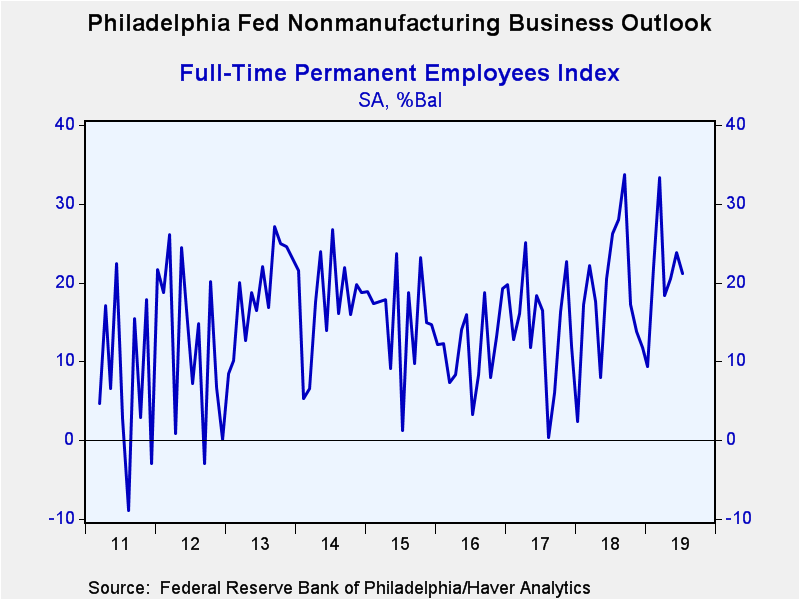

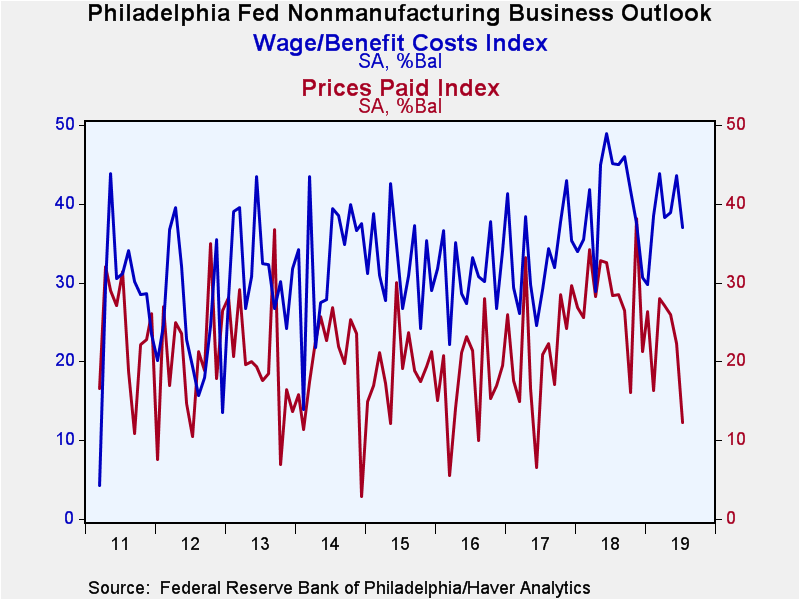

The labor market measures both weakened somewhat for July. Full-time permanent employment has a net reading of 21.1, down from 23.8 in June, and part-time/temporary employment sagged to 11.6 from 20.2. The workweek figure was almost the same this month, 18.7, as in June, 18.9. The wages & benefits measure paused in its uptrend, although at 37.0, it’s certainly not low.

Prices were mixed. Prices received picked up to 20.5 this month from June’s 8.8, while prices paid faded to 12.2, the lowest reading since June 2017. The net of these price measures is 8.3, the first positive result since last October, and one of only a few positive movements in what might be regarded as “margins,” suggesting that overall pricing power is not great.

The capital expenditure measures both eased in the July survey. That for physical plant was 18.0, down from 19.1 in June. This is, however, still better than late last year and early this year when readings were 15 to 16. The equipment & software expenditure reading fell back to 21.9 from 28.4 in June, which had represented almost a 10-point jump.

The Philadelphia Fed figures are diffusion indexes which are calculated by subtracting the percent of respondents reporting decreases in business activity from those reporting improvement. So, readings above zero indicate more positive than negative responses. These indexes have a good correlation with growth in the series covered. The data are available in Haver's SURVEYS database.

| Federal Reserve Bank of Philadelphia: Nonmanufacturing Business Outlook Survey (Diffusion Index, SA) | Jul | Jun | May | Jul'18 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| General Activity - Company | 24.6 | 12.2 | 28.1 | 34.9 | 33.6 | 27.3 | 19.7 |

| New Orders | 25.5 | 14.3 | 10.6 | 27.6 | 24.3 | 19.1 | 15.8 |

| Sales or Revenue | 22.5 | 17.0 | 26.6 | 34.8 | 30.9 | 27.9 | 16.1 |

| Inventories | 8.6 | 2.9 | -3.2 | 5.4 | 5.2 | 3.8 | 4.3 |

| Number of Full-Time Permanent Employees | 21.1 | 23.8 | 20.5 | 26.2 | 18.2 | 14.8 | 11.7 |

| Part-Time/Temporary/Contract Employees | 11.6 | 20.2 | 11.3 | 12.5 | 15.6 | 12.4 | 11.8 |

| Prices Paid | 12.2 | 22.3 | 25.9 | 28.4 | 28.3 | 21.4 | 17.6 |

| Wage & Benefit Costs | 37.0 | 43.6 | 38.9 | 45.1 | 40.0 | 33.4 | 31.2 |

| Expected General Activity - Company | 36.0 | 26.4 | 56.9 | 44.0 | 50.2 | 50.1 | 43.2 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates