Global| Jan 07 2008

Global| Jan 07 2008PPI Headline Inflation Soars While ex Energy Prices Hold at a Too-High Pace

Summary

The Euro Area’s past two month’s headline gains for the PPI excluding construction were a sizeable +0.8% and +0.7%, respectively. These are huge increases. On the same period the ex-energy PPI rose by 0.1% and 0.4% a much better [...]

The Euro Area’s past two month’s headline gains for the PPI excluding construction were a sizeable +0.8% and +0.7%, respectively. These are huge increases. On the same period the ex-energy PPI rose by 0.1% and 0.4% a much better pairing - but still not satisfactory for the ECB. While the ECB’s inflation ceiling of 2% applies to the HICP clearly having other indices rising faster than that creates problems for price stability.

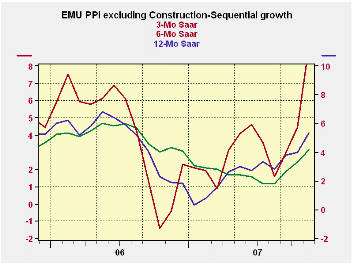

At the moment energy prices are pushing headline prices off the map. The 3-mo headline inflation gain of the E-zone PPI is 7.7% up from 4.8% over six months and 4.1% Yr/Yr. All of these figures are excessive. The core rate flattened out at 2.6% over 3-mo and 6-mo lower than the 3.2% it is up Yr/Yr. That is some encouragement but the pace of ex-energy inflation is still excessive.

Still, across countries problems linger. Excl energy inflation in Germany is decelerating, true. But in Italy and in the UK excl energy inflation is higher over three months than it was over six months. It is no wonder that the ECB continues to rattle its saber over inflation.

| Euro Area and UK PPI Trends | ||||||

|---|---|---|---|---|---|---|

| M/M | Saar | |||||

| Ezone-13 | Nov-07 | Oct-07 | 3-Mo | 6-MO | Yr/Yr | Y/Y Yr Ago |

| Total excl Construction | 0.8% | 0.7% | 7.7% | 4.8% | 4.1% | 4.3% |

| Excl Energy | 0.1% | 0.4% | 2.6% | 2.6% | 3.2% | 3.5% |

| Capital Goods | 0.0% | 0.1% | 1.0% | 0.9% | 1.5% | 1.8% |

| Consumer Goods | 0.3% | 0.5% | 5.2% | 5.0% | 3.6% | 1.6% |

| Intermediate & Capital Goods | 0.0% | 0.3% | 1.3% | 1.3% | 2.8% | 4.5% |

| Energy | 3.2% | 1.8% | 26.9% | 12.3% | 7.8% | 6.8% |

| MFG | 0.7% | 0.5% | 6.9% | 4.7% | 4.8% | 2.9% |

| Germany | 0.8% | 0.4% | 5.8% | 3.2% | 2.5% | 4.7% |

| Total excl Energy | -0.1% | 0.4% | 1.4% | 1.8% | 2.3% | 2.9% |

| Italy | 0.9% | 0.5% | 7.8% | 5.2% | 4.6% | 5.3% |

| Total excl Energy | 0.2% | 0.3% | 2.4% | 2.2% | 3.2% | 4.2% |

| UK | 2.2% | 1.9% | 22.6% | 13.2% | 3.1% | 2.6% |

| Total excl Energy | 0.1% | 0.4% | 3.2% | 2.9% | 3.2% | 3.3% |

| E-zone 13 Harmonized PPI excluding Construction | ||||||

| The EA 13 countries are Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal, Slovenia | ||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.