Global| Sep 15 2009

Global| Sep 15 2009PPI Headline Spurts As Core Is Stable

Summary

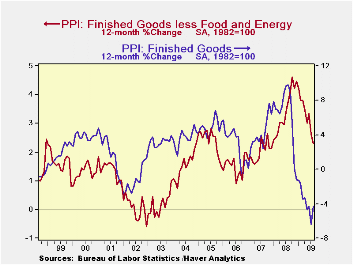

The PPI headline spurted by 1.7% in August as the core rose by 02% and core for consumer prices at the producer level edged up by just 0.1%. Finished energy prices rose by 8% in the month. The headline displays an accelerating pattern [...]

The PPI headline spurted by 1.7% in August as the core rose by

02% and core for consumer prices at the producer level edged up by just

0.1%. Finished energy prices rose by 8% in the month. The headline

displays an accelerating pattern of growth rates for 12-month to

6-month to 3-month rates of inflation. But the core pattern has been

more settled and core pattern for consumer prices at the producer level

has been even more tranquil.

We learned from the last time energy prices spiked in the

recession that a transmission of their gains to the core was not

automatic. Rising energy prices have both inflationary and deflationary

effects. When consumers and firms do not have the power to bargain for

wage and price hikes, as is the case now, it is more likely that rising

energy prices impact growth adversely instead of impacting inflation

positively.

Still what we are seeing here are volatile price movements.

Energy prices have had a standard deviation of 5 percentage points on

the month to month percentage changes since the recession began. That

kind of volatility tends to impart considerable uncertainty into the

headline PPI each month.

The 8% m/m rise in energy prices in August is the largest

since a 10.2% gain in November 2007. Energy prices are up in four of

the last five months and in six of the last eight months. Prior to that

energy prices had fallen for five months in a row.

Spot oil prices on world markets, however, have been hovering

around the $70/bbl mark for a number of months. Oil prices have been

playing catch up since the recession has come off its worst of times

and oil prices have bounced and are trying and find a new higher

equilibrium.

For now the core PPI price patterns are reassuring. Since

global oil price trends are not running away we can look for the energy

market in the US to find a level that is consistent with global prices

and for the energy component of the PPI to settle down. It does not

look very inflationary now in this economy but we are looking for

recovery to set in. As that happens the risk will multiply and the

potential for inflation to take root will improve somewhat. I am no

inflation monger. But circumstance will change. For now inflation is

not the worry, it’s just a bad monthly result in the least important of

all US inflation reports.

Long live the CPI and the PCE deflator where trends are more important. In that regard the tranquil inflation embedded in core consumer prices at the producer prices level is reassuring.

| Key Trends In Producer Prices | |||||

|---|---|---|---|---|---|

| Aug-09 | PPI Trends By Type Of Good | ||||

| PPI | 1Mo:M/M | 3-Mo:ar | 6-Mo:ar | 1-Yr | Yr-Ago |

| Total PPI | 1.7% | 11.0% | 4.3% | -4.3% | 9.8% |

| Finished Consumer Gds | 2.3% | 14.4% | 5.5% | -5.9% | 11.7% |

| Consumer Foods | 0.4% | 0.0% | -1.7% | -3.9% | 9.1% |

| Finished C Gds Excl Foods | 2.9% | 19.5% | 8.1% | -7.0% | 12.7% |

| Nondurables less Food | 3.9% | 26.6% | 10.4% | -10.4% | 16.6% |

| ConsNonDurxF&E | 0.0% | 1.9% | 2.0% | 3.0% | 5.4% |

| Durable Goods | 0.3% | 2.8% | 2.1% | 2.5% | 2.2% |

| Finished Core Cons Gds | 0.1% | 2.2% | 2.0% | 2.8% | 4.0% |

| Capital Goods | 0.3% | 2.3% | 0.6% | 1.8% | 3.3% |

| MFG Industries | 0.1% | 0.8% | 0.3% | 0.6% | 3.9% |

| NonMFG Industries | 0.3% | 2.9% | 0.8% | 2.2% | 3.1% |

| Core PPI | 0.2% | 2.4% | 1.4% | 2.3% | 3.8% |

| Memo: Finished Energy | 8.0% | 59.6% | 19.8% | -21.3% | 27.9% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates