Global| Aug 17 2010

Global| Aug 17 2010Producer Prices Turn Up in July, But Subgroups Decidedly Mixed

Summary

The producer price index for finished goods turned back higher in July, gaining 0.2% after June's 0.5% drop. The July rise pushed the year-on-year performance to a sharp 4.2% increase, compared with 2.7% registered in June. Both the [...]

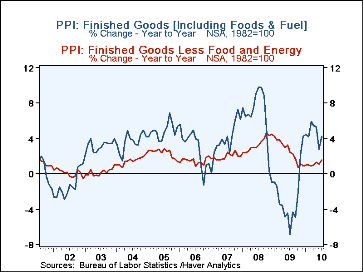

The producer price index for finished goods turned back higher in July, gaining 0.2% after June's 0.5% drop. The July rise pushed the year-on-year performance to a sharp 4.2% increase, compared with 2.7% registered in June. Both the food-and-energy portion and the "core" participated.

The producer price index for finished goods turned back higher in July, gaining 0.2% after June's 0.5% drop. The July rise pushed the year-on-year performance to a sharp 4.2% increase, compared with 2.7% registered in June. Both the food-and-energy portion and the "core" participated.

Finished food prices rose 0.7%, following a 2.2% fall in June. Fresh fruits and vegetables both contributed, jumping 3.8% and 9.8%, respectively, while meat prices were mixed. Beef and pork fell, 6.4% and 0.8%, while chicken, turkey and fish prices were up, 0.8%, 0.9% and 1.2%, in order. All of these but turkey had declined in June. Finished energy prices continued to fall overall, down 0.9% after 1.5% in June, but among various kinds, they showed diverse movement: gasoline was down 2.2% and home heating oil, 3.5%, but wholesale residential electricity prices increased 1.2% after 0.7% in June – we'd surmise due to the unrelentingly hot weather – and residential gas gained 3.1% after 2.1% in June.

Core consumer goods prices were up 0.4% last month, continuing a moderate uptrend that saw 0.3% in May and 0.2% in June. Pharmaceuticals and furniture led the increase; footwear prices turned up, but apparel prices declined. Passenger car prices rose 0.3%. Capital equipment prices rose 0.3% after being flat in June; light trucks had the biggest increase, 1.5%.

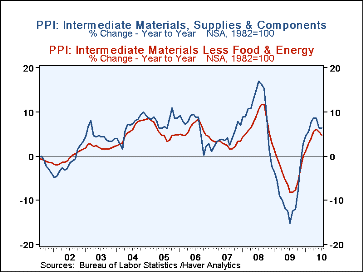

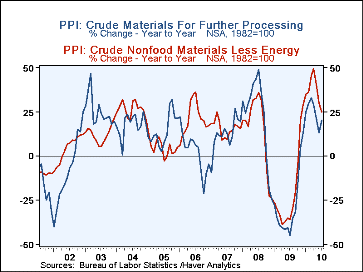

Intermediate goods prices remained soft, falling 0.4% in July after 0.9% in June (but up 6.4% from a year ago); intermediate energy was down 0.7% last month and intermediate foods and feeds were also down 0.4%, as was the associated core index (which was up 4.8% from July 2009). Crude goods prices turned noticeably higher, 2.7% in the month after drops of 2.8% in May and 2.4% in June. Food and feed prices gained 3.3% in July and crude energy prices 4.5%; the core rate, however, was -1.4%, after drops of 1.6% in May and 4.8% in June. The rise in foods came in grains and soybeans, and that in energy from a sizable 11.7% increase in natural gas; crude petroleum declined 0.1%. The crude core index saw a 7.4% surge in iron ore, but most metal scrap prices declined.

The mixed performance of many of these wholesale and raw material prices looks to us like a mirror of the economy as a whole: muddling along with gains in one place and then another without much evidence so far of a cumulative, coordinated development of upward momentum. The PPI data are contained in Haver's USECON database, with further detail in PPI and PPIR.

| Producer Price Index (%) | July | June | May | Year Ago | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|

| Finished Goods | 0.2 | -0.5 | -0.3 | 4.2 | -2.5 | 6.4 | 3.9 |

| Less Food & Energy | 0.3 | 0.1 | 0.2 | 1.5 | 2.6 | 3.4 | 2.0 |

| Intermediate Goods | -0.4 | -0.9 | 0.4 | 6.4 | -8.4 | 10.3 | 4.0 |

| Less Food & Energy | -0.4 | -0.4 | 0.3 | 4.8 | -4.2 | 7.4 | 2.8 |

| Crude Materials | 2.7 | -2.4 | -2.8 | 20.5 | -30.3 | 21.4 | 11.9 |

| Less Food & Energy | -1.4 | -4.8 | -1.6 | 25.0 | -23.5 | 14.8 | 15.6 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates