Global| May 31 2006

Global| May 31 2006Q1 GDP Strong in India; Growth Uneven but on Trend in Malaysia & the Philippines

Summary

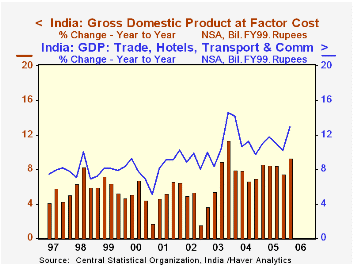

Economic growth in South Asia was firm in Q1, according to reports out today from government statistics offices in India, Malaysia and Philippines. India, especially, with a 9.3% year/year gain in GDP, saw its strongest quarter since [...]

Economic growth in South Asia was firm in Q1, according to reports out today from government statistics offices in India, Malaysia and Philippines. India, especially, with a 9.3% year/year gain in GDP, saw its strongest quarter since the end of 2003. In Malaysia, growth appears uneventful, with year-on-year gains hovering between 5% and 7%, but after the steep recession of 1998 and the slowdown in 2001, this looks attractive. In the Philippines, the latest quarter was up a modest 0.8% from Q4 but 5.5% from the year earlier. This pace compares to a 4.9% average over the past 5 years.

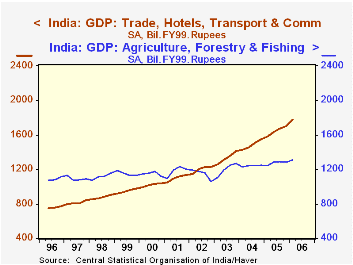

In India, agriculture continues to dominate the economy, although as seen in the second graph, the trade and transport sector surpassed it in 2002; that industrial segment also continues to grow rapidly now, surging 12.9% in Q1. The same group also includes hotels and communications; we'd suspect that as the Indian infrastructure builds, "communications" would be expanding rapidly. The same holds for construction; it is smaller in absolute size, but has sustained better than 10% average growth for the last five years. Other sectors are chasing along, too. Manufacturing gained 8.9% over the last four quarters, while finance, insurance and business services was up 10.8%.

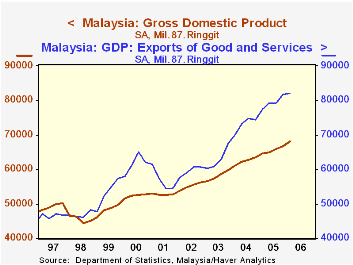

The Malaysian economy has the interesting feature that exports are larger than total GDP -- by a sizable amount. In Q1, exports were 82.0 billion ringgit (1987 prices) while GDP was 68.1 billion. See the third graph. Imports are sizable too, of course, at 77.8 billion ringgit. So goods and services are imported into the country, processed, and shipped out. This chain of events yielded GDP growth of 2.2% in Q1 alone (from Q4), the largest single quarter since early 2000. The domestic economy is fairly vibrant; it expanded 5.7% in the quarter, pushed by an 11.1% surge in fixed investment. But it is also more volatile, with Q4 down 3.7%.

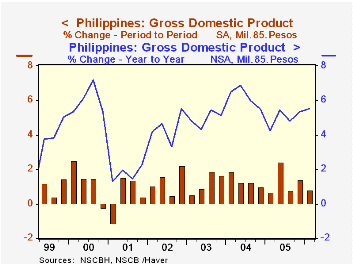

In the Philippines, quarterly movements in individual sectors are frequently uneven. In Q1, total GDP slowed to 0.8% from 1.4% growth in Q4. Agriculture, mining, manufacturing, trade and real estate contributed to the slowing, transportation and private services were steady to somewhat slower, but construction, finance and government picked up considerably. On the demand side, total domestic demand accelerated to 1.4% growth from -0.1% in Q4; net exports also added to growth through a much smaller deficit. But the statistical discrepancy turned sharply negative, so it is hard to identify the genuine demand-side source of the slower pace in total GDP. At the same time, gains in prior quarters meant, as noted above, that the overall economy still saw 5.3% year-on-year growth. See in the last graph how the lurches in quarter-to-quarter performance still produce the respectable yearly pace.

| GDP: % Changes* | Q1 2006 | Q4 2005 | Q3 2005 | Year/ Year | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|---|

| India | 2.7 | 1.1 | 1.8 | 9.3 | 8.2 | 7.3 | 7.3 |

| Manufacturing | 3.4 | 2.6 | 1.5 | 8.9 | 8.8 | 8.0 | 7.1 |

| Trade, Hotels, Transport, Etc. | 4.4 | 2.1 | 2.5 | 12.9 | 10.9 | 11.4 | 10.9 |

| Finance, Business Services, Etc. | 1.3 | 1.7 | 3.1 | 10.8 | 9.7 | 7.8 | 4.9 |

| Malaysia | 2.2 | 1.1 | 1.7 | 5.3 | 5.2 | 7.2 | 5.5 |

| Philippines | 0.8 | 1.4 | 0.7 | 5.5 | 5.0 | 6.2 | 4.9 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates