Global| Mar 06 2007

Global| Mar 06 2007Q4 Productivity Revised Down; Bonus Payments Boost Unit Labor Cost

Summary

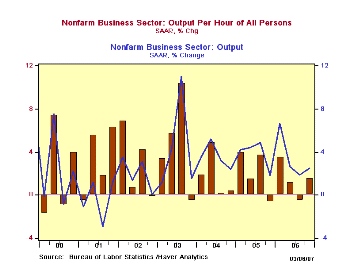

Nonfarm labor productivity was revised to 1.6% in Q4 from 3.0% reported a month ago. The revision was in line with market forecasts, which were based on the most recent revision to GDP. For 2006 as a whole, productivity was also up [...]

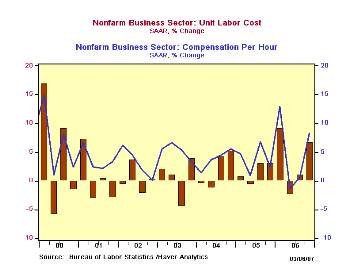

Compensation per hour last quarter was lifted substantially, reflecting unusually large bonuses paid by companies in Q4. Originally seen at 4.8%, that figure is now at 8.2%. However, Q3 was revised downward to just 0.6% from 3.1%, so the year as a whole was lowered to 4.8% from 5.3% reported last month.

Unit labor cost growth rose commensurately in Q4 with the upward revision to compensation and the downward shift in productivity. It is now reported at 6.6% from 1.7% before. Forecast expectations had it at about 3.0% but at least some forecasters projected as much as 6.5%, factoring in all of the changes in output and compensation. Interestingly, though, these various changes all offset each other over the course of 2005 and 2006, so that unit labor costs for those years as a whole were unchanged from the initial 2.0% and 3.2% estimates.

Compensation per hour last quarter was lifted substantially, reflecting unusually large bonuses paid by companies in Q4. Originally seen at 4.8%, that figure is now at 8.2%. However, Q3 was revised downward to just 0.6% from 3.1%, so the year as a whole was lowered to 4.8% from 5.3% reported last month.

Unit labor cost growth rose commensurately in Q4 with the upward revision to compensation and the downward shift in productivity. It is now reported at 6.6% from 1.7% before. Forecast expectations had it at about 3.0% but at least some forecasters projected as much as 6.5%, factoring in all of the changes in output and compensation. Interestingly, though, these various changes all offset each other over the course of 2005 and 2006, so that unit labor costs for those years as a whole were unchanged from the initial 2.0% and 3.2% estimates.

Factory sector productivity growth was unchanged in Q4 from the 2.2% gain shown earlier. The yearly figure was pushed up slightly, however, from 3.9% to 4.0%. Compensation in manufacturing had already shown a sizable Q4 increase of 7.3% and it was actually reduced a bit to 7.1%. For the year, it rose 3.8%, compared with 4.1% reported before. Unit labor costs were still firm in Q4, 4.7%, revised from 5.0%. The sharp reduction in Q3 compensation lowered annual unit labor costs in manufacturing to an outright decline of 0.2% from a 0.2% increase reported last month.

| Non-farm Business Sector (SAAR) | 4Q '06 (Rev) | 4Q '06 (Old) | 3Q '06 (Rev) | Y/Y (Rev) | 2006 (Rev) | 2005 (Rev) | 2004 (Rev) |

|---|---|---|---|---|---|---|---|

| Output per Hour | 1.6% | 3.0% | -0.5% | 1.4% | 1.6% | 2.1% | 2.9% |

| Compensation per Hour | 8.2% | 4.8% | 0.6% | 4.9% | 4.8% | 4.1% | 3.6% |

| Unit Labor Costs | 6.6% | 1.7% | 1.1% | 3.4% | 3.2% | 2.0% | 0.7% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates