Global| May 11 2007

Global| May 11 2007Record Tax Collections Bring Large Monthly Budget Surplus for Federal Government

Summary

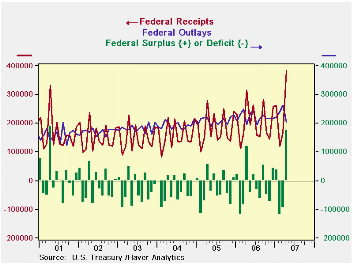

We know this is [literally] yesterday's news, but the state of the US Government budget for April 2007 deserves comment regardless. The Treasury took in a record $383.6 billion in the month, contributing to a surplus of $177.7 [...]

We know this is [literally] yesterday's news, but the state of the US Government budget for April 2007 deserves comment regardless. The Treasury took in a record $383.6 billion in the month, contributing to a surplus of $177.7 billion, the second largest monthly surplus ever. This result well exceeded the year-ago figure of $118.8 billion and was considerably larger than consensus forecasts of $140 billion. The associated outlay total was $206.0 billion. The largest surplus was in April 2001, $189.8 billion, when the receipts rolled in from the peak of the tech boom.

For the fiscal year to date (since October), the deficit has been $80.8 billion, compared with $184.8 billion in the same period a year ago. Receipts are up 11.2%, while outlays have increased only 3.2%.

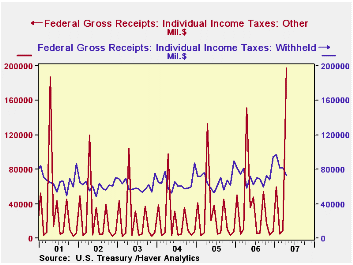

Individual income taxes in April were a monthly record $226.3 billion, up 33.9% from a year ago. This increase consisted in a hefty jump in individual income taxes, with withholdings up 24.4%; this does, however, follow a restrained withholding figure for March. Year-to-date withholdings are up 10.7%. "Other" individual tax payments, those submitted with 2006 tax returns, came in at an eye-popping $197.8 billion, almost 31% ahead of last year. These taxes, which cover non-wage income, were $300.5 billion for the fiscal year to date, up almost 26% from the comparable year-ago period. Corporate income taxes were $46.7 billion in April, up 6.1% from April 2006; the year-to-date gain has been 15.2%, as December and March quarterly payments were both up from year-ago amounts by a substantial margin. Social insurance taxes were $95.9 billion in April, up 9.3% from April 2006 and 6.2% for the year-to-date.

As noted above, outlays were $206.0 billion, up 5.0% from a year ago. The fiscal year total so far is up just 3.2%. Defense outlays were $41.2 billion, up 3.5% from last April, with the cumulative amount for the fiscal year so far up 6.0% from the year earlier. Social security outlays were $48.8 billion in April, up 5.5%. Interest expense continues to climb, rising 21.6% in April from the year ago, and up 5.2% for the year so far. Last month here, we suggested that calendar quirks had advanced spending in several government programs forward to March and that they could slow commensurately in April. This appears to have occurred. Overall, total spending is expanding quite modestly, making it easier to keep the federal budget position under control for fiscal 2007 as a whole, even if tax receipt growth were to slow in the remaining months.

| US Government Budget, Bil.$ | Apr 2007 | Mar 2007 | Oct 2006- Apr 2007 |

Oct 2005- Apr 2006 |

FY 2006 | FY 2005 | FY 2004 |

|---|---|---|---|---|---|---|---|

| Budget Balance | +177.7 | -96.3 | -80.8 | -184.1 | -248.2 | -318.7 | -411.1 |

| Net Revenues | 383.6 | 166.5 | 1504.6 | 1352.7 | 2,406.7 | 2,153.4 | 1,879.8 |

| 11.2% | 11.2% | 11.8% | 14.6% | 5.4% | |||

| Net Outlays | 206.0 | 262.8 | 1585.3 | 1536.8 | 2,654.9 | 2,472.1 | 2,290.9 |

| 3.2% | 5.8% | 7.4% | 7.9% | 6.2% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates